Chapter 4 Ledger

1. Answer in one sentence only.

Question 1.

What is Ledger?

Answer:

Ledger is an important book of account in which individual records business transactions with respect to persons, properties, expenses, or losses are maintained.

Question 2.

What is ledger posting?

Answer:

Transferring the entry passed in the journal to the ledger for the individual record is called ledger posting.

Question 3.

When does an account show a nil balance?

Answer:

When the total credit side of an account equals the total of the debit side, such an account shows a nil balance.

Question 4.

What is Folio?

Answer:

Page number of the account opened in the ledger is called Ledger folio.

Question 5.

Where is the statement form of ledger A/c is used in actual practice?

Answer:

The statement form of ledger A/c is used in the banks and financial institutions to prepare the client’s account showing balances of accounts after each transaction is complete.

Question 6.

Why Proprietor’s Capital account is a liability for the business?

Answer:

Capital invested in the business by the proprietor is an asset for the proprietor and liability for the business.

Question 7.

Why does a cash account never shows a credit balance?

Answer:

Available cash with the business is an asset of the business and the account of every asset shows debit, cash account always shows debit balance.

Question 8.

What is ‘Trial Balance’?

Answer:

Trial Balance is an abstract or list of all the ledger accounts as on a specified date showing debit total and the credit total of all the accounts or their net balance.

2. Write the word, term, phrase, which can substitute each of the statements.

Question 1.

Principal Book of accounts.

Answer:

Ledger

Question 2.

Transferring a journal entry to the appropriate accounts in the Ledger.

Answer:

Posting

Question 3.

Page number of Ledger to which an entry is posted.

Answer:

Ledger folio

Question 4.

The process of extracting the balance and inserting it on the lesser side of an account.

Answer:

Balancing

Question 5.

A debit balance to Personal Accounts.

Answer:

Debtor

Question 6.

A credit balance to Bank Account.

Answer:

Bank overdraft

Question 7.

An account to be debited for goods damaged by fire.

Answer:

Loss by fire

Question 8.

A Trial Balance in which only net balances of all ledger accounts are transferred.

Answer:

Net Trial Balance

3. Select appropriate alternatives from those given below and rewrite the sentences.

Question 1.

In case of a credit transaction one of the account must be a ______________ account.

(a) Cash

(b) Credit

(c) Personal

(d) Debit

Answer:

(c) Personal

Question 2.

‘c/d’ indicates ______________ balance.

(a) Opening

(b) Closing

(c) Positive

(d) Negative

Answer:

(b) Closing

Question 3.

______________ Column of ledger is used for writing page number of Journal.

(a) J.F.

(b) L.F.

(c) Date

(d) Particulars

Answer:

(a) J.F.

Question 4.

Debtors Account shows ______________ balance.

(a) Real

(b) Negative

(c) Credit

(d) Debit

Answer:

(d) Debit

Question 5.

______________ is the process of deriving the difference between totals of the debit and credit side of each ledger a/c.

(a) Totalling

(b) Journalizing

(c) Balancing

(d) Posting

Answer:

(c) Balancing

Question 6.

Total of Purchase book is ______________ to Purchase Account.

(a) posted

(b) moved

(c) given

(d) entered

Answer:

(a) posted

Question 7.

Real account always shows ______________ balance.

(a) minimum

(b) maximum

(c) debit

(d) credit

Answer:

(c) debit

Question 8.

______________ is prepared to test arithmetical accuracy of Books of Accounts.

(a) Trial Balance

(b) Ledger

(c) Journal

(d) List

Answer:

(a) Trial Balance

4. State whether the following statements are ‘True or False’ with reasons.

Question 1.

Ledger is a book of Original Entry.

Answer:

This statement is False.

Ledger is a book of Secondary Entry.

Journal is a book of Original Entry: First, all transactions are recorded to journal or subsidiary books, and then they are pasted to the respective ledger accounts.

Question 2.

The process of recording a transaction in the Journal is called Posting.

Answer:

This statement is False.

The process of recording a transaction in the Journal is called Journalising. Posting means transferring journal entries to respective ledger accounts.

Question 3.

A cash withdrawal from business by the trader should be credited to Drawings A/c.

Answer:

This statement is False.

Cash withdrawn from the business by the trader should be debited to Drawing A/c. It is a personal account and as per the golden rules of a personal account Debit the receiver.

Question 4.

Balances of Nominal Accounts are carried forward to the next year.

Answer:

This statement is False.

Balances of Nominal Accounts are transferral to Trading and Profit and loss accounts of the year to find Gross Profit and Net Profit.

Question 5.

When the debit side of an account is greater than the credit side, the account shows a debit balance.

Answer:

This statement is True.

While balancing the ledger account the side which is greater is the balance of that account so when the debit side of an account is greater the account shows debit balances.

Question 6.

The name of an account written on top of each account is called ‘Head of Account’.

Answer:

This statement is True.

There are many ledger accounts in the ledger book. To identity, the name of the account, every account on the Top Head of Account is written.

Question 7.

Agreement of Trial Balance always proves accounting accuracy.

Answer:

This statement is False.

Even though the Trial balance is tally there may be some mistake like the complete omission of transaction or compensatory error so Agreement of Trial Balance does not always prove accounting accuracy.

Question 8.

The trial balance is based on the double-entry principle that for every debit there is an equal amount of corresponding credit.

Answer:

This statement is True.

Trial balance is an extract of ledger balances. Ledger is prepared of journal book which follows the Double Entry System of book-keeping. When both the effects of debit and credit with equal amount is given. The trial balance will be tally.

5. Fill in the blanks.

Question 1.

______________ Balance on Nominal Account shows expenses or loss.

Answer:

debit

Question 2.

Cash account always shows ______________ balance.

Answer:

debit

Question 3.

The right hand side of an account is called ______________ side.

Answer:

credit

Question 4.

Creditors shows ______________ balance.

Answer:

credit

Question 5.

______________ accounts are closed by transferring its balances to Profit and Loss Account.

Answer:

Nominal

Question 6.

‘b/d’ means ______________

Answer:

brought down

Question 7.

Rent paid for the residential quarter will be debited to ______________ account.

Answer:

Drawings

Question 8.

Sold goods of ₹ 24,000 at 20% Profit on cost, the purchase price of the goods is ______________

Answer:

₹ 20,000

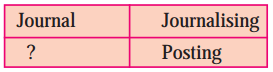

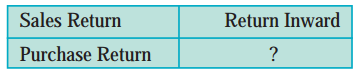

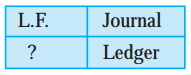

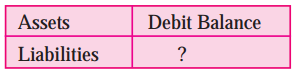

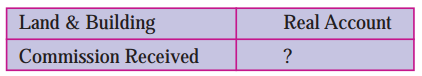

6. Complete the following table.

Question 1.

Answer:

Ledger

Question 2.

Answer:

Return outward

Question 3.

Answer:

J.F.

Question 4.

Answer:

Credit balance

Question 5.

Answer:

Nominal A/c

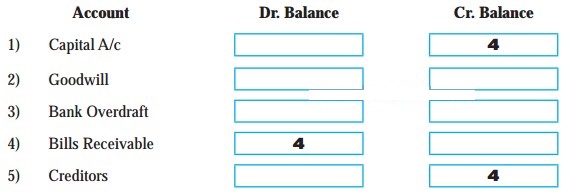

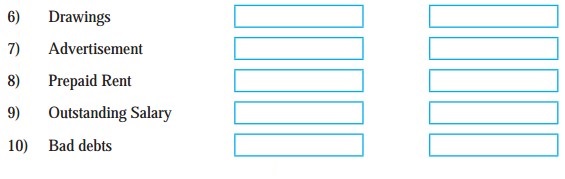

7. Put ‘4’ mark for the nature of balance for the following.

Question 1.

Answer:

Account | Dr. Balance | Cr. Balance |

1. Capital A/c | 4 | |

2. Goodwill | 4 | |

3. Bank Overdraft | 4 | |

4. Bills Receivable | 4 | |

5. Creditors | 4 | |

6. Drawings | 4 | |

7. Advertisement | 4 | |

8. Prepaid Rent | 4 | |

9. Outstanding Salary | 4 | |

10. Bad debts | 4 |

Practical Problems

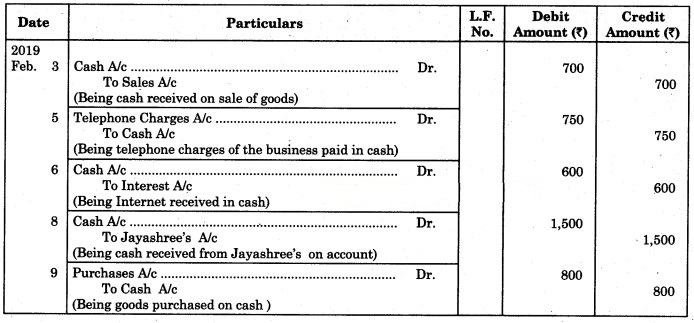

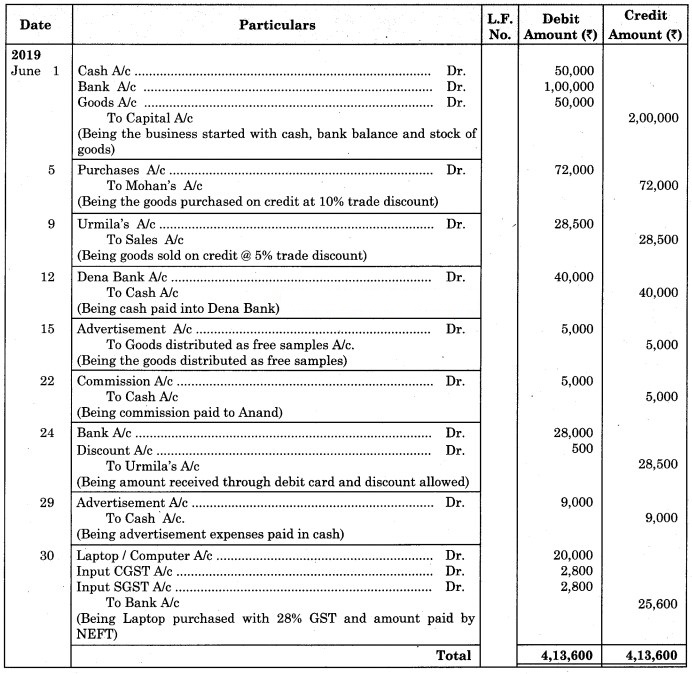

Question 1.

Give Journal entries of the following posting from the ledger account.

In the books of Sopan

Solution:

Journal of Sopan

Question 2.

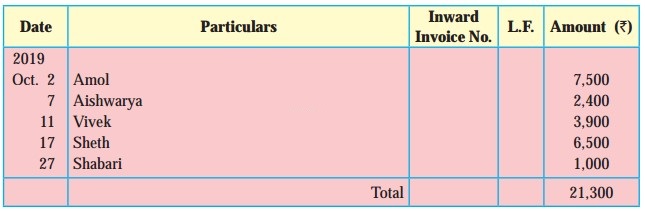

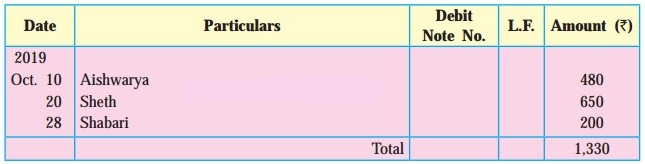

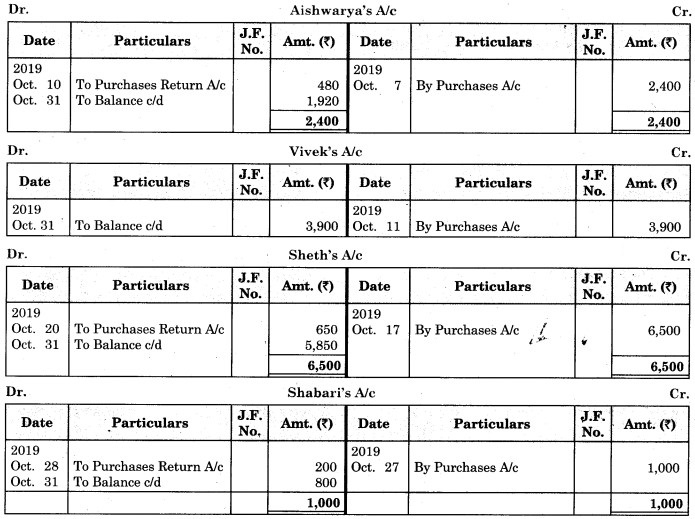

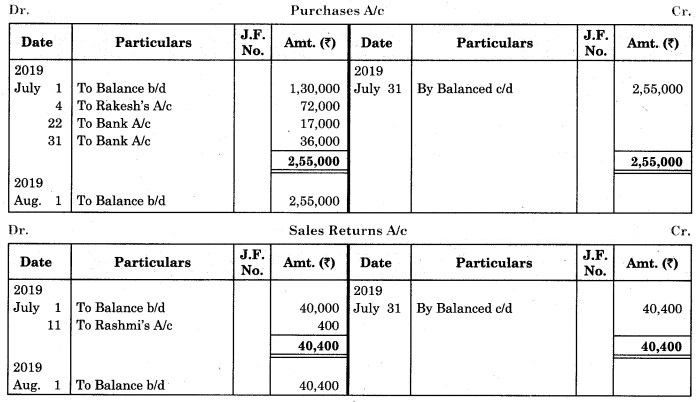

Prepare necessary Ledger Accounts from the following Subsidiary Books.

Purchase Book

Purchase Return Book

Solution:

In the Ledger of ______________

Question 3.

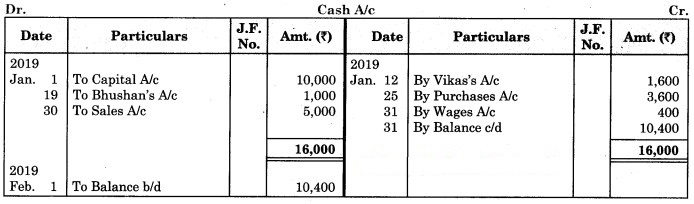

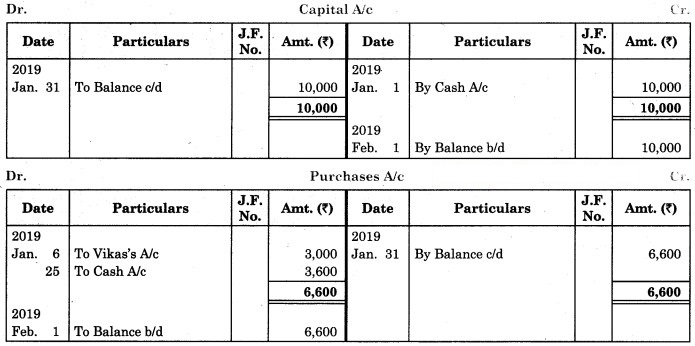

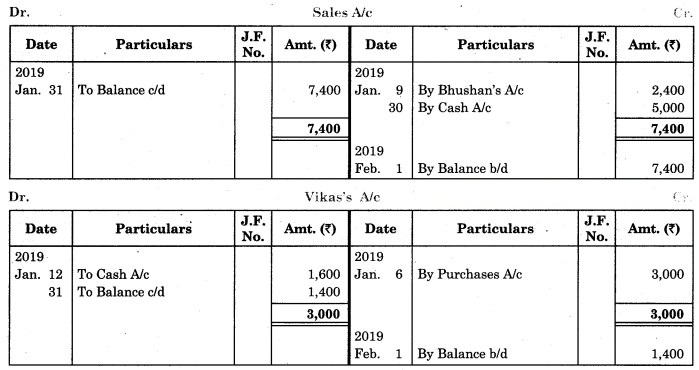

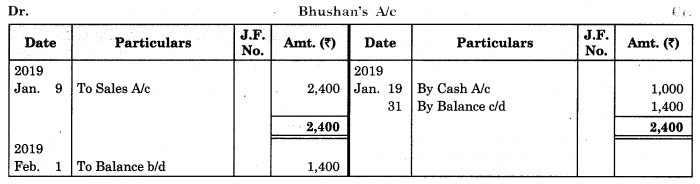

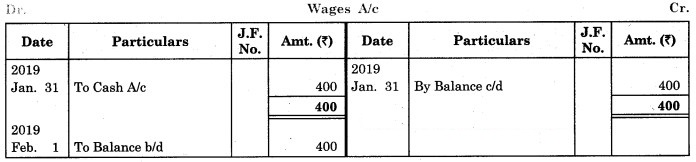

From the following transactions prepare necessary Ledger Accounts in the Books of Vinay and balance the same.

2019 Jan.

1 Started business with Cash ₹ 10,000

6 Bought goods from Vikas ₹ 3,000

9 Sold goods to Bhushan ₹ 2,400

12 Paid to Vikas on account ₹ 1,600

19 Received on account from Bhushan ₹ 1,000

25 Cash Purchases ₹ 3,600

30 Cash Sales ₹ 5,000

31 Paid Wages ₹ 400

Solution:

In the Ledger of Vinay

Question 4.

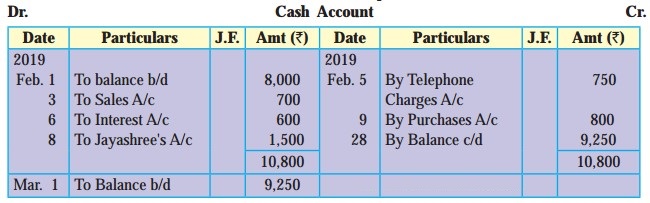

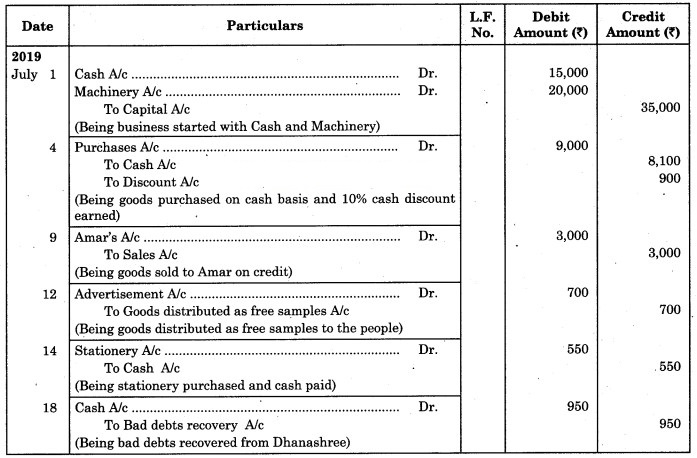

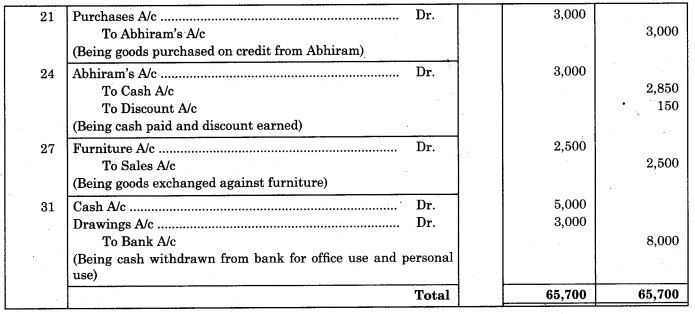

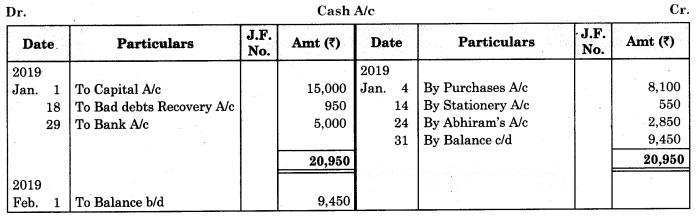

Journalise the following transactions and prepare Cash A/c only.

2019 July

1 Hardik started the business with Cash ₹ 15,000 and Machinery ₹ 20,000.

4 Purchased goods for ₹ 9,000 less 10% Cash Discount.

9 Sold goods to Amar ₹ 3,000.

12 Distributed goods worth ₹ 700 as free samples.

14 Bought Stationery for ₹ 550 for office use.

18 Received ₹ 950 from Dhanashree, a customer, whose account was earlier written off as a bad debt.

21 Abhiram invoiced us goods worth ₹ 3,000.

24 Settled Abhiram’s account, he allowed 5% cash discount.

27 Exchanged goods worth ₹ 2,500 against Furniture of the same amount.

29 Withdrawn cash from ATM ₹ 5,000 for office use and ₹ 3,000 for personal use.

Solution:

Journal of Hardik ______________

Ledger of Hardik

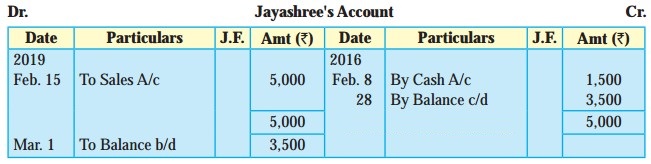

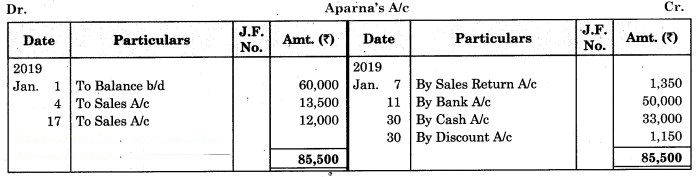

Question 5.

Prepare Aparna’s account in the books of Suparna.

2019 Jan.

1 Balance due from Aparna ₹ 60,000

4 Sold goods to Aparna ₹ 15,000 at 10% Trade Discount.

7 Goods returned by Aparna ₹ 1,500 (Gross)

11 Received crossed cheque from Aparna ₹ 50,000

17 Invoiced goods to Aparna ₹ 12,000

25 Sold goods to Aparna in cash ₹ 6,000

30 Received cash from Aparna ₹ 33,000 in full settlement of her account.

Solution:

Ledger of Suparna

Working Notes:

Jan. 4:

Trade discount = 10% on ₹ 15,000

= × ₹ 15,000

= ₹ 1,500

Net Selling Price = Catalogue price – Trade discount

= 15,000 – 1,500

= ₹ 13,500

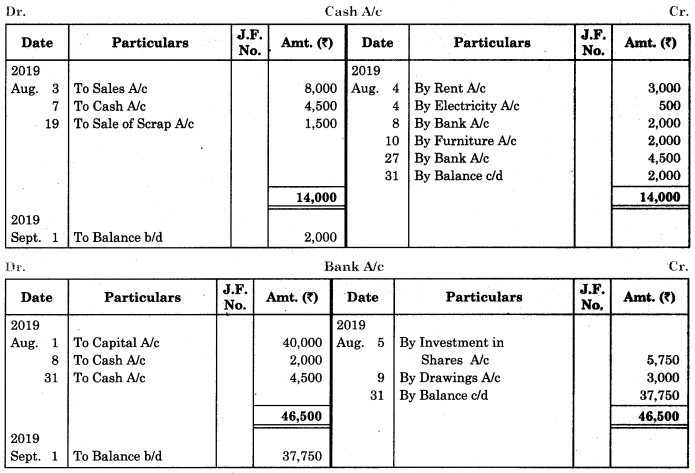

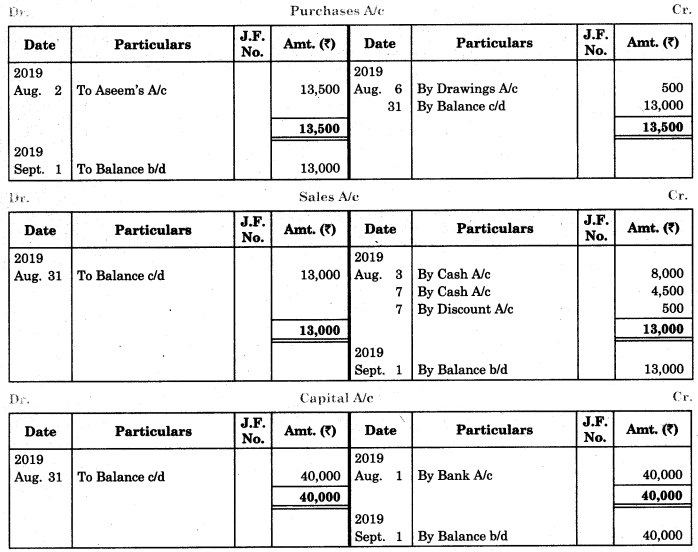

Question 6.

Prepare Cash A/c, Bank A/c, Purchases A/c, Sales A/c, and Capital A/c and balance the same in the books of Madanlal.

2019 Aug.

1 Started business with a bank balance of ₹ 40,000.

2 Purchased goods from Aseem worth ₹ 15,000 less 10% Trade Discount.

3 Sold goods to Arun for ₹ 8,000 in cash.

4 Paid Rent ₹ 3,000 and Electricity bill ₹ 500.

5 Purchased 100 Shares of Perfect Technologies for ₹ 55 per share and paid Brokerage ₹ 250 by transfer through net banking.

6 Withdrawal of goods for personal use ₹ 500.

7 Sold goods for cash ₹ 5,000 less 10% Cash Discount.

8 Deposited cash into Bank ₹ 2,000.

9 Paid ₹ 3,000 for daughter’s tuition fees by Debit Card.

10 Purchased a Table for ₹ 2,000.

19 Received ₹ 1,500 by selling the scrap.

27 Paid cash into a bank in excess of ₹ 2,000

Solution:

In the Ledger of Madanlal

Question 7.

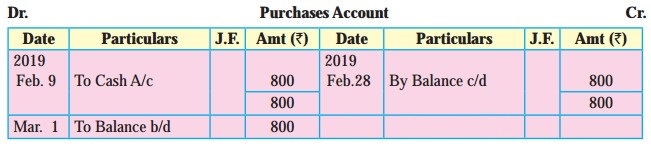

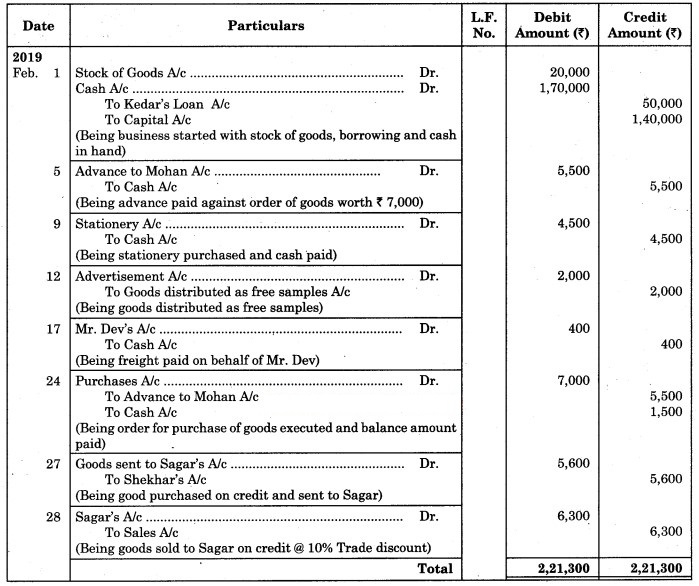

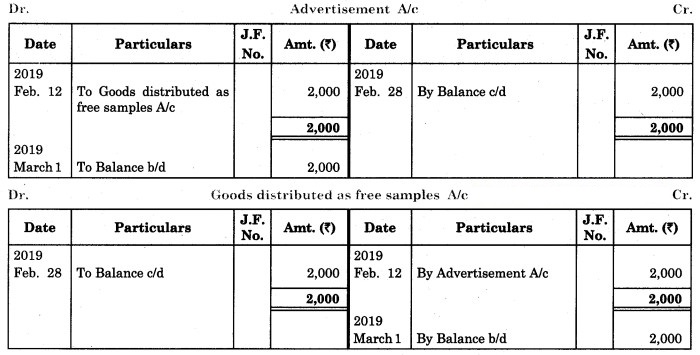

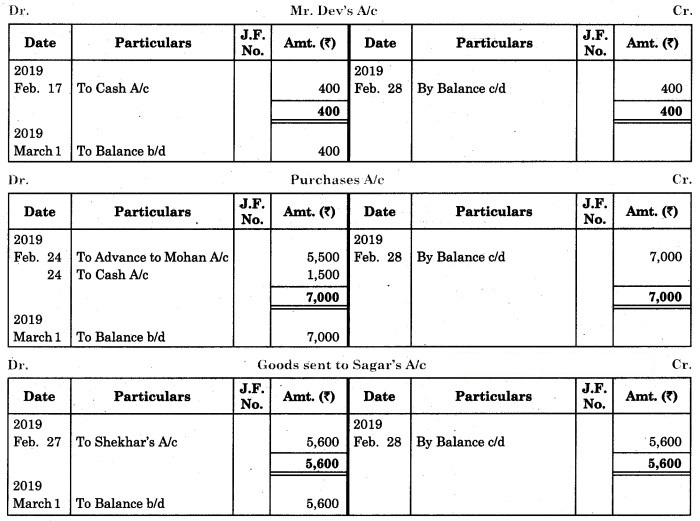

Journalise the following transactions; post them into Ledger for February 2019

1 Sunil Started business with a stock of goods ₹ 20,000 and Cash ₹ 1,70,000 out of which ₹ 50,000 borrowed from his friend Kedar @ 10 p.a.

5 Placed an order for goods worth ₹ 7,000 with Mohan for which an advance of ₹ 5,500 was paid.

9 Purchased Stationery for office use ₹ 4,500

12 Goods distributed as free samples ₹ 2,000

17 Paid Freight ₹ 400 on behalf of Mr. Dev.

24 Received Goods from Mohan as per our order dated 5th Feb and settled his account.

27 Bought goods from Shekhar on two months credit for ₹ 7,000 at 20% Trade Discount with instructions to send them to Sagar.

28 Sent to Sagar Outward Invoice for goods supplied by Shekhar, at list price less 10% Trade Discount.

Solution:

Journal of Sunil

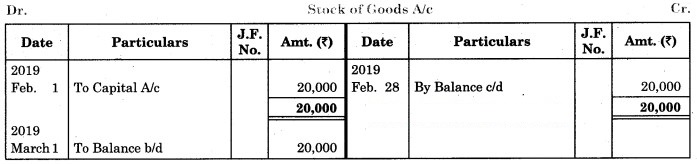

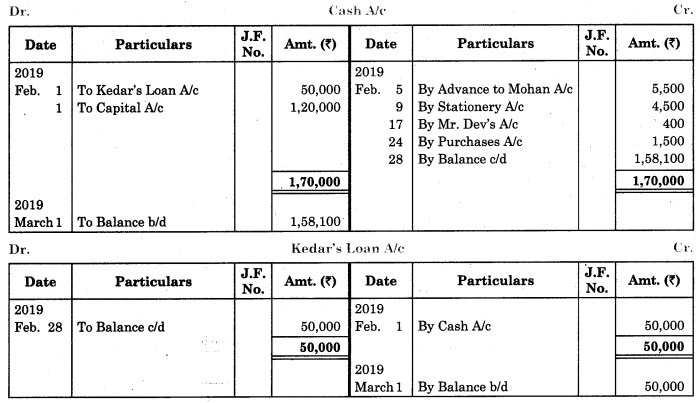

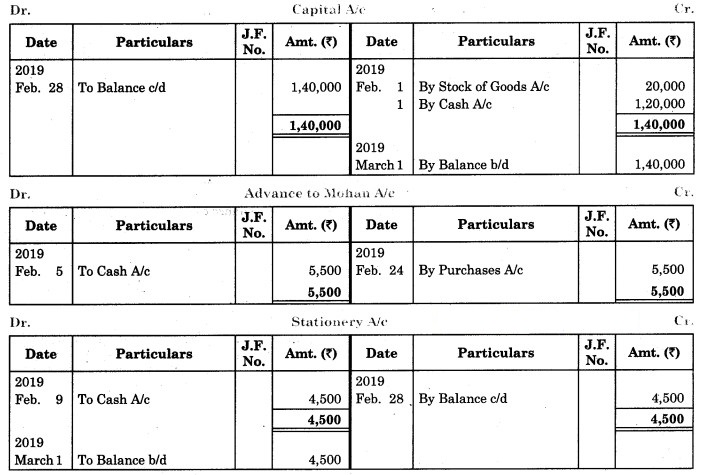

Ledger of Sunil

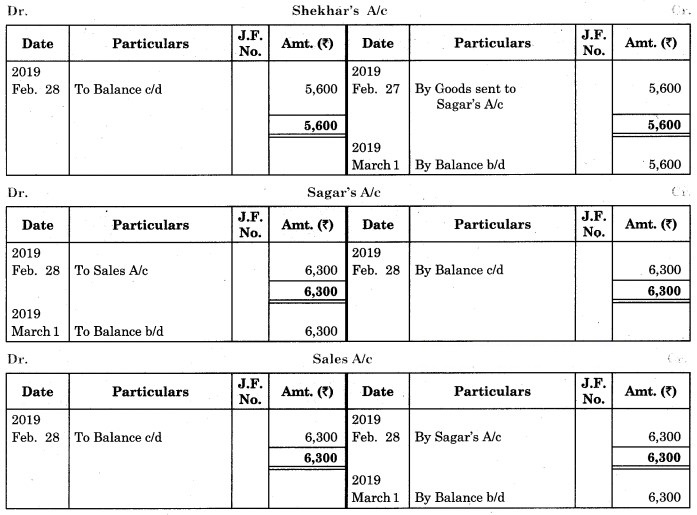

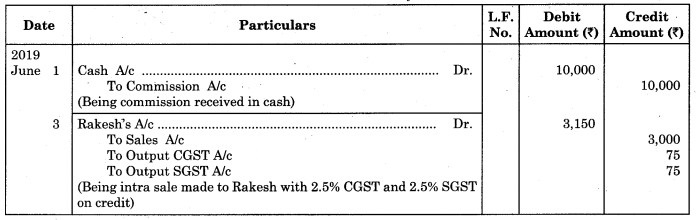

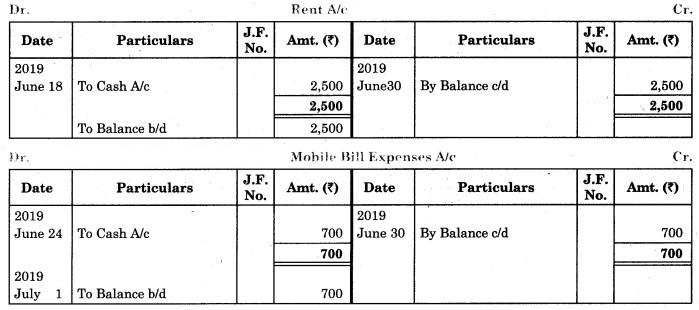

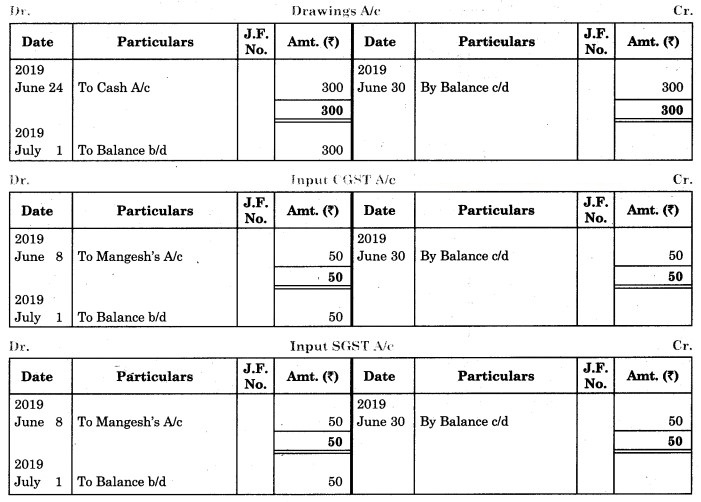

Question 8.

Journalise the following transactions and Prepare ledger accounts in the books of Sanjeev.

2019 June

1 Cash Received from Raju ₹ 10,000 for commission.

3 Intra-state sale to Rakesh ₹ 3,000 and SGST @ 2.5% and CGST @ 2.5% applicable.

5 Received full amount from Rakesh.

8 Intra-state purchases from Mangesh ₹ 2,000 and SGST @ 2.5% and CGST @ 2.5% applicable.

11 Paid the necessary amount to Mangesh.

18 Paid Rent ₹ 2,500

24 Paid mobile bill ₹ 1,000 out of which ₹ 700 for office use and for ₹ 300 for personal use.

Solution:

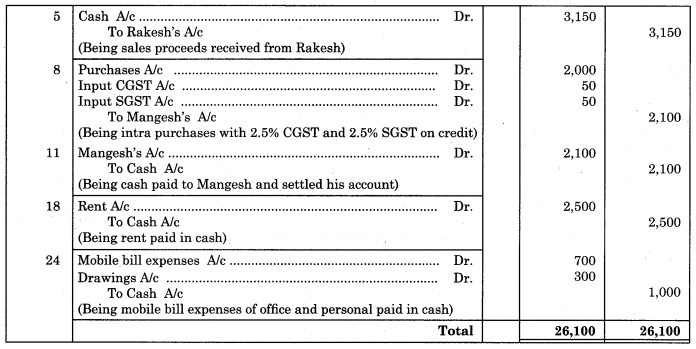

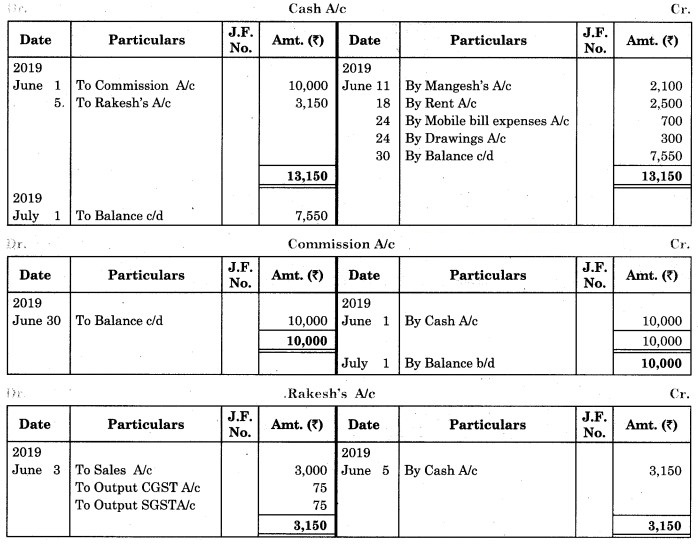

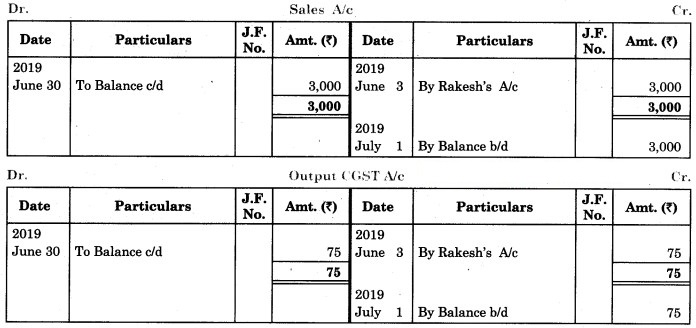

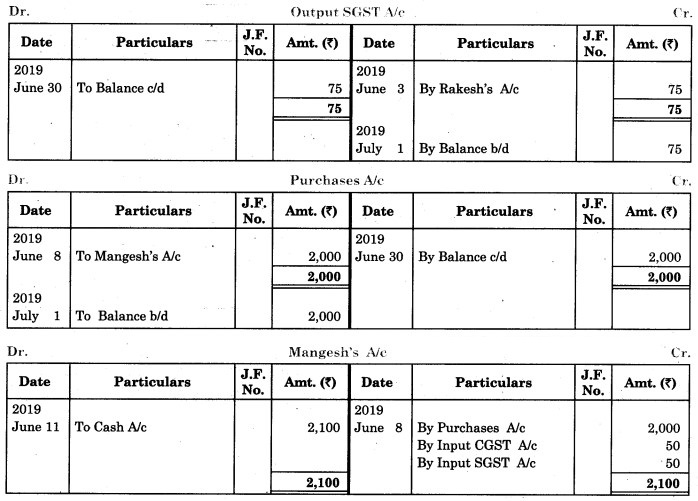

Journal of Sanjeev

In the Ledger of Sanjeev

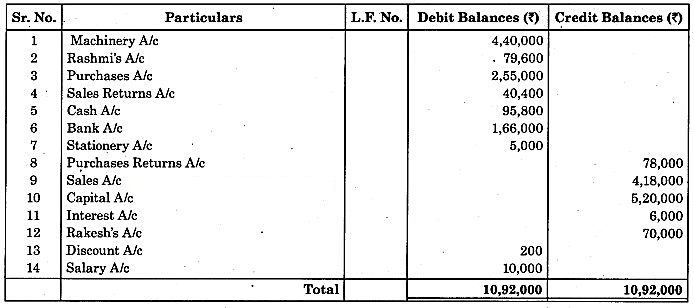

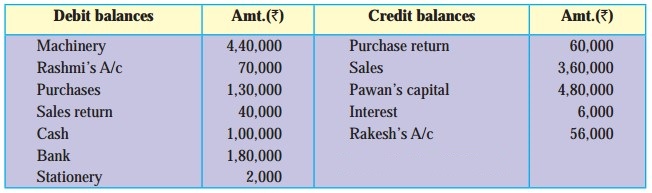

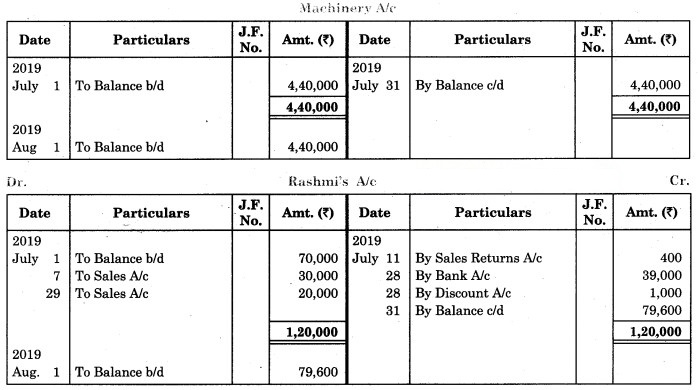

Question 9.

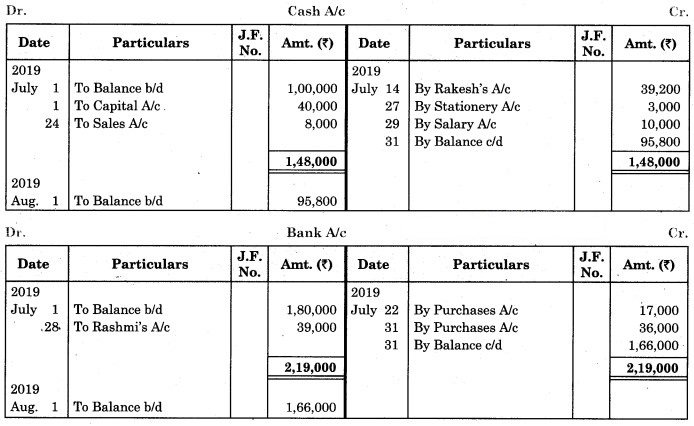

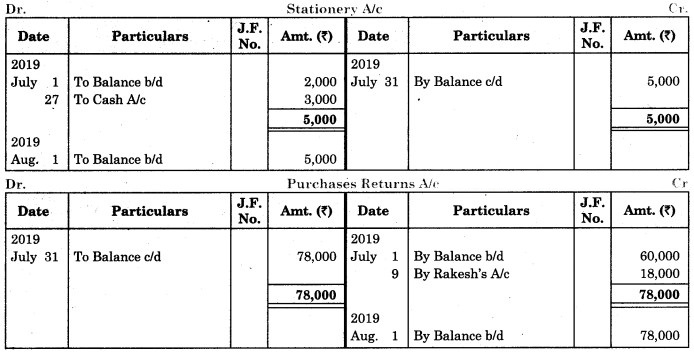

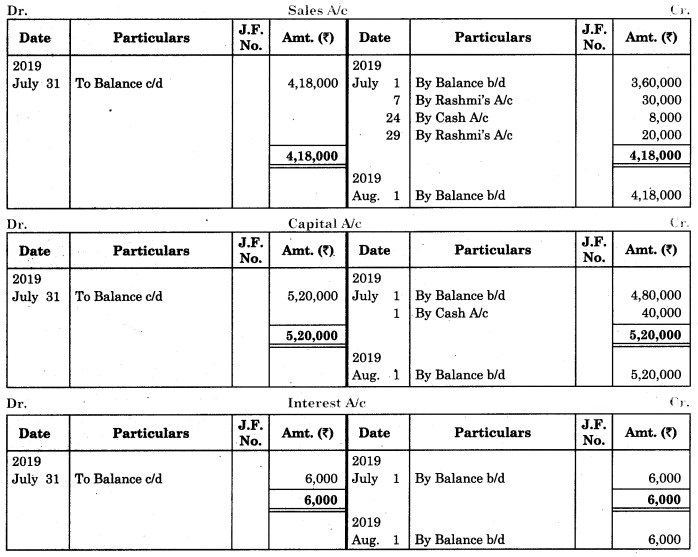

The following ledger balances were extracted from the books of Pawan Pawar, Pune as of 1st July 2019.

The following transactions took place during July 2019. Post them into Ledger and prepare Trial Balance as of 31st July 2019.

1 Introduced additional Capital ₹ 40,000

4 Bought goods from Rakesh ₹ 80,000 @ 10% Trade Discount

7 Sold goods to Rashmi ₹ 30,000

9 Returned goods to Rakesh ₹ 20,000 (Gross)

11 Rashmi returned goods to us ₹ 400

14 Paid to Rakesh ₹ 40,000 @ 2% Cash Discount

22 Made purchases ₹ 17,000 and amount paid by cheque

24 Cash Sales ₹ 8,000

27 Bought Stationery ₹ 3,000

28 Received from Rashmi ₹ 39,000 by RTGS and discount allowed ₹ 1000

29 Paid Salary ₹ 10,000

29 Sold goods to Rashmi ₹ 20,000

31 Bought goods from Rakesh ₹ 36,000 and paid by cheque.

Solution:

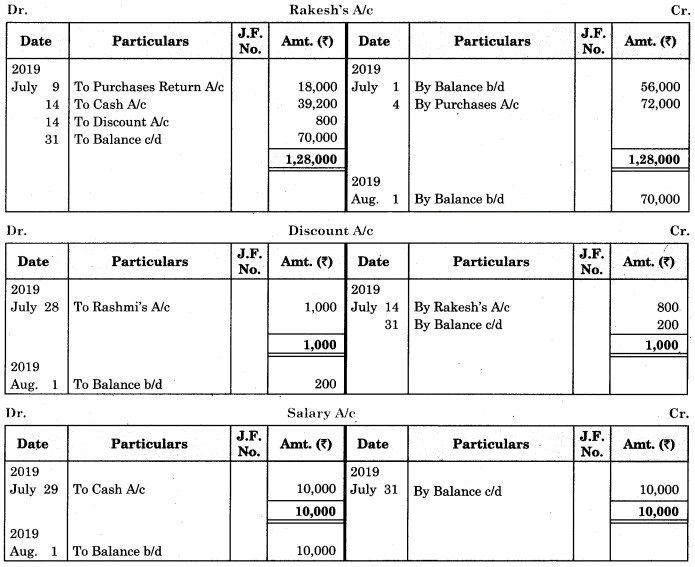

Ledger of Pawan Pawar, Pune

Trial Balance as of 31st July 2019