Chapter 2 Sources of Corporate Finance

Chapter 2 Sources of Corporate Finance

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1.

___________ is the smallest unit in the total share capital of the company.

(a) Debenture

(b) Bonds

(c) Share

Answer:

(c) Share

Question 2.

The benefit of Depository Receipt is ability to raise capital in ___________ market.

(a) national

(b) local

(c) international

Answer:

(c) international

Question 3.

___________ are residual claimants against the income or assets of the company.

(a) Bondholders

(b) Equity shareholders

(c) Debenture holders

Answer:

(b) Equity shareholders

Question 4.

___________ participate in the management of their company.

(a) Preference shareholders

(b) Depositors

(c) Equity shareholders.

Answer:

(c) Equity shareholders

Question 5.

___________ shares are issued free of cost to existing equity shareholders.

(a) Bonus

(b) Right

(c) Equity

Answer:

(a) Bonus

Question 6.

The holder of preference share has the right to receive ___________ rate of dividend.

(a) fixed

(b) fluctuating

(c) lower

Answer:

(a) Fixed

Question 7.

Accumulated dividend is paid to ___________ preference shares.

(a) redeemable

(b) cumulative

(c) convertible

Answer:

(b) Cumulative

Question 8.

The holder of ___________ preference shares has the right to convert their shares into equity shares.

(a) cumulative

(b) convertible

(c) redeemable

Answer:

(b) Convertible

Question 9.

Debenture holders are ___________ of the company.

(a) creditors

(b) owners

(c) suppliers

Answer:

(a) creditors

Question 10.

___________ is paid on borrowed capital.

(a) Interest

(b) Discount

(c) Dividend

Answer:

(a) Interest

Question 11.

Debenture holders get fixed rate of ___________ return on their investment.

(a) interest

(b) dividend

(c) discount

Answer:

(a) interest

Question 12.

Convertible debentures are converted into ___________ after a specific period.

(a) equity shares

(b) deposits

(c) bonds

Answer:

(a) equity shares

Question 13.

Retained earnings are ___________ source of financing.

(a) internal

(b) external

(c) additional

Answer:

(a) internal

Question 14.

The holder of bond is ___________ of the company.

(a) secretary

(b) owner

(c) creditor

Answer:

(c) creditor

Question 15.

Company can accept deposits from public, minimum for ___________ months.

(a) six

(b) nine

(c) twelve

Answer:

(a) six

Question 16.

Company can accept deposits from public maximum for ___________ months.

(a) 12

(b) 24

(c) 36

Answer:

(c) 36

Question 17.

A depository receipt traded in ___________ is called American Depository Receipt.

(a) London

(b) Japan

(c) USA

Answer:

(c) the USA

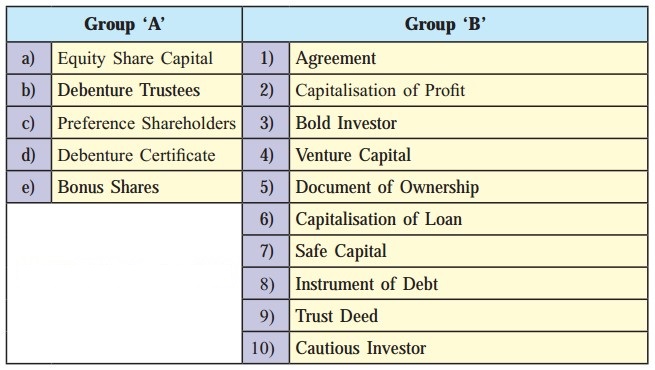

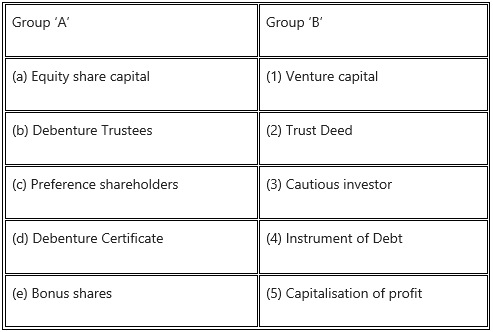

1B. Match the pairs.

Question 1.

Answer:

1C. Write a word or a term or a phrase that can substitute each of the following statements.

Question 1.

The real masters of the company.

Answer:

Equity shareholders

Question 2.

A document of ownership of shares.

Answer:

Share certificate

Question 3.

The holders of these shares are entitled to participate in surplus profits.

Answer:

Participating preference shares

Question 4.

A party through whom the company deals with debenture holders.

Answer:

Debenture trustees

Question 5.

Name the shareholder who participates in the management.

Answer:

Equity shareholders

Question 6.

The value of a share is written on the share certificate.

Answer:

Face value

Question 7.

The value of a share is determined by demand and supply forces in the share market.

Answer:

Market value

Question 8.

The policy of using undistributed profit for the business.

Answer:

Retained earnings/ploughing back of profit

Question 9.

It is an acknowledgment of a loan issued by the company to the depositor.

Answer:

Deposit receipt

Question 10.

A dollar-denominated instrument trader in the USA.

Answer:

American Depository Receipt

Question 11.

The Depository Receipt is traded in a country other than the USA.

Answer:

Global depository receipt

Question 12.

Money raised by the company from the public for a minimum of 6 months to a maximum of 39 months.

Answer:

Public Deposits

Question 13.

Credit extended by the suppliers with an intention to increase their sales.

Answer:

Trade Credit

Question 14.

The credit facility is provided to a company having a current account with the bank.

Answer:

Overdraft

1D. State Whether the following statements are True or False.

Question 1.

Equity share capital is known as venture capital.

Answer:

True

Question 2.

Equity shareholders enjoy a fixed rate of dividends.

Answer:

False

Question 3.

Debenture holders have the right to vote at a general meeting of the company.

Answer:

False

Question 4.

Equity shareholders are described as ‘shock absorbers’ when a company has a financial crisis.

Answer:

True

Question 5.

Bondholders are owners of the company.

Answer:

True

Question 6.

Cash credit is given against hypothecation of goods and security.

Answer:

True

Question 7.

Trade credit is a major source of long-term finance.

Answer:

False

Question 8.

Depository bank stores the shares on behalf of the GDR holder.

Answer:

True

Question 9.

Financial institutions underwrite the issue of securities.

Answer:

True

1E. Find the odd one.

Question 1.

Debenture, Public Deposit, Retained Earnings

Answer:

Retained earnings

Question 2.

Face value, Market value, Redemption value

Answer:

Redemption value

Question 3.

Share certificate, Debenture certificate, ADR

Answer:

ADR

Question 4.

Trade credit, Overdraft, Cash credit

Answer:

Trade credit

1F. Complete the sentences.

Question 1.

The finance needed by business organisation is termed as ___________

Answer:

Capital

Question 2.

The convertible preference shareholders have a right to convert their shares into ___________

Answer:

Equity shares

Question 3.

Equity shareholders elect their representative Called ___________

Answer:

Directors

Question 4.

Bonus shares are issued as gift to ___________

Answer:

Equity share holders

Question 5.

The bondholders are ___________of the company.

Answer:

Creditors

Question 6.

Depository receipt traded in a country other than USA is called ___________

Answer:

Global Depository Receipt

Question 7.

First Industrial policy was declared in the year ___________

Answer:

1948

Question 8.

When goods are delivered by the supplier to the customer on the basis of deferred payment is called as ___________

Answer:

Trade credit

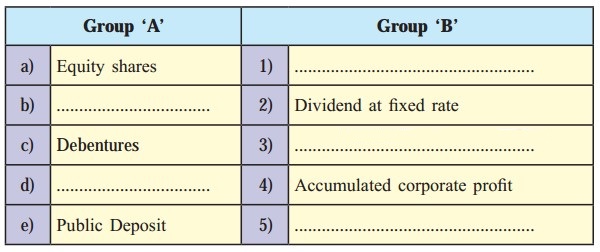

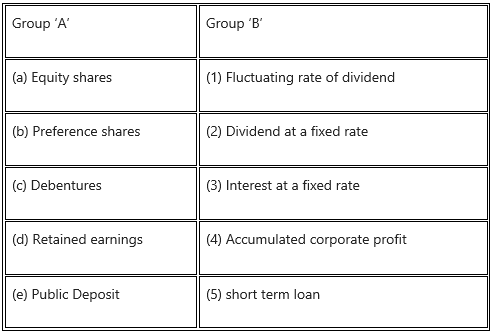

1G. Select the correct option from the bracket.

Question 1.

(Fluctuating rate of dividend, Preference shares, Interest at fixed rate, Retained earnings, short term loan)

Answer:

1H. Answer in one sentence.

Question 1.

What is a share?

Answer:

A share is the smallest unit of the share capital of a company.

Question 2.

What are equity shares?

Answer:

Equity shares are shares that do not preference shares and do not carry priority in receiving dividends nor repayment of capital.

Question 3.

What are preference shares?

Answer:

Preference shares are shares that have preferential rights with regard to receiving dividends and repayment of capital.

Question 4.

What are retained earnings?

Answer:

A part of the net profit which is not distributed to shareholders as dividend but retained by the company as reserve fund is retained earnings.

Question 5.

What is a debenture?

Answer:

It is a document/instrument issued in the form of a debenture certificate under the common seal of the company acknowledging/evidencing the debt.

Question 6.

What is a bond?

Answer:

A bond is a debt security and a formal contract to repay borrowed money with interest.

Question 7.

In which country can ADR be issued?

Answer:

ADR (American Depository Receipt) is a depository Receipt that is issued in the USA.

Question 8.

In which country can GDR be issued?

Answer:

GDR (Global depository receipt) can be issued in countries other than the USA.

Question 9.

What are convertible debentures?

Answer:

Convertible debentures are debentures that are converted into equity shares after a specific period as specified at the time of issue.

Question 10.

What are cumulative preference shares?

Answer:

Cumulative preference shares are shares where dividend, if not paid in a year accumulates till it is paid.

1I. Correct the underlined words and rewrite the following sentences.

Question 1.

Owned capital is temporary capital.

Answer:

Owned capital is permanent capital.

Question 2.

Equity shares get dividends at a fixed rate.

Answer:

Equity shares get dividends at fluctuating rates.

Question 3.

Preference shares get dividends at fluctuating rates.

Answer:

Preference shares get dividends at a fixed rate.

Question 4.

Retained earnings are an external source of finance.

Answer:

Retained earnings are an internal source of finance.

Question 5.

The debenture holder is the owner of the company.

Answer:

The debenture holder is a creditor of the company.

Question 6.

Bond is a source of short-term finance.

Answer:

Bond is a source of long-term finance.

Question 7.

Depository receipt traded in the USA is called Global Depository Receipt.

Answer:

Depository receipt traded in the USA is called American Depository Receipt.

2. Explain the following terms/Concepts.

Question 1.

Borrowed capital

Answer:

- It consists of capital that is raised through borrowings.

- It can be raised by issuing debentures, deposits, loans from banks or financial institutions.

Question 2.

Owned capital

Answer:

- Owned capital is the capital raised by the company with the help of owners (shareholders).

- It can be raised by issuing equity and preference shares.

Question 3.

Ploughing back of profit

Answer:

- Ploughing back of profit or retained earnings is a management policy under which all profits are not distributed amongst shareholders.

- It is an internal source of financing or self-financing as when the need arises, such reserves are ploughed back, brought into the business to meet the financial needs.

Question 4.

Overdraft

Answer:

- It is a credit agreement made with a bank that allows an account holder to withdraw more money than what a company has in its account up to a specific/prescribed limit.

- This facility is available to current account holders.

Question 5.

Trade Credit

Answer:

- Trade credit is credit extended by one trader to another when goods and services are bought/sold on credit.

- It facilitates the purchase of supplies without making an immediate payment.

- It is used by business organisations as a source of short-term financing and granted to those having reasonable standing and goodwill.

3. Study the following case/situation and express your opinion.

1. The Balance sheet of a Donald Company for the year 2018-19 reveals equity share capital of Rs. 25,00,000 and retained earnings of Rs. 50,00,000.

Question (a).

Is the company financially sound?

Answer:

The company is financially sound as it has double the amount as reserves or retained earnings or kept aside profits.

Question (b).

Can the retained earnings be converted into capital?

Answer:

Yes, the retained earnings can be converted into capital by means of capitalisation of reserves.

Question (c).

What type of source retained earning is?

Answer:

Retained earning is self-financing or an internal source of finance.

2. Mr. Satish is a speculator. He desires to take advantage of the growing market for the company’s products and earn handsomely.

Question (a).

According to you, which type of share Mr. Satish will choose to invest in.

Answer:

As Mr. Satish is a speculator, he will choose equity shares to invest in because if there are good earnings/profits, so will be the rate of dividend.

Question (b).

What does he receive as a return on investment?

Answer:

He receives a fluctuating rate of dividends.

Question (C).

State anyone, right he will enjoy as a shareholder.

Answer:

The right to attend the meeting and vote on resolutions can be the right Mr. Satish can exercise as a member.

3. Mr. Rohit, an individual investor, invests his own funds in the securities. He depends on investment income and does not want to take any risk. He is interested in the definite rate of income and safety of the principal.

Question (a).

Name the type of security that Mr. Rohit will opt for.

Answer:

As Mr. Rohit does not want to take risks, he will opt for preference shares which will assure him of steady income and safety of his investment.

Question (b).

What does he receive as a return on his investment?

Answer:

Mr. Rohit will receive dividends in return.

Question (c).

The return on investment which he receives is fixed or fluctuating.

Answer:

The return on his investment will be fixed and not fluctuating.

4. Distinguish between the following.

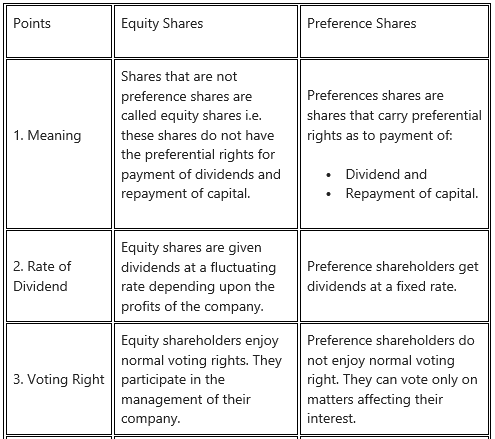

Question 1.

Equity Shares and Preference Shares

Answer:

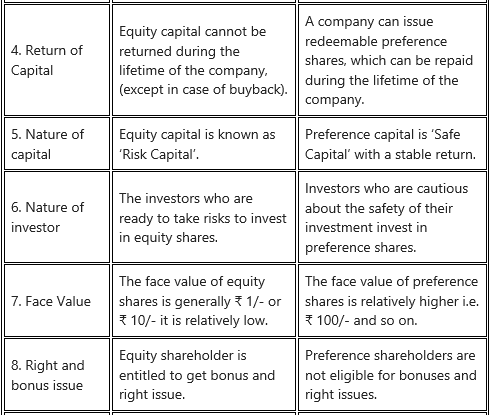

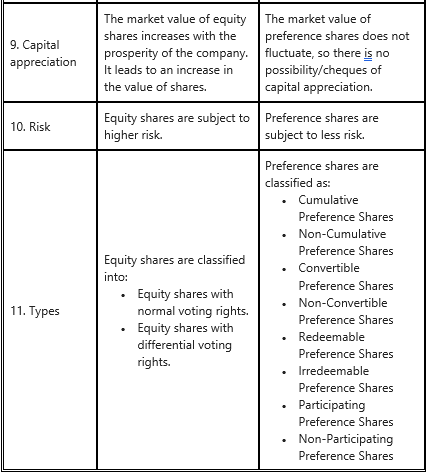

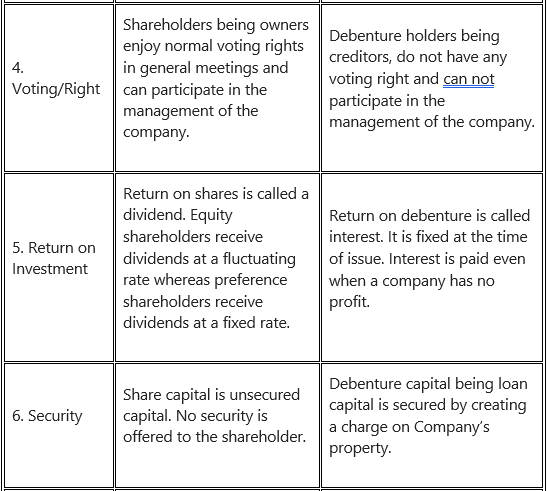

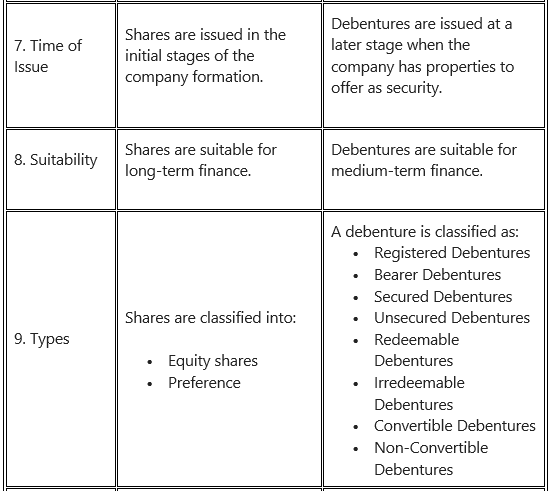

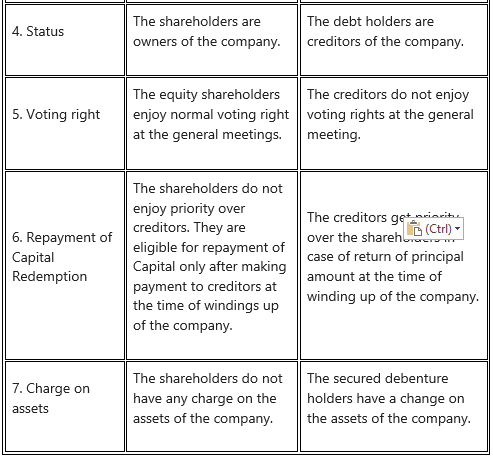

Question 2.

Shares and Debentures

Answer:

Question 3.

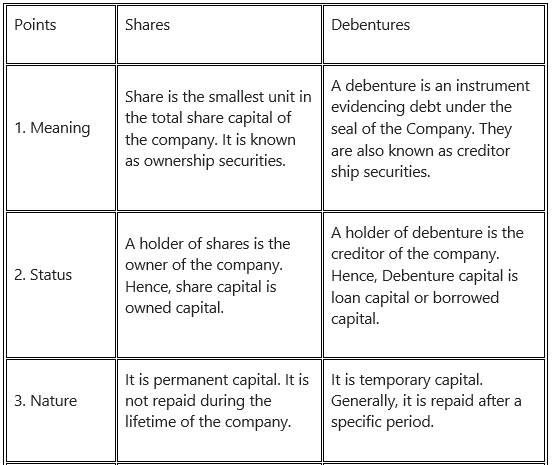

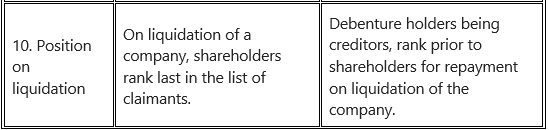

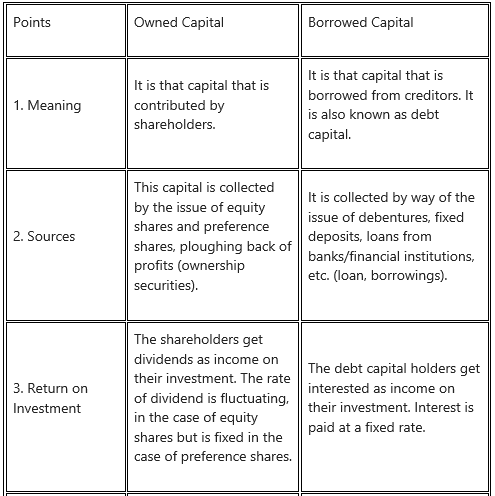

Owned Capital and Borrowed Capital

Answer:

5. Answer in brief:

Question 1.

What is a public deposit?

Answer:

- Public deposit is an important source of financing short-term requirements of the company.

- Companies generally receive public deposits for a period ranging from 6 months to 36 months.

- Interest is paid by the companies on such deposits.

- The company issues a’ Deposit Receipt’ to the depositor.

- The receipt is an acknowledgment of debt/loan by the company.

- Deposits are either secured or unsecured loans offered by a company.

- It is considered a risky investment but investors can earn high returns on public deposits.

Advantages of deposits to the company

- It is an easier method of mobilizing funds during periods of credit squeeze.

- The rate of interest payable by the company on public deposits is lower than the interest from banks and financial institutions.

- It helps the company to borrow funds from a larger segment and thus, reduces dependence on financial institutions.

Question 2.

What are Global Depository Receipt and American Depository Receipt?

Answer:

- The shares that are issued by public limited companies are traded in various share markets.

- In India, shares are traded in the Bombay Stock Exchange (BSE) National Stock Exchange (NSE), etc.

- Similarly, Shares are traded in foreign stock exchanges like NYSE (New York Stock Exchange) or NASDAQ (National Association of Securities Dealers Automated Quotation).

- Companies that cannot list directly on foreign stock exchange get listed indirectly using GDR & ADR.

- GDR and ADR are Dollar/Euro denominated instruments traded on stock exchanges of foreign countries and are depository receipts containing a fixed number of shares.

- The Depository Receipts which are traded in the USA are called ADRs and Depository Receipts which are traded in all foreign countries other than the USA are called GDR.

- Indian Companies raise equity capital in the international market through GDR and ADR.

- Companies issue shares to an intermediary called ‘depository’.

- Bank of New York, Citigroup, etc act as Foreign Depository Bank.

- The Depository Banks issue GDRs or ADRs to investors against Indian Company’s shares.

- These ‘Depository Receipts’ are then, sold to foreign investors who wish to invest their savings in Indian Cost.

- The Depository Receipts are listed on the stock exchanges like regular shares.

- It is a depository bank that stores the shares on behalf of the receipt holder.

- NRI and foreign investors buy Depository Receipt Using their regular equity trading account.

- The company pays dividends in the home currency to the depository and the depository converts them into the currency of investor and pays dividends.

- Indian Companies like HDFC, ICICI, Infosys Technologies, MTNL, WIPRO have ADR and GDR.

- Tata Motors and VSNL have ADRs.

- Bajaj Auto Limited ITC, L&T, Hindalco, Ranbaxy Laboratories, and SBI have GDRs.

- ADR allows the sale of securities only in the American market whereas GDR allows the sale of securities globally.

Question 3.

What is Trade Credit?

Answer:

- Every business requires trade credit and is common to all business types.

- Credit sales or granting of credit is inevitable in the present competitive business world.

- It is short-term financing to businesses.

- The small retailers, to a large extent, rely on obtaining trade credit from their suppliers.

- The cheapest method of financing; it is an easy kind of credit that can be obtained without signing any debt instrument.

- This is not a cash loan. It results from a sale of goods services which have to be paid sometime after the sale takes place.

- It is given by one trader to another trader to delay payment for goods and services involved in the transaction.

- Suppliers sell goods and willingly allow 30 days or more credit period for the bill to be paid.

- They offer discounts if bills are cleared within a short period such as 10 or 15 days.

- Such credit is given/granted to those having reasonable standing and goodwill.

Advantages of Trade Credit:

- Trade Credit is the cheapest and easiest method for raising short-term finance.

- It can be obtained without making any formal and written agreement or signing the same.

- It is readily available whenever goods and services are purchased on credit in bulk.

- It is free of cost source of financing.

- The terms of trade are lenient and not rigid.

Question 4.

What are the schemes for disbursement of credit by banks?

Answer:

Meaning: Banks play an important role in terms of providing finance to the companies.

They provide short-term finance for working capital, in the form of bank and trade credits.

The innovative schemes by banks for disbursement of credit are as follows:

(i) Overdraft:

- A company having a current account with the bank is allowed an overdraft facility.

- The borrower can withdraw funds/overdraw on his current account up to the credit limit sanctioned by the bank.

- Any number of drawings up to the sanctioned limit is allowed for a stipulated term period.

- Interest is determined/calculated on the basis of the actual amount overdrawn.

- Repayments can be made during the time period.

(ii) Cash Credit:

- The borrower can withdraw the amount from his cash credit up to a stipulated/granted limit based on security margin.

- Cash credit is given against pledge or hypothecation of goods or by providing alternate securities.

- Interest is charged on the outstanding amount borrowed and not on the credit limit sanctioned.

(iii) Cash Loans:

- In this, the total amount of the loan is credited by the bank to the borrower’s account.

- Interest is payable on the actual outstanding balance.

(iv) Discounting bills of exchange:

- In the bill of exchange, the drawer of the bill (seller) receives money from the drawee (buyer) on the date or after the due date (the term mentioned in the bill).

- But due to discounting facility the drawer can receive money before the due date by discounting the bill with the bank (by giving the bill as security to the bank).

- The bank gives money to the drawer less than the face value of the bill (amount mentioned in the bill) after deducting a certain amount known as discounting charges.

- The bills are usually traded bills i.e. outcome of trade transactions.

- The bills are accepted by the banks and cash is advanced against them.

Question 5.

State the features of bonds.

Answer:

Definition:

According to Webster Dictionary, “a bond is an interest bearing certificate issued by a Government or business firm promising to pay the holder a specific sum at a specified date”.

A bond is thus-

- A formal contract to repay borrowed money with interest.

- Interest is payable at a fixed internal or on the maturity of the bond.

- A bond is a loan.

- The holder is a lender to the company.

- He gets a fixed rate of interest.

Features:

(i) Nature of finance:

- It is debt or loan finance.

- It provides long-term finance of 5 years, 10 years, 25 years, 50 years.

(ii) Status of investor:

- The bondholders are creditors.

- They are non-owners and hence, not entitled to participate in the general meetings.

- The bondholder has no right to vote.

(iii) Return on bonds:

- The bondholders get a fixed rate of interest.

- It is payable on maturity or at a regular interval.

- Interest is paid to the bondholder at a fixed rate.

(iv) Repayment:

- A bond is a formal contract to repay borrowed money.

- Bonds have a specific maturity date, on which the principal amount is repaid.

6. Justify the following statements:

Question 1.

Equity shareholders are real owners and controllers of the company.

Answer:

- They do not have special preferential rights as to dividends or returns of capital in the event of the winding-up of the company.

- They are joint owners and thus, have ownership rights.

- They have the right to participate in the management of the company and to vote on every resolution in the meetings thus, having exclusive voting rights.

- They use the right to vote to appoint directors, amend Memorandum of Association, Articles of Association, can remove directors appoint bankers, etc.

- Their shares bear ultimate risks associated with ownership.

- Thus, it is rightly said, that the equity shareholders are real owners and controllers of the company.

Question 2.

Preference Shares do not carry normal voting rights.

Answer:

- Preference shares enjoy priority or preference over equity shareholders as regards payment of dividends and repayment of capital.

- They carry a fixed rate of dividend.

- They do not take much risk as they are cautious investors.

- They attend class meetings if they have any problem affecting their interests or dividend is not paid to them for two or more consecutive years.

- As they do not take risks, they do not attend general meetings or take part in the management nor vote at the meetings.

- Thus, it is rightly said, that the preference shares do not carry voting rights.

Question 3.

The debenture is secured by a charge on assets of the company.

Answer:

- A debenture is a document that grants lenders a charge over a company’s assets giving them a means of collecting debt if a default occurs.

- The charges may be floating or fixed.

- A specific property is pledged as security.

- In case the debenture is not redeemed or exercised, the lenders can recover the cost by selling the fixed assets.

- Thus, it is rightly said, that the debenture is secured by a charge on assets of the company.

Question 4.

Retained earnings are the simple and cheapest method of raising finance.

Answer:

- Retained earnings is an internal source of financing used by established companies.

- Retained earnings is a kept aside profit by the company instead of distributing all the dividends to the shareholders.

- The accumulated profits are re-invested by the companies by issuing bonus shares.

- It does not create a charge on assets, nor dilute the shareholdings.

- Thus, it is rightly said, that the retained earnings also known as ploughing back of profit/capitalization of reserves/self-financing are the simple and cheapest methods of raising finance.

Question 5.

Public deposit is a good source of short-term financing.

Answer:

- Deposits can be accepted by the general public by public limited companies and not private limited companies.

- Deposits are accepted from the general public for a short term i.e. minimum 6 months and a maximum of 36 months or a 3-year term.

- The amount so raised is used for short-term financial requirements.

- The time of deposit is predetermined in advance and paid after the expiry of such period as per terms and conditions agreed.

- The depositors form the general public not necessarily equity shareholders.

- The administrative cost of deposits of the company is lower than that involved in the issue of shares and debentures.

- The rate of interest payable is lower than other loans. Thus, it is rightly said, that the public deposit is a good source for meeting short-term requirements.

Question 6.

The bondholder is a creditor of the company.

Answer:

- A bond is a debt security which the company borrows for long-term finance and issues certificates under its seal as acknowledgment.

- The owners get interested as a return on their investment which is decided and fixed at the time of issue.

- The interest payable to bondholders is a fixed charge and a direct expenditure.

- It has to be paid whether the company makes a profit or not.

- As the bondholders are creditors they do not have the right to attend meetings or participate in management.

- Thus, it is rightly said, that the bondholder is a creditor of the company.

Question 7.

Trade credit is not a cash loan.

Answer:

- Trade credit is a business-to-business agreement wherein there is an arrangement to purchase goods and services on credit and pays at a later date and not immediately.

- The credit period extends up to a month.

- Discount is given if the same is paid earlier.

- It is an interest-free loan given by one businessman to another.

- It does not involve loan formalities but only a trade transaction. Hence, not a cash loan.

- Thus, it is rightly said, that the trade credit is not a cash loan.

Question 8.

Different investors have different preferences.

Answer:

- Investors make different decisions and have different risk preferences when getting gains and losses.

- Educated ones may opt for capital markets as compared to others who may invest in gold or silver.

- Cautious investors are ready to have steady income rather than fluctuations.

- Risk-takers are ready to face the ups and downs of their invested money and on their returns.

- Active investors try to beat the market while passive track the market index.

- Thus, it is rightly said, that the different investors have different choices and preferences.

Question 9.

Equity Capital is risk capital.

Answer:

- Equity shareholders have a claim over residual proceeds of the company.

- In the event of winding up, they are the last to be paid off after setting the claims of creditors and external liabilities.

- They have fluctuating returns and risk of fluctuating market value.

- Equity capital is permanent capital and not refunded during the lifetime of the company.

- Not having any assurance as regards dividend, repayment of capital Equity Capital becomes risk capital.

- Thus, it is rightly said, that equity capital is risk capital.

7. Answer the following questions.

Question 1.

What are a share and state its features?

Answer:

- The term share is defined by section 2(84) of the Companies Act 2013 ‘Share means a share in the share capital of a company and includes stock.’ The capital of a company is divided into a large number of shares.

- It facilitates the public to subscribe to the company’s capital in smaller amounts.

- The share is thus, an indivisible unit of share capital.

- It is a unit by which the share capital is divided.

- The total capital is divided into small parts and each such part is called a share.

- The value of each part/unit is known as face value.

- A person can purchase any number of shares as and when he or she desires.

- A person who purchases shares of the company is known as a shareholder of the company.

- Generally, companies issue equity shares and preference shares in the market.

Features of shares:

(i) Meaning:

- Share is the smallest unit in the total share capital of a company.

- The total share capital of a company is divided into small parts and each part is called a share.

(ii) Ownership:

- A share shows the ownership of the shareholder.

- The owner of the share is called a shareholder.

(iii) Distinctive number:

- Unless dematerialized, each share has a distinct number, which is noted in the share certificate.

- A share has a distinct number for identification.

(iv) Evidence of title:

- The company issues a share certificate under its common seal.

- It is a document of title of ownership of the share.

- A share is not a visible thing.

- It is shown by share certificate or in the form of ‘Demat share’

(v) Value of a share:

- Each share has a value expressed in terms of money.

- Face value: This value is written on the share certificate and mentioned in the Memorandum of Association.

- Issue Value: It is the price at which a company sells its shares. At par – equal to face value; At premium – more than the face value; At discount – Less than the face value.

(vi) Rights:

- A share confers/gives certain rights to the shareholders.

- Rights such as the right to receive dividends, right to inspect statutory books, right to attend shareholders’ meetings, right to vote in meetings, etc. (group rights), and right to receive notice, circulars, dividends, bonus shares, rights issue, etc. (individual rights).

(vii) Income:

- A shareholder is entitled to get a share in the net profit of the company.

- It is called a dividend.

(viii) Transferability:

- The shares of the public Ltd. company are freely transferable as per the rules laid down in the Articles of Association.

- Shares of a private company cannot be transferred.

(ix) Property of shareholder:

- A share is a movable property of a member.

- It can be transferred (gifted, sold) or transmitted (passed on to the legal heir after/due to death, insolvency or insanity of a member).

(x) Kinds of shares:

- A company issues two types of shares depending upon the right to control, income and risk.

- Equity shares – which do not carry preferential right to receive dividend or repayment of capital when the company winds up its activities.

- Preference shares – which carry preferential rights as regards dividend and repayment of capital in the event of winding up of the company.

Question 2.

What is an equity share? Explain its features.

Answer:

- Equity shares are the fundamental and basic source of financing activities of the business.

- Equity shares are also known as ordinary shares.

- Indian Companies Act 1956 defines equity shares as those shares which do not preference shares.

- The equity shares do not enjoy a preference in getting dividends.

Features of equity shares:

(i) Permanent Capital:

- Equity shares are irredeemable shares. It is permanent capital.

- The amount received from equity shares is not refunded by the company during its lifetime.

- Equity shares become redeemable/refundable only in the event of the winding-up of the company or the company decides to buy back shares.

- Equity shareholders provide long-term and permanent capital to the company.

(ii) Fluctuating dividend:

- Equity shares do not have a fixed rate of dividend.

- The rate of dividend depends upon the amount of profit earned by the company.

- If a company earns more profit, the dividend is paid at a higher rate.

- If there is insufficient profit, the Board of Directors may postpone the payment of dividends.

- The shareholders cannot compel them to declare and pay the dividend.

- The dividend is thus, always uncertain and fluctuating.

- The income of equity shares is uncertain and irregular.

(iii) Rights:

- Equity shareholders enjoy certain rights.

- Right to share in profit when distributed as dividend.

- Right to vote by which they elect Directors, amend Memorandum, Articles, etc.

- Right to inspect books of account of their company.

- Right to transfer shares.

- Participation in management.

- Enjoy Right Issue and Bonus Issue.

(iv) No preferential right:

- Equity shareholders do not enjoy preferential rights in respect to the payment of dividends.

- They are paid dividends only after the dividend is paid to preference shareholders.

- At the time of winding up, they are the last claimants. They are paid last after all the other claims are settled.

(v) Controlling power:

- The control of a company vests in the hands of equity shareholders.

- They are often described as real masters of the company as they enjoy exclusive voting rights.

- Equity shareholders may exercise their voting right by proxies, without attending the meeting in person.

- The Act provides the right to cast vote in proportion to the number of shareholdings.

- They participate in the management of the company.

- They elect their representatives called the Board of Directors for management of the company.

(vi) Risk:

- Equity shareholders bear maximum risk in the company.

- They are described as ‘shock absorbers when the company is in a financial crisis.

- The rate of dividend falls if the income of the company falls.

- The market value of shares goes down resulting in capital loss.

(vii) Residual claimants:

- A residual claim means the last claim on the earnings of the company.

- Equity shareholders are owners and they are residual claimants to all earnings after expenses, taxes, dividends, interests are paid.

- Even though equity shareholders are the last claimants, they have the advantage of receiving the entire earnings that are leftover.

(viii) No charge on assets:

- The equity share does not create any charge over the assets of the company.

- There is no security/guarantee of capital invested being returned.

(ix) Bonus issue:

- Bonus shares are issued as gifts to equity shareholders.

- They are issued ‘free of cost’.

- These shares are issued out of accumulated profits.

- These shares are issued to existing equity shareholders in a certain ratio or proportion of their existing shareholdings.

- Capital investment of equity shareholders grows on its own.

- This facility is available only to equity shareholders.

(x) Rights issue:

- Equity shareholders get the benefit of rights issues.

- When a company raises further capital by issue of shares, the existing shareholders are given priority to get newly offered shares, known as a rights issue.

(xi) Face value:

- The face value of equity share is very less.

- It can be ₹ 10 per share or even ₹ 1/- per share

(xii) Market value:

- Market value fluctuates, according to the demand and supply of shares.

- The demand and supply of equity shares depend on profits earned and dividends declared.

- When a company earns huge profits, the market value of shares increases.

- When it incurs a loss, the market value of shares decreases.

- There are frequent fluctuations in the market value of shares in comparison to other securities.

- Equity shares are more appealing to speculators.

(xiii) Capital Appreciation:

- Share capital appreciation takes place when the market value of share increases in the share market.

- The profitability and prosperity of a company enhance the reputation of the company in the share market and thus, facilitates appreciation of the market value of equity shares.

Question 3.

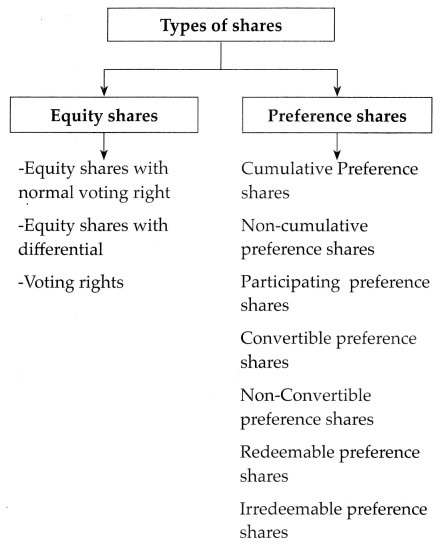

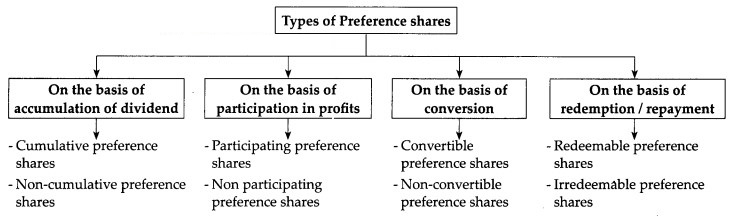

Define preference shares/What are preference shares? What are the different types of preference shares?

Answer:

- These shares have certain privileges and preferential rights such as to payment of dividends, return of capital, etc.

- Preference Share has which fixed rate of dividend is prescribed at the time of issue.

- The preference shareholders are co-owners but not controllers.

- They are cautious investors as they are interested in the safety of the investment.

(i) Cumulative Preference Shares:

- Cumulative preference shares are those shares on which dividend accumulates until it is fully paid.

- That is if the dividend is not paid in one or more years due to inadequate profit, then such unpaid dividend gets accumulated and is carried forward till next year.

- The accumulated dividend is paid when the company performs well.

- The arrears of dividends are paid before making payment to equity shareholders.

- The preference shares are always cumulative unless otherwise stated in Articles of Association.

(ii) Non-Cumulative Preference Shares:

- The dividend on these shares does not accumulate.

- That is the dividend on shares can be paid only out of profits of that particular year.

- The right to claim dividends will lapse if the company does not make a profit in that particular year.

- If the dividend is not paid in a year, it is lost.

(iii) Participating Preference Shares:

- The holders of these shares are entitled to participate in surplus profit besides preferential dividends. They participate in the high-profit condition of the company.

- Surplus profit here means excess profit that remains after making payment of dividends to equity shareholders.

- Such surplus profit up to a certain limit is distributed to preference shareholders.

(iv) Non-Participating Preference Shares:

- The preference shares are deemed to be non-participating if there is no clear provision in Articles of Association regarding participation in surplus profit.

- Such shareholders are entitled to receive a fixed rate of a dividend prescribed in the issue.

(v) Convertible Preference Shares:

- These shares have a right to convert their preference shares into equity shares.

- The conversion takes place within a certain agreed fixed period.

(vi) Non-Convertible Preference Shares:

- These shares are not converted into equity shares.

- They will remain as preference shares forever till paid back.

(vii) Redeemable Preference Shares:

- Shares that can be redeemed after a certain fixed period are called redeemable preference shares.

- A company limited by shares if authorized by Articles of Association issues redeemable preference shares.

- Such shares must be fully paid.

- The shares are redeemed out of divisible profit or out of the fresh issue of shares made for this purpose.

(viii) Irredeemable Preference Shares:

- Shares which are not redeemable are payable only on winding up of the company and are called irredeemable preference shares.

- As per section 55(1) of the Companies Act 2013, the company cannot issue irredeemable preference shares in India.

- Thus, are the types of preference shares.

Question 4.

What are preference shares? State its features.

Answer:

- The shares which carry preferential rights are termed preference shares.

- These shares have certain privileges and preferential rights such as payment of dividend, return of capital, etc.

- The preference shareholders are co-owners but not controllers.

- They are cautious investors as they are interested in the safety of the investment.

- They prefer a steady rate of returns on investment.

Features of preference shares:

(i) Preference for dividend:

- They have the first charge on the distributable amount of annual profits.

- The dividend is payable to preference shareholders before anything else is paid to equity shares, but after the settlement of dues of debentures, bonds and loans.

(ii) Prior repayment of capital:

- Preference shareholders have a preference over equity shareholders in respect of return of capital when the company is liquidated.

- It saves preference shareholders from capital losses.

(iii) Fixed return:

- These shares carry dividends at a fixed rate.

- The rate of dividend is predetermined at the time of issue.

- It may be in the form of a fixed sum or may be calculated at a fixed rate.

- The preference shareholders are entitled to dividends which can be paid only out of profit.

- Though the rate of dividend is fixed, the director in the financial crisis of the company may decide that no dividend be paid if there are no profits, the preference shareholders would have no claims for the dividend.

(iv) Nature of capital:

- Preference share capital is safe capital as the rate of dividend and market value do not fluctuate.

- Preference shares do not provide permanent share capital.

- They are redeemed after a certain period of time.

- It is generally issued at a later stage when a company gets established business.

- They are used to satisfy the need for additional capital of the company.

(v) Market value:

- The market value of preference shares does not change as the rate of dividend payable to them is fixed.

- The capital appreciation is considered to be low as compared with equity shares.

(vi) Voting right:

- The preference shares do not have normal voting rights.

- They have voting rights in matters that affect their interests – change of rights in terms of repayment of capital, or dividend payable to them are in arrears for two or more years.

(vii) Risk:

- Cautious investors generally purchase preference shares.

- Safety of capital and fixed return on investment are advantages attached with preference shares.

- These shares are a boon for shareholders during the depression when the interest rate is continuously falling.

(viii) Face value:

- The face value of preference shares is relatively higher than equity shares.

- They are normally issued at a face value of ₹ 100/-

(ix) Right or Bonus issue:

- Preference shareholders are not entitled to bonus or rights issues.

- It can be issued to the equity shares only.

(x) Nature of investor:

- Preference shares attract a moderate type of investors.

- Investors who are conservative, cautious, interested in the safety of capital, expect a steady rate of returns on investment purchase preference shares.

Question 5.

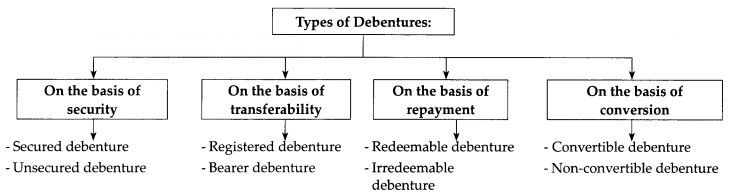

What is Debenture/Define Debenture. Discuss the different types of Debentures.

Answer:

- Debentures are one of the main sources of raising debt capital for meeting long-term and medium-term financial needs.

- Debentures represent borrowed capital.

- A person who purchased debenture is called a debenture holder.

- The holders get a fixed rate of interest as a return on their investment.

- The Board of Directors has the power to issue debentures.

Definitions:

Topham defines: “A debenture is a document given by a company as evidence of debt to the holder, usually arising out of the loan and most commonly secured by the charge.”

They are as follows:

(i) Secured Debentures:

- The debentures can be secured.

- The property of a company is charged as security for the loan.

- The security may be for some particular asset (fixed charge) or it may be the asset in general (floating charge).

- The debentures are secured through ‘Trust Deed’.

(ii) Unsecured Debentures:

- These debentures do not have security.

- The issue of unsecured debentures is prohibited by the Companies Act, 2013.

(iii) Registered Debentures:

- They are the ones whose details are mentioned in the Register of debenture maintained by the company.

- The details include the name, address, particulars of

- The transfer of such debentures requires the execution of regular transfer deeds.

- Interest is paid through Dividend warrants.

(iv) Bearer Debentures:

- The details of the debentures are not recorded in the register of the debenture.

- Their names do not appear in the Register of Debenture Holders.

- Such debentures are transferred by mere delivery.

- Payment of interest is made by means of coupons attached to the debentures certificate.

(v) Redeemable Debentures:

- Debentures are mostly redeemable i.e. payable at the end of some fixed period, mentioned on the Debentures Certificate.

- Repayment may be made at a fixed date, at the end of a specific period, or six installments during the lifetime of the company.

- The provision of repayment is normally made in Trust Deed.

(vi) Irredeemable Debentures:

- These debentures are not repayable during the lifetime of the company.

- They are repayable only on liquidation of the company or when there is a breach of any condition or in contingencies.

(vii) Convertible Debentures:

-

These debentures give the right to the holder to convert the debentures into equity shares after a specific period.

the period of conversion is mentioned in the debenture certificate. - The issue must be approved by a special resolution in the general meeting before they are issued to the public.

- A Convertible debentures holder is hence entitled to equity shares at a rate lower than the market value after which he can participate in the profits and meetings of the company.

(viii) Non-Convertible Debentures:

- These are not convertible into equity shares on maturity.

- They are normally redeemed on the maturity date.

- There is no appreciation in their value which acts as a disadvantage.

Question 6.

Define Debenture/What is a debenture? Explain the features of debenture?

Answer:

- A debenture is one of the main sources of raising debt capital for meeting long-term and medium-term financial needs.

- Debentures represent borrowed capital.

- A person who purchases debenture is called a debenture holder.

- The holders get a fixed rate of interest as a return on their investment.

- The Board of Directors has the power to issue debentures.

Definitions:

Topham defines: “A debenture is a document given by a company as evidence of debt to the holder, usually arising out of the loan and most commonly secured by the charge.”

A debenture is evidence of indebtedness.

Features of Debenture:

(i) Written Promise:

- A debenture is a written promise by a company that it owes a specified sum of money to the holder of the debenture.

(ii) Face Value:

- The face value of debenture normally carries a high denomination.

- It is ₹ 100 or multiples of ₹ 100.

(iii) Time of payment:

- A debenture is issued with the due date stated in the Debenture Certificate.

- It provides for repayment of the principal amount on the maturity date.

(iv) Priority of Payment:

- Debenture holders have a priority in repayment of their capital over other claimants of the company.

- The amounts of debentures are settled before shareholders.

(v) Assurance of repayment:

- Debenture constitutes a long-term debt.

- They carry an assurance of repayment on the due date.

(vi) Terms of issue and redemption of Debenture:

- Debenture can be issued at par, premium, and even at discount.

- Its redemption takes place only at par and premium.

(vii) Authority to issue:

Board of Directors has the authority/power to issue debenture as per Companies Act 2013 Section 179(3).

(viii) Interest:

- A fixed-rate of interest is agreed upon and is paid periodically.

- The rate of interest that a company pays/offers depends upon the market conditions and nature of the business.

- Payment of interest is a liability of the company. It has to be paid whether the company makes a profit or not.

(ix) Parties to Debenture:

- Company: This is an entity that borrows money.

- Trustees: The company has to appoint Debenture Trust if it is offering debenture to more than 500 people.

- Trust is a party through whom the company deals with debenture holders and enters into an agreement known as Trust Deed.

- Trust Deed contains obligations of the company rights of debenture holders, power of trustees, etc.

- Debenture holders: They are the parties who provide loans to the company and receive a ‘Debenture Certificate’ as evidence.

(x) Status of debenture holder:

- The debenture holder is a creditor of the company.

- Debenture being loan taken by the company interest is payable on it at a fixed interval and fixed-rate till redeemed/paid.

- They cannot participate in the management of the company.

(xi) No Voting Right:

- According to sec. 71 (2) of Companies Act 2013, no company shall issue debenture carrying voting rights.

- Debenture holders do not have the right to vote in the general meetings of the company.

(xii) Security:

- Debenture can be secured with some property of the company by fixed or floating charge.

- Debenture holders can sell of charged property of the company and recover their money if the company is not in a position to make payment of interest or repayment of capital.

(xiii) Issuers:

- Debenture can be issued by both, private as well as public limited companies.

(xiv) Listing:

- A debenture must be listed with at least one recognized stock exchange.

(xv) Transferability:

- Debentures can be easily transferred through instruments of transfer.