Chapter 8 Correspondence with Depositors

Chapter 8 Correspondence with Depositors

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1.

Depositors are ____________ of a company.

(a) members

(b) creditors

(c) debtors

Answer:

(b) creditors

Question 2.

Depositors provide ____________ capital to the company.

(a) short term

(b) long term

(c) medium-term

Answer:

(a) short term

Question 3.

A company cannot accept deposit for more than ____________ months.

(a) 24

(b) 36

(c) 45

Answer:

(b) 36

Question 4.

A company cannot accept deposit for less than ____________ months.

(a) 6

(b) 3

(c) 5

Answer:

(a) 6

Question 5.

Deposits are ____________ loans of the company.

(a) fixed

(b) short term

(c) long term

Answer:

(b) short term

Question 6.

Public deposits are accepted to meet the requirement of ____________ capital.

(a) fixed

(b) working

(c) owned

Answer:

(b) working

Question 7.

____________ has the power to invite deposits from public.

(a) Shareholders

(b) Auditors

(c) Board of Directors

Answer:

(c) Board of Directors

Question 8.

Rate of interest on deposits is ____________

(a) fixed

(b) fluctuating

(c) moderate

Answer:

(a) fixed

Question 9.

The return or income for the investment of money on deposits is called ____________

(a) dividend

(b) interest

(c) discount

Answer:

(b) interest

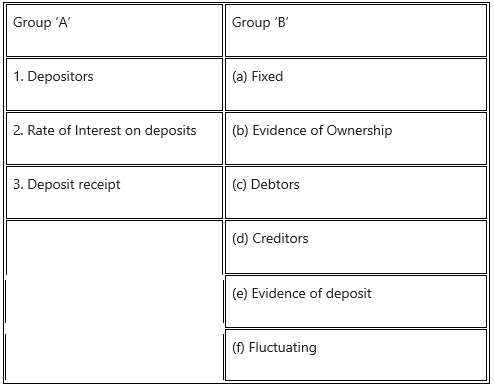

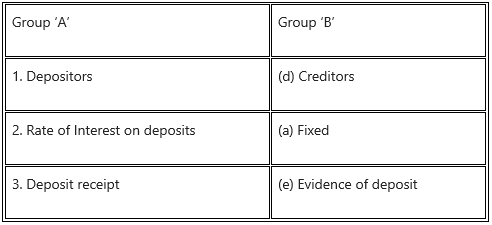

1B. Match the pairs.

Question 1.

Answer:

1C. Write a word or a term or a phrase that can substitute each of the following statements.

Question 1.

Return on investment on deposit.

Answer:

Interest

Question 2.

The instrument for payment of interest on the deposit.

Answer:

Interest Warrant

Question 3.

An acknowledgment of the fixed deposit accepted by a company.

Answer:

Fixed Deposit Receipt

Question 4.

Return of deposits on the maturity date.

Answer:

Repayment of deposit

Question 5.

The maximum period of deposits.

Answer:

36 months

1D. State whether the following statements are true or false.

Question 1.

Fixed deposit is a short-term source of finance for the company.

Answer:

True

Question 2.

Fixed deposit holder is a creditor of the company.

Answer:

True

Question 3.

Deposits are invited by the company without issuing statutory advertisement.

Answer:

False

Question 4.

Fixed deposit holders are entitled to receive dividends.

Answer:

False

Question 5.

A private company cannot accept deposits from the general public.

Answer:

True

Question 6.

Depositors are given voting rights.

Answer:

False

1E. Find the odd one.

Question 1.

Dividend, Depositor, Deposit Receipt

Answer:

Dividend

Question 2.

Trust Deed, Depository, Deposit Receipt

Answer:

Depository

1F. Complete the Sentences.

Question 1.

Depositors are the ____________ of the company.

Answer:

Creditors

Question 2.

The ____________ must be cautious and careful while writing letters to the depositors.

Answer:

Secretary

Question 3.

Deposit is a ____________ term source of finance of the company.

Answer:

Short

Question 4.

A company can accept deposits for the minimum period of ____________ months.

Answer:

6 months

Question 5.

Depositors are entitled to receive ____________ at fixed rate.

Answer:

Interest

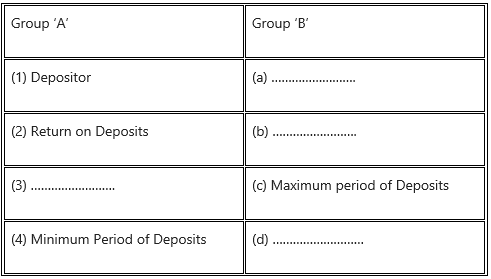

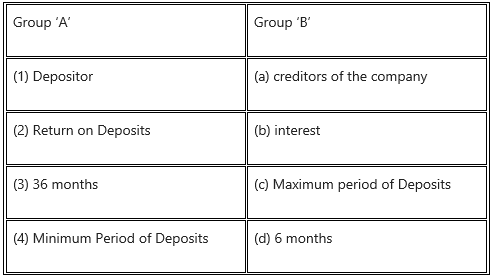

1G. Select the correct option from the bracket.

Question 1.

(Interest, Creditors of the company, 36 months, 6 months)

Answer:

1H. Answer in one sentence.

Question 1.

Who is the depositor?

Answer:

The person who keeps his/her money for a fixed period of time with the company is known as ‘Depositor’.

Question 2.

What is the return on deposit?

Answer:

Fixed-rate of interest is provided as the return on a deposit.

Question 3.

What is Interest Warrant?

Answer:

An interest warrant is an instrument of payment of interest.

Question 4.

What is a renewal of deposit?

Answer:

A process of continuing the deposit for an additional time period after maturity of investment (deposit) is called “Renewal of Deposit”.

Question 5.

Which document is enclosed along with the Renewal Letter?

Answer:

Renewal Deposit Receipt is enclosed along with the Renewal Letter.

Question 6.

When will the company return the deposits?

Answer:

The company will return the deposit amount at the time of maturity (after the expiry of the fixed period).

Question 7.

What is the minimum and maximum period of deposit?

Answer:

The deposit can be accepted for a minimum period of 6 months and a maximum period of 36 months.

1I. Correct the underlined words and rewrite the following sentence.

Question 1.

Depositors are owners of the company.

Answer:

Depositors are creditors of the company.

Question 2.

Deposits are the internal source of financing.

Answer:

Deposits are the external source of financing.

Question 3.

Deposit is a long-term source of capital.

Answer:

Deposit is a short-term source of capital.

Question 4.

Depositors are entitled to receive dividends.

Answer:

Depositors are entitled to receive interest.

1J. Arrange in proper order.

Question 1.

(a) Renewal of deposit

(b) Acceptance of deposit

(c) Deposit Receipt

Answer:

(a) Acceptance of deposit

(b) Deposit Receipt

(c) Renewal of deposit

Question 2.

(a) Payment of interest

(b) Deposit Receipt

(c) Acceptance of deposits

Answer:

(a) Acceptance of deposits

(b) Deposit Receipt

(c) Payment of interest

2. Explain the following terms/concepts.

Question 1.

Depositor

Answer:

The person who keeps deposits with the company for a fixed period of time is known as ‘Depositor’.

Question 2.

Deposit

Answer:

Deposit is a short-term source of finance of the company and it is used in order to satisfy the short-term working capital needs of the company.

Question 3.

Interest on deposit

Answer:

Interest on deposit refers to the return on the investment of money in deposits.

Question 4.

Deposit Receipt

Answer:

A deposit Receipt is an acknowledgment of deposit money accepted by the company.

Question 5.

Renewal of deposit

Answer:

Renewal of Deposit means accepting the same deposit for an additional period of time after its maturity.

Question 6.

Repayment of Deposit

Answer:

Refunding the amount of deposit on the maturity of tenure of deposits is known as ‘Repayment of Deposit’.

3. Answer in brief.

Question 1.

Which precautions are to be taken by the secretary while corresponding with depositors?

Answer:

Following precautions should be undertaken while drafting letters to the depositors:

(i) Courtesy:

While writing letters to the depositors, polite replies are essential. Rude and harsh words should be strictly avoided.

(ii) Quick response:

Being the creditors of the company, due respect should be given to the depositors of the company. Immediate replies to be given to the queries and complaints of the depositors without any delay.

(iii) Accuracy:

Letters written to the depositors should be accurate and precise. True and correct information should be provided to them.

(iv) Conciseness:

The letters to the depositors must be concise i.e. short, brief, and to the point. Unnecessary and irrelevant information should be avoided.

(v) Your Attitude:

The letters to the depositors must be written after taking into consideration the requirements of the depositors.

(vi) Secrecy:

As a confidential officer, the secretary has to maintain secrecy regarding correspondence with the depositors. Any secret information regarding the company must not be disclosed through correspondence.

(vii) Image and Goodwill:

Correspondence plays a very important role in maintaining the goodwill of the company. While corresponding, the secretary should take all necessary steps so that the goodwill of the company will not get affected.

(viii) Legal Provision:

The secretary should see to it that all provisions relating to invitation, acceptance, renewal, and repayment of deposits are duly followed by the company while corresponding with depositors.

Question 2.

What are the circumstances under which the Secretary makes correspondence with depositors?

Answer:

- A company secretary has to conduct correspondence with depositors on different occasions.

- This correspondence is limited as they are creditors and not the owners of the company.

- Deposits are accepted for a short period.

- The relationship of depositors also comes to an end immediately after deposits are repaid.

Following are the circumstances under which correspondence is done with the depositors:

- Letter to express thanks to the depositor for showing faith in the company and depositing the amount

- Intimation about payment of interest

- Interest warrant

- Electronic payment of Interest

- Letter informing about the renewal of deposit

- Informing the depositor about the maturity of deposits.

4. Justify the following statements.

Question 1.

The Company Secretary should take certain precautions while corresponding with depositors.

Answer:

- The deposit represents the short-term borrowed capital of the company.

- Depositors are the creditors of the company.

- The company secretary should correspond properly with the depositors in order to ensure the continuous flow of investments.

- The reply to queries and complaints of depositors should be prompt and courteous.

- The letter should be written from the depositors’ point of view and accurate information must be supplied to them.

- All the legal provisions must be followed and the goodwill of the company has to be maintained.

- Thus, it is rightly justified that the company secretary should take every precaution while corresponding with depositors.

Question 2.

There are certain circumstances when a secretary has to correspond with depositors.

Answer:

- Depositors are the creditors of the company and not the owners.

- Frequent correspondence with depositors is not required as they do not participate in the management of the company.

- The company secretary has to conduct correspondence with depositors regarding the acceptance of deposits, payment of interest on deposits, renewal of deposits, repayment of deposits, and so on.

- Secretary conducts such correspondence on behalf of the company and also as per the instructions of the Board of Directors.

- The secretary should be very cautious and careful while corresponding with depositors of the company.

- Thus, it is rightly justified that the secretary has to correspond with depositors on certain circumstances.

5. Attempt the following.

Question 1.

Draft a letter of thanks to depositors of a company.

Answer:

RADHIKA INDUSTRIES LIMITED

501A, Bandra-Kurla Complex, Bandra (East), Mumbai: 400 051

CIN: L46001 MH2002 PLC 503433

Tel. No.: 022-24761524

Fax No.: 022-24881242

Ref. No.: D/DEP/05/2018-19

Website: www.radhikalimited.com

Email: radhika4@gmail.com

Date: 15th May 2019

Mr. Deepak Ved

C/25, LIC Colony

L.J. Road, Mahim,

Mumbai – 400 096

Sub: Thanking Depositor For Fixed Deposit.

Dear Sir,

As per your application received for a fixed deposit of ₹ 1,00,000/- for a period of 1 year, dated 10th May 2019, we are thankful to you for showing faith and confidence in the company.

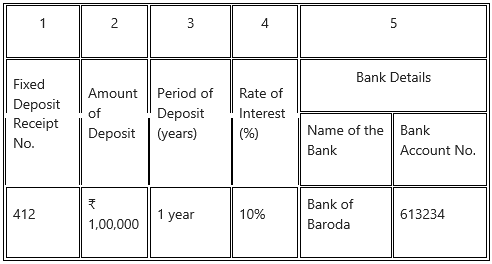

The details of deposits accepted are given in the following schedule:

The Board of Directors of our company expresses their gratitude for depositing money in our company. The fixed deposit receipt is enclosed along with this letter.

We assure you the best of our services all the time.

Thanking you,

Yours faithfully

For Radhika Industries Limited,

Sign

Mr. Harshad Sagwekar

Encl: Fixed Deposit Receipt No. 412

Question 2.

Draft a letter to a depositor informing him about payment of interest through interest warrant.

Answer:

RADHIKA INDUSTRIES LIMITED

501A, Bandra-Kurla Complex, Bandra (East), Mumbai: 400 051

CIN: L46001 MH 2002 PLC 503433

Tel. No.: 022-24761524

Fax No.: 022-24881242

Ref. No.: D/DEP/25/2019-20

Email: radhika4@gmail.com

Website: www.radhikalimited.com

Date: 18th April 2019

Mrs Ruchika Korgaonkar

A/23, BPT Colony,

N.K.Road, Mahim,

Mumbai:-400 096.

Sub: Payment of Interest on Fixed Deposits.

Dear Madam,

As per the board resolution passed in the Board Meeting held on 16th April 2019, this is to inform you that the interest @ 10% on your Fixed Deposit is due for payment.

Your company has complied with all the provisions relating to the payment of interest on deposits and the interest warrant drawn on ICICI Bank, Prabhadevi branch is enclosed herewith.

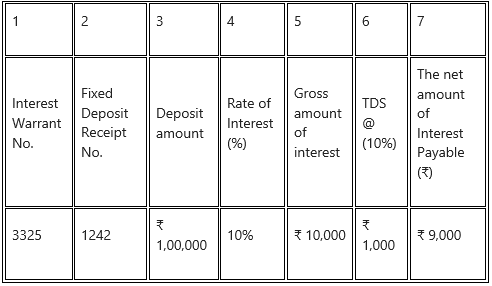

The details of your Fixed Deposit and interest payable on the deposit are given in the following schedule:

TDS certificate is enclosed for income tax purposes along with the interest warrant.

Thanking you,

Yours faithfully,

For Radhika Industries Limited

Sign

Mr. Fazal Shahzman

Encl:

- Interest Warrant No. 3325

- TDS certificate

Question 3.

Write a letter to the depositor for the renewal of his deposit.

OR

Draft a letter to the depositor for renewal of his deposit.

Answer:

SUNRISE INDUSTRIES LIMITED

50/A, Swami Narayan Road, Tunga Village, Mumbai: 400 072

CIN: L42105 MH2005 PLC 402512

Tel. No.: 022-23731242

Fax No.: 022-23738656

Ref. No.: S/DEP/51/2019-20

Website: www.sunriselimited.com

Email: sunrise5@gmail.com

Date: 17th Feb 2019

Mr. Rajesh Joshi

20, Hilton Complex,

Laxmi Road,

Solapur – 413 018

Sub: Renewal on Fixed Deposits.

Dear Sir,

We, hereby, acknowledge receipt of your application for the renewal of a deposit of ₹ 50,000/- for a further period

of one year. We have also received duly discharged deposit receipt No. 1242 and the same has been placed before the Board for consideration and approval.

As per the resolution passed at the Board meeting held on 15th Feb 2019, the Board has decided to renew the deposits for a further period of 1 year on the same terms and conditions.

A deposit receipt No 4424 is enclosed along with this letter.

Thanking you,

Yours faithfully,

For Sunrise Industries Ltd,

Sign

Miss Shalakha Suvarna

Company Secretary

Encl: Fixed Deposit receipt No 4424

Question 4.

Draft a letter to the depositor regarding redemption or repayment of his deposit.

Answer:

SWARG MARBLE LIMITED

40/B, C – Ramchandra Road, Khar (East), Mumbai: 400 053

CIN: L24308 MH2006 PLC 211388

Tel. No.: 022-4133242

Fax No.: 022-4215212

Ref. No.: S/DEP/15/19-20

Email: swarglimitedl2@gmail.com

Website: www.swarglimited.com

Date: 21st April 2019

Mr. Santosh Vichare

A/21, Swastik Colony,

Bhadkamkar Marg,

Fort, Mumbai:-400 020

Sub: Repayment of Fixed Deposits.

Dear Sir,

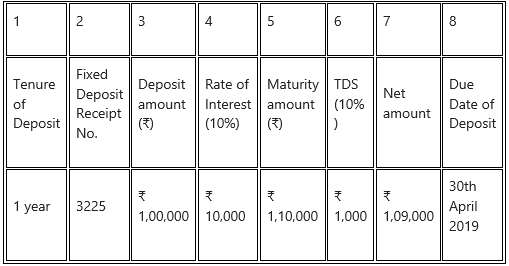

This is to inform you that your Fixed Deposit Receipt No. 3225 dated 1st May 2018 for ₹ 1,00,000/- will be due for repayment on 30th April 2019.

We have received original Deposit Receipt No. 3225 duly discharged along with instruction for repayment. The Board of Directors in the meeting held on 20th April 2019 has passed a resolution for the redemption of the deposits.

The details of repayment of deposit are as under:

Please find enclosed herewith a crossed cheque of ₹ 1,09,000, bearing No. 126224 dated 30th April 2019 drawn on Bank of India, Tardeo, Mumbai:- 400 034.

Thanking you,

Yours faithfully,

For Sward Industries Ltd,

Sign

Mr. Sandesh Virkar

Company Secretary

Encl: Crossed Cheque No. 126224

Question 5.

Draft a letter to a depositor informing him about payment of interest through electronic mode.

Answer:

RADHIKA INDUSTRIES LIMITED

501 A, Bandra-Kurla Complex, Bandra (East), Mumbai: 400 051

CIN: L46001 MH2002 PLC 503433

Tel. No.: 022-24761524

Fax No.: 022-24881242

Ref. No.: D/DEP/25/2019-20

Email: radhika4@gmail.com

Website: www.radhikalimited.com

Date: 18th April 2019

Mrs Anushka Khanvilkar

A/21, Mahindra Tower,

Tardeo Road, Mumbai Central,

Mumbai – 400 034

Sub: Payment of Interest on Fixed Deposits through ECS or NEFT.

Dear Madam,

As per the board resolution passed in the Board Meeting held on 16th April 2019, this is to inform you that the interest @ 10% on your Fixed Deposit is due for payment.

Your company has complied with all the provisions relating to the payment of interest on the deposits.

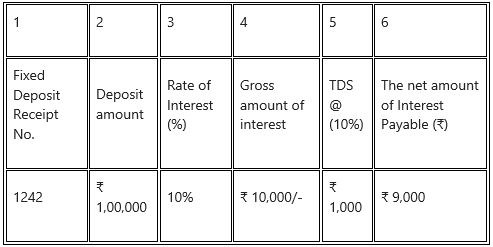

The details of your Fixed Deposit and interest payable on the deposit are given in the following schedule:

Interest will be payable by electronic transfer (ECS/NEFT), i.e. by crediting said interest to your bank account as per details provided by you to the company.

Thanking you,

Yours faithfully,

For Radhika Industries Limited,

Sign

Mr. Deepak Ved