Chapter 11 Financial Market

Chapter 11 Financial Market

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1.

A financial market is a market in which people trade _____________ and derivatives at low transaction costs.

(a) Gold

(b) Financial securities

(c) Commodities

Answer:

(b) Financial securities

Question 2.

When the trade bills are accepted by commercial banks it is known as _____________

(a) Treasury bills

(b) Commercial bills

(c) Commercial papers

Answer:

(b) Commercial bills

Question 3.

Money market is a market for lending and borrowing of funds for _____________ term.

(a) short

(b) medium

(c) long

Answer:

(a) short

Question 4.

Central Government is a borrower in the money market through the issue of _____________

(a) Commercial Papers

(b) Trade Bills

(c) Treasury Bills

Answer:

(c) Treasury Bills

Question 5.

_____________ is the market for borrowing and lending long term capital required by business enterprises.

(a) Money Market

(b) Capital Market

(c) Gold Market

Answer:

(b) Capital Market

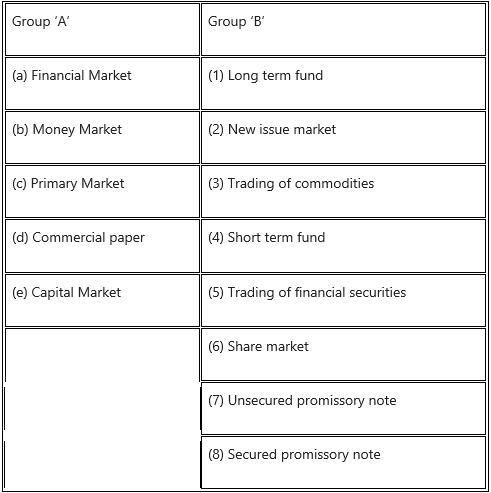

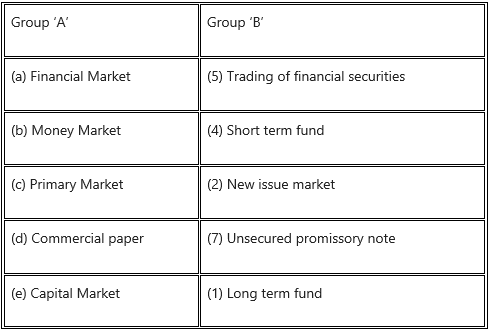

1B. Match the pairs.

Question 1.

Answer:

1C. Write a word or term or a phrase that can substitute each of the following statements.

Question 1.

A market where people trade financial securities and derivatives at low transaction costs.

Answer:

Financial Market

Question 2.

A market that provides long-term funds.

Answer:

Capital Market

Question 3.

A market that provides short-term funds.

Answer:

Money Market

Question 4.

A money market instrument is used by banks when one bank faces a temporary shortage of cash.

Answer:

Call Money

Question 5.

A bill is issued by the Reserve Bank of India on behalf of the Government of India.

Answer:

Treasury Bill

Question 6.

A market that exclusively deals with the new issue of securities.

Answer:

Primary Market

1D. State whether the following statements are True or False.

Question 1.

A Financial Market is a market in which people trade financial securities and derivatives at high transaction costs.

Answer:

False

Question 2.

The money market is the market for long-term funds.

Answer:

False

Question 3.

The capital market is the market for long-term funds.

Answer:

True

Question 4.

The primary market is also known as the new issue market.

Answer:

True

Question 5.

The secondary market is commonly known as the stock market.

Answer:

True

Question 6.

Commercial paper is a secured promissory note.

Answer:

False

Question 7.

Treasury bills are issued by commercial banks.

Answer:

False

1E. Find the odd one.

Question 1.

Treasury Bills, Shares, Certificate of Deposit.

Answer:

Shares

Question 2.

FPO, Private Placement, Commercial paper.

Answer:

commercial paper

Question 3.

New Issues Market, Call Money Market, Secondary Market.

Answer:

call money market

1F. Complete the sentences.

Question 1.

Funds borrowed and lent in money market are for _____________ term.

Answer:

short

Question 2.

When trade bills are accepted by commercial banks, it is known as _____________

Answer:

Trade Bill

Question 3.

Unsecured negotiable promissory notes issued by a commercial bank is called as _____________

Answer:

certificate of deposit

Question 4.

New shares, debentures, etc. are traded in _____________ market.

Answer:

primary

Question 5.

In capital market the instruments traded have maturity period of more than _____________ year.

Answer:

one

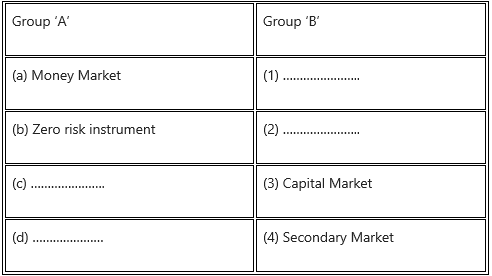

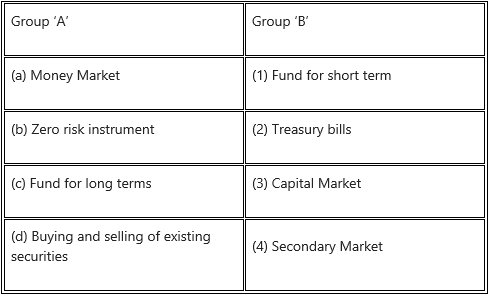

1G. Select the correct option from the bracket.

Question 1.

(Buying and selling of existing securities, Treasury Bills, Funds for long term, Fund for short term)

Answer:

1H. Answer in one sentence.

Question 1.

What is the financial market?

Answer:

A financial market is a market where financial securities are exchanged. It acts as an intermediary between investors and borrowers.

Question 2.

What is call a money market?

Answer:

The call money market is a market where funds are borrowed or lent for a very short period of 2 days to 14 days.

Question 3.

What is a Certificate of deposit?

Answer:

They are the negotiable term deposit certificates issued by commercial banks and financial institutions to build short-term finance.

Question 4.

What is a Trade bill?

Answer:

The seller draws a bill and the buyer accepts it, on acceptance, the bill becomes a marketable instrument called a Trade bill.

Question 5.

What is the new issue market?

Answer:

The market which is utilized to build fresh capital is called as ‘new issue market.’

1I. Correct the underlined word/s and rewrite the following sentences.

Question 1.

In the Primary market, already existing securities are traded.

Answer:

In the Secondary market, already existing securities are traded.

Question 2.

Companies sell fresh shares for the first time to the public in the secondary market.

Answer:

Companies sell fresh shares for the first time to the public in the Primary market.

Question 3.

In the Money market, the instruments traded have a maturity period of more than one year.

Answer:

In the Capital market, the instruments traded have a maturity period of more than one year.

Question 4.

The financial market can be classified as a capital market and call money market.

Answer:

The financial market can be classified as capital market and Money market.

2. Explain the following terms/concepts.

Question 1.

Financial Market

Answer:

- Every business unit has to raise short-term as well as long-term funds to meet the working and fixed capital requirements.

- In any economy, there are two different groups, one who invests money or lends money and the other who borrows or uses the money.

- The financial market acts as a link between these two different groups.

- The financial market provides a place or a system through which the transfer of funds by investors to the business units is adequately facilitated.

- A financial market consists of two major segments:

- Money Market

- Capital Market

- Money market deals in short-term credit and the capital market deals in medium-term and long-term credit.

Question 2.

Capital Market

Answer:

- It is a market for borrowing and lending long-term capital required by business enterprises.

- The financial assets dealt with in a capital market have a long or indefinite maturity period.

- The capital market forms an important core of a country’s financial system.

Definition:

G.H. Peters defines, “Capital Market as being the market or collection of inter-related markets in which potential borrowers are brought into contact with potential lenders.”

Question 3.

Money Market

Answer:

- A market where short-term funds are borrowed and lent is called ‘money market7. It is a market for financial assets that are close substitutes for money.

- The instruments dealt within the market are liquid and can be converted quickly into cash at a low transaction cost.

Definition:

According to the Reserve Bank of India, “The money market is the center for dealings mainly of short-term characters in money assets; it needs the short-term requirements of borrowers and provides liquidity or cash to the lenders. It is a place where short-term surplus investible funds at the disposal of financial, institutions or individuals are bid by borrower’s agents comprising institutions and individuals and also by the government itself.”

Question 4.

Call Money Market

Answer:

- Call money and Notice money market is an important segment of the money market in India. Under Call money, funds are lent or borrowed for very short periods i.e. one day.

- Under Notice money, funds are lent or borrowed for periods between 2 days to 14 days. Funds have to be repaid within a specified time on the receipt of the notice given by the lender.

- When one bank faces a temporary shortage of cash, then another bank with surplus cash lends money to it. Hence, the Call/Notice money market is also called as interbank Call money market.

Question 5.

Treasury Bills

Answer:

- Treasury Bills are short-term securities issued by the Reserve Bank of India on behalf of the Central Government of India to meet the government’s short-term funds requirement.

- Treasury Bills have three maturity periods – 91 days, 182 days, and 364 days. These bills are sold to banks and individuals, firms, institutions, etc. These bills are negotiable instruments and are freely transferable.

- The minimum value of T-bills is Rs. 25,000 or in multiples of Rs. 25000. These are issued at a discount and repaid at par and hence they are also called Zero-Coupon Bonds.

Question 6.

Commercial Bills

Answer:

Trade Bills/Commercial Bills:

- Bill of Exchange also called Trade bills are negotiable instruments or bills drawn by a seller on the buyer for the value of goods sold under credit sales.

- These have a short-term maturity period, generally of 90 days, and can be easily transferred.

- If the seller wants immediate cash, he can discount the trade bills with Commercial banks.

Question 7.

Repurchase agreement

Answer:

It is an agreement where the seller of security (i.e. one who needs money) agrees to buy it back from the lender at a higher price on a future date. Usually, this agreement is between RBI and commercial banks. RBI uses this agreement to control the money supply in the economy. These agreements are the most liquid of all money market investments having maturity ranging from 24 hours to several months.

Question 8.

Primary Market

Answer:

- It is a component of the financial market where short-term borrowing takes place.

- In the money market, the instruments are traded for not more than one year.

Question 9.

Secondary Market

Answer:

- The securities issued earlier are traded in the secondary market.

- It is the market where existing securities are resold or traded.

- Only listed securities can be dealt with in the secondary market.

3. Study the following case/situation and express your opinion.

1. Joy Ltd. Company is a newly incorporated company. It wants to raise capital for the first time by issuing equity shares.

Question (a).

Should d go to primary market or secondary market to issue its shares?

Answer:

Joy Ltd. should go to the primary market to issue equity shares in the market. Primary Market is mainly dealing with fresh issues of securities.

Question (b).

Should it offer its shares through public offer or rights issue?

Answer:

Joy Ltd. should offer its shares through public offer (IPO) as Joy Ltd. Company is going to its securities first time.

Question (c).

What will be the issue of Equity shares by Joy Ltd. Company called IPO or FPO?

Answer:

When Joy Ltd. issued its securities first time then it is called as IPO at the same time if Joy Ltd. offered securities for the second, third, or fourth time it is called a follow on public offering (EPO)

2. Mr. X is the CFO (Chief Financial Officer) of PQR Co. Ltd. which is a reputed company in the field of construction business. Often Mr. X has to decide on investing surplus funds of the company for short durations. And at times, he also has to decide the sources from where he can raise funds for short durations.

Question (a).

Assume on behalf of the company Mr. X has Rs. 5 lakhs and wants to invest for a short period. Should he buy Equity shares of Certificate of Deposit?

Answer:

As Mr. X wants to invest for a short period with the amount of Rs. 5 lakhs, then he should buy a certificate of deposit.

Question (b).

The company has surplus funds and wants to invest it. However, he needs the money back in 4 months, so should he invest in Treasury Bills or Government Securities?

Answer:

If he needs money back in 4 months, then he should invest in Treasury bills with the option of 91 days Maturity.

Question (c).

Can the company issue Certificate of Deposit?

Answer:

PQR Company Ltd. is a construction company. Hence it cannot issue a certificate of deposit as it can be issued by commercial banks and financial institutions only.

4. Distinguish between the following.

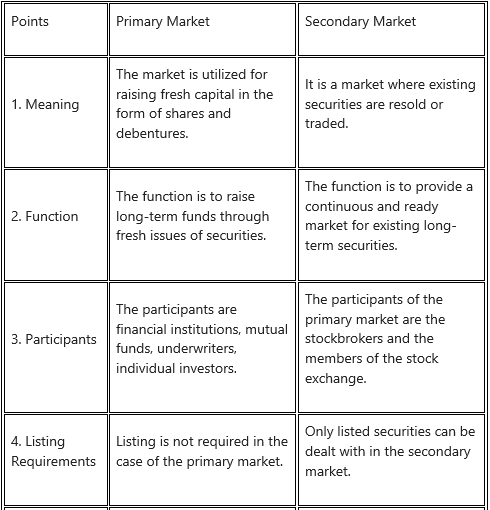

Question 1.

Primary Market and Secondary Market

Answer:

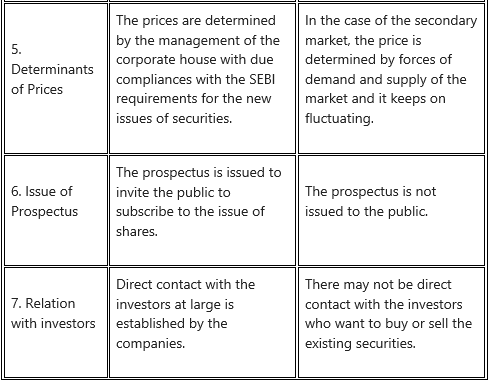

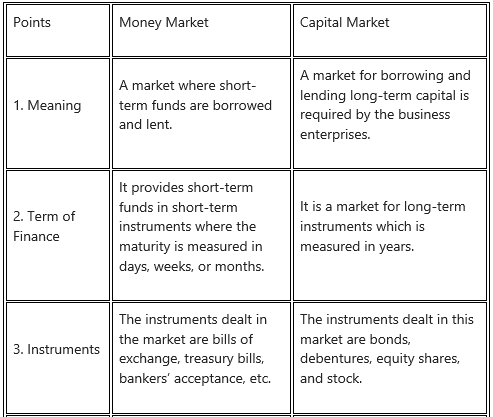

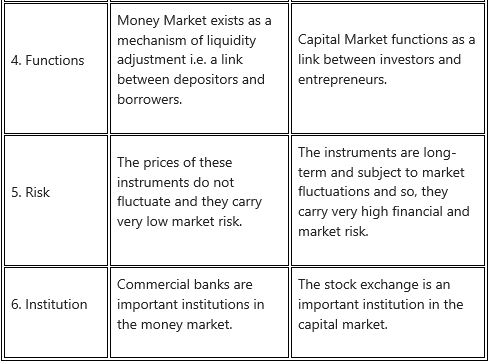

Question 2.

Money Market and Capital Market

Answer:

5. Answer in brief.

Question 1.

State any four functions of the financial market.

Answer:

Functions of financial market:

(i) Capital formation:

- Capital is the main part of the functioning of the business.

- The capital market provides a channel through which savings flow to organizations in the form of capital.

- This leads to capital formation.

(ii) Transfer of Resources:

- The financial market is one of the key sources of transfer of resources.

- The financial market facilitates the transfer of real economic resources from lenders to ultimate users.

(iii) Mobilization of funds:

- Investors that have savings must be linked with corporate that require investment.

- The financial market enables the investors to invest their saving according to their choices and risk assessment.

- This will utilize funds and the economy will boom.

(iv) Price determination:

- The financial instruments traded in a financial market get their prices from the mechanism of demand and supply.

- The interaction between demand and supply will help to determine the prices.

Question 2.

State any four features of the money market.

Answer:

The features of the money market are as follows:

(i) No Fixed Place for Trading of Securities/Shares:

In the money market, there is no definite place to carry out lending and borrowing operations of securities or shares.

(ii) Involvement of Brokers:

- Dealings in such a market can be conducted with or without the participation of brokers.

- Companies, banks, etc. may directly deal in the money market.

(iii) Financial Assets:

The financial assets that are dealt in the money market are close substitutes for money as these assets can be easily converted into cash without any loss in value.

(iv) Organisations Involved:

The main organizations dealing in the money market in India are the Reserve Bank of India (RBI), State governments, banks, corporate investors, etc.

Question 3.

State any four features of the capital market.

Answer:

Following are the main features of the capital market:

- The link between investors and borrowers: The capital market links investors with the borrowers of funds. It routes money from savers to entrepreneurial borrowers.

- Deals in medium and Long-term investment: A capital market is a market where medium and long-term financial instruments are traded. Through this market corporate, industrial organizations, financial institutions access long-term funds from both, domestic and foreign markets.

- Presence of Intermediaries: The capital market operates with the help of intermediaries like brokers, underwriters, merchant bankers, collection bankers, etc. These intermediaries are important elements of a capital market.

- Promotes capital formation: The capital market provides a platform for investors and borrowers of long-term funds to trade. This leads to capital formation in an economy as it mobilizes funds.

Question 4.

Explain any 4 types of money market instruments.

Answer:

Instruments of Money Market:

(i) Commercial Paper:

- Commercial papers were first issued in the Indian money market in 1990.

- They are unsecured debt instruments.

- They are issued only by companies with strong credit ratings. They are issued at a discount rate. They are in the form of promissory notes.

- They are negotiable instruments i.e. they are freely transferable by endorsement and delivery.

- They are issued for a period of 15 days to 1 year.

(ii) Commercial Bills:

- When the goods are sold on credit, the buyer becomes liable to make payment on a specific date in the future.

- The seller draws a bill and the buyer accepts it. On acceptance, the bill becomes a marketable instrument called a Trade Bill.

- When a Trade Bill is accepted by a commercial bank, it is known as a commercial bill.

- They are in the form of negotiable instruments.

- They are usually issued for a period of 90 days. But this period can vary between 30 to 90 days.

- The liquidity of this bill is very high.

- It is the most common method to meet the credit needs of trade and industry.

(iii) Certificate of Deposits:

- Certificate of Deposits was first introduced to the money market of India in 1989.

- They are issued by commercial banks or financial institutions at discount, at par, or at market rate.

- They are in the form of promissory notes and stamp duty is applicable on the instrument.

- The maturity periods of this instrument are from 15 days to 1 year.

- The subscribers for certificates of deposits are individuals, associations, companies, trusts, etc.

- They are freely transferable by endorsement and delivery after a lock-in period of a minimum of 15 days.

(iv) Treasury Bills:

- Issue/Use of Treasury Bills was started by the Indian government in 1917.

- This instrument is issued by the government to institutions or the public to bridge the gap between receipts and expenditure.

- It is issued by the government on a discount for a fixed period not exceeding 1 year.

- These bills are in the nature of promissory notes containing a promise to pay the amount stated to the bearer of the instrument.

- The maturity period of this bill is 182 days.

- These bills enjoy a high degree of liquidity.

6. Justify the following statements.

Question 1.

Financial Markets act as a link between investor and borrower.

Answer:

- The financial market is the market that brings together borrowers and lenders.

- The financial market attracts fund from investors by offering them a variety of schemes and then collected fund is diverted into the business organizations.

- People having surplus cash invested into financial market securities, the financial market provides finance than to businesses.

- Similarly, when the financial market generates income from investments in business, it shares with the investor.

- Thus, it is a valuable link between borrower and lender.

Question 2.

Money Market makes available short-term finance through different instruments.

Answer:

- The money market is the market that provides short-term loans to businesses and governments.

- The loan period ranging from one day to one year.

- Call money and notice money provide finance for periods between 2 days to 14 days.

- Treasury Bills offer finance to the government for 91 days, 182 days, 364 days. Trade Bill or commercial bills offer finance up to 90 days.

- Commercial paper offers finance to the business organization from 7 days to 1 year. Money Market Mutual Fund offers finance for a maximum period of 1 year.

- Hence, the money market makes available short-term finance through different instruments.

Question 3.

Capital Market is useful for the corporate sector.

Answer:

- Capital Market is the market that provides loans for long-term periods. It is controlled by SEBI.

- It uses shares, debenture bonds, Mutual funds.

- The corporate sector issues these securities in the market and attracts saving from investors by offering them a variety of schemes. These savings become capital and get invested in the business.

- It is helpful to develop the corporate and industrial sectors.

- Thus, the capital market is useful for the corporate sector.

Question 4.

There are many participants in the money market.

Answer:

Some important participants in the money market are:

(i) Reserve Bank of India:

It is the most important participant in the money market. Through the money market, RBI regulates the money supply and implements its monetary policy. It issues government securities on behalf of the government and also underwrites them. It acts as an intermediary and regulator of the market.

(ii) Central and State Government:

Central Government is a borrower in the Money Market, through the issue of Treasury Bills (T-Bills). The T-Bills are issued through the Reserve Bank of India (RBI). The T-Bills represent zero risk instruments. Due to its risk-free nature banks, corporate, etc. buy the T-Bills and lend to the government as a part of its short-term borrowing program. The state government issues bonds called State Development Loans.

(iii) Public Sector Undertakings (PSU):

Many listed government companies can issue commercial paper in order to obtain their working capital.

(iv) Scheduled Commercial Banks:

Scheduled commercial banks are very big borrowers and lenders in the money market. They borrow and lend in the call money market, short notice market, Repo and Reverse Repo market.

(v) Insurance Companies:

Both the general and life insurance companies are usual lenders in the money market. They invest more in capital market instruments. Their role in the money market is limited.

(vi) Mutual Funds:

Mutual Funds offer varieties of schemes for the different investment objectives of the public. Mutual funds schemes are liquid schemes. These schemes have the investment objective of investing in money market instruments.

(vii) Non-Banking Finance Companies (NBFCs): NBFCs use their surplus funds to invest in government securities, bonds, etc. (Example of NBFC – Unit Trust of India)

(viii) Corporates:

Corporates borrow by issuing commercial papers which are nothing but short-term promissory notes. They are the lender to the banks when they buy the certificate of deposit issued by the banks.

(ix) Primary Dealers:

Their main role is to promote transactions in government securities. They buy as well as underwrite the government securities.

7. Answer the following questions.

Question 1.

Explain the functions of the financial market.

Answer:

Financial Market – Meaning:

- A financial market is an institution, that facilitates the exchange of financial instruments including deposits, loans, corporate stocks, bonds, etc.

- The financial market provides a place through which the transfer of funds by investors to the business is adequately facilitated.

- Financial Markets attract funds from investors and channelizes them to corporations.

- The financial market consists of money and capital markets. They help to raise short and long-term capital.

Functions of Financial Market:

(i) Capital formation:

- Capital is the main part of the functioning of the business.

- The capital market provides a channel through which savings flow to organizations in the form of capital.

- This leads to capital formation.

(ii) Transfer of Resources:

- The financial market is one of the key sources of transfer of resources.

- The financial market facilitates the transfer of real economic resources from lenders to ultimate users.

(iii) Mobilization of funds:

- Investors that have savings must be linked with corporates that require investment.

- The financial market enables investors to invest their savings according to their choices and risk assessment.

- This will utilize funds and the economy will boom.

(iv) Price determination:

- The financial instruments traded in a financial market get their prices from the mechanism of demand and supply.

- The interaction between demand and supply will help to determine the prices.

(v) Productive usage:

- Financial Market allow productive use of the fund.

- An excess fund of investors is used by the borrowers for productive purposes.

(vi) Enhancing Income:

- The financial market allows lenders to earn interest or dividends on their surplus funds.

- Thus, it helps in the enhancement of the individual and the national income.

(vii) Liquidity:

- The financial market provides a mechanism through which liquidating of financial instruments take place.

- Here, the investor can sell their financial instruments and convert them into cash.

(viii) Sale Mechanism:

- Financial Market provides a mechanism for selling a financial instrument by investors.

- It helps to offer the benefit of marketability and liquidity of such assets.

(ix) Easy access:

- Both industries and investors need each other.

- The financial market provides a platform where buyers and sellers can find each other easily.

(x) Industrial Development:

The financial market transforms saving into capital. Corporate use of funds of investors to undertakes productive or commercial activities leads to economic development.

Question 2.

State the instruments in the money market.

Answer:

- The money market is a market for borrowing and lending of funds for the short term.

- RBI is an apex body that controls the money market.

- The short period of time varies from one day to one year.

Instruments of Money Market:

(i) Commercial Paper:

- Commercial papers were first issued in the Indian money market in 1990.

- They are unsecured debt instruments.

- They can be, therefore, issued only by companies with strong credit ratings.

- They are issued by corporate houses for raising short-term finance mainly to finance their working capital requirements.

- They are issued at a discount rate. They are in the form of promissory notes.

- They are negotiable instruments i.e. they are freely transferable by endorsement and delivery.

- They are issued for a period of 15 days to 1 year.

- Face value is in multiples of ‘5 lakhs.

- The issuing company has to bear all expenses like dealer’s fees, agency fees, etc. related to the uses of the commercial paper.

- The rate of interest varies greatly as it is influenced by various factors such as the economy, the credit rating of the instruments, etc.

- The marketability of these instruments is influenced by the rates prevailing in the call market as well as the foreign exchange market.

- It used to be 30 days and it is further reduced to 15 days w.e.f 25th May 1998.

(ii) Commercial Bills:

- When the goods are sold on credit, the buyer becomes liable to make payment on a specific date in the future.

- The seller draws a bill and the buyer accepts it. On acceptance, the bill becomes a marketable instrument called a Trade Bill.

- When a Trade Bill is accepted by a commercial bank, it is known as a commercial bill.

- The seller draws a bill and the buyer accepts it.

- They are in the form of negotiable instruments.

- They are usually issued for a period of 90 days. But this period can vary between 30 to 90 days.

- The liquidity of this bill is very high.

- It is the most common method to meet the credit needs of trade and industry.

- The bank can rediscount the bills and are able to meet the short-term liquidity requirements.

- The commercial bill lacks development in the money market due to lack of bill culture, high stamp duty, inadequate credit backing, absence of a secondary market, etc.

(iii) Certificate of Deposits:

- Certificate of Deposits was first introduced to the money market of India in 1989.

- They are negotiable term deposit certificates.

- They are issued by commercial banks or financial institutions at discount, at par, or at market rate.

- They are in the form of promissory notes and stamp duty is applicable on the instrument.

- The maturity periods of this instrument are from 15 days to 1 year.

- The subscribers for certificates of deposits are individuals, associations, companies, trusts, etc.

- They are freely transferable by endorsement and delivery after a lock-in period of a minimum of 15 days.

(iv) Treasury Bills:

- Issue/use of Treasury Bills was started by the Indian government in 1917.

- This instrument is issued by the government to institutions or the public for raising short-term funds to bridge the gap between receipts and expenditure.

- It is issued by the government on a discount for a fixed period not exceeding 1 year.

- These bills are in the nature of promissory notes containing a promise to pay the amount stated to the bearer of the instrument.

- The maturity period of this bill is 182 days.

- These bills enjoy a high degree of liquidity.

(v) Government Securities:

- The marketable debt issued by the government or by semi-government bodies represents a claim on the government in known as government securities.

- These securities are issued by agencies such as central government, state government, local government such as municipalities, etc.

- These government securities are in the form of stock certificates, promissory notes, and bearer bonds.

- The liquidity is high for securities issued by the central government and limited for the state government and the local government.

- These securities are safe investments as payment of interest and repayment of the principal amount is guaranteed by the government.

- Rebates for investment in these securities are available under the Income Tax and other Acts.

(vi) Money Market Mutual Funds:

- It is a mutual fund that invests solely in money market instruments.

- These are issued by mutual fund organizations.

- They are in the form of debt.

- These mature in less than a year.

- They are very liquid.

- They are the safest and most secure of all mutual funds investments.

- The assets in money market funds are invested in safe and stable instruments of investments issued by the government, banks, corporations, etc.

- These mutual funds allow retail investors the opportunity of investing in money market instruments and benefit from the price advantage.

(vii) Repo Rate:

- It is the repurchase rate which is also known as the official bank rate.

- The repo rate is the discounted interest rate at which a central bank repurchases the government securities.

- It is the transaction that is carried by the central bank with the commercial bank to reduce some of the short-term liquidity in the system.

Question 3.

State the features of the capital market.

Answer:

Meaning:

- Capital markets provide medium and long-term loans to business enterprises.

- SEBI is responsible to control the working of the capital market.

- It attracts saving from people and form capital to the business.

- It is dealing in shares, debentures, bonds, mutual funds, etc.

Features of Capital Market:

Following are the main features of the capital market:

(i) Link between investors and borrowers:

The capital market links investors with the borrowers of funds. It routes money from savers to entrepreneurial borrowers.

(ii) Deals in medium and Long-term investment: A capital market is a market where medium and long-term financial instruments are traded. Through this market corporate, industrial organizations, financial institutions access long-term funds from both, domestic and foreign markets.

(iii) Presence of Intermediaries:

The capital market operates with the help of intermediaries like brokers, underwriters, merchant bankers, collection bankers, etc. These intermediaries are important elements of a capital market.

(iv) Promotes capital formation:

The capital market provides a platform for investors and borrowers of long-term funds to trade. This leads to capital formation in an economy as it mobilizes funds.

(v) Regulated by government rules, regulations, and policies:

The capital market operates freely. However, it is regulated by government rules, regulations, and policies.

For e.g. SEBI is the regulator of Capital markets.

(vi) Deals in marketable and non-marketable securities:

Capital market traders in both, marketable and non-marketable securities. Marketable securities are securities that can be transferred, e.g. Shares, Debentures, etc. and non-marketable securities are those which cannot be transferred, e.g. Term Deposits, Loans, and Advances.

(vii) Variety of Investors:

The capital market has a wide variety of investors. It comprises both, individuals like the general public and institutional investors like Mutual Funds, Insurance companies, Financial Institutions, etc.

(viii) Risk:

Risk is very high here as the instruments have long maturity periods. However, the return on investments is very high.

(ix) Instruments in capital market:

- Equity shares

- Preference shares

- Debentures

- Bonds

- Government securities

- Public Deposits.

(x) Types of Capital Market:

Capital market is mainly classified as-

(i) Government Securities Market or Gilt-edged markets:

In this market, government and semi-government securities are traded.

(ii) Industrial Securities Market:

In this market, industrial securities, i.e. shares and debentures of new or existing corporate are traded. This market is further divided into:

- Primary or New issues Market – Here companies sell fresh shares, debentures, etc. for the first time to the public.

- Secondary Market – Here already existing shares, debentures, etc. are traded through the Stock Exchanges.