Chapter 7 Correspondence with Debentureholders

Chapter 7 Correspondence with Debentureholders

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1.

Debenture Capital is a ______________ capital of a company.

(a) borrowed

(b) owned

(c) permanent

Answer:

(a) borrowed

Question 2.

Debenture holders are ______________ of the company.

(a) Owner

(b) Creditors

(c) Debtors

Answer:

(b) Creditors

Question 3.

Borrowed capital is provided to the company by ______________

(a) Equity shareholder

(b) Debenture holders

(c) Reference Shareholders

Answer:

(b) Debenture holders

Question 4.

Interest on Registered Debentures is given through ______________

(a) Interest Coupons

(b) Interest Warrant

(c) Refund order

Answer:

(b) Interest Warrant

Question 5.

______________ are the creditors of the company.

(a) Shareholders

(b) Debenture holders

(c) Directors

Answer:

(b) Debenture holders

Question 6

Bearer Debenture holders get interest though ______________

(a) Interest Warrants

(b) Refund Orders

(c) Interest Coupons

Answer:

(c) Interest Coupons

Question 7.

Return of income on debentures is ______________ at fixed rate.

(a) Dividend

(b) Loan

(c) Interest

Answer:

(c) Interest

Question 8.

______________ is an acknowledgement of debt issued by the company under common seal.

(a) Debentures

(b) Shares

(c) Reserve

Answer:

(a) Debentures

Question 9.

Debentures repayable after a certain period are ______________ debentures.

(a) Convertible

(b) Registered

(c) Redeemable

Answer:

(c) Redeemable

Question 10.

The rate of interest payable on Debentures is ______________

(a) uncertain

(b) Floating

(c) Fixed

Answer:

(c) Fixed

Question 11.

Debenture holders receive ______________ Certificate from the company.

(a) Share

(b) Bond

(c) Debenture

Answer:

(c) Debenture

Question 12.

Interest Warrants are sent to ______________ of the company.

(a) Shareholders

(b) Debenture holders

(c) Owners

Answer:

(b) Debenture holders

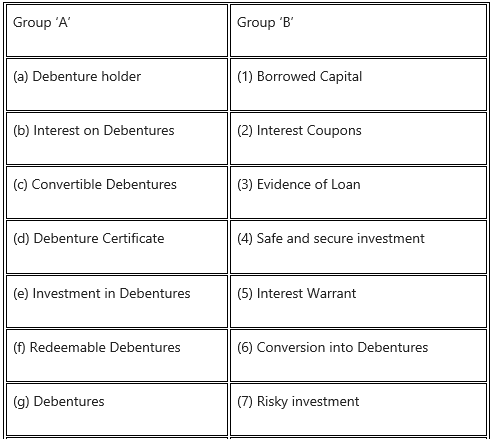

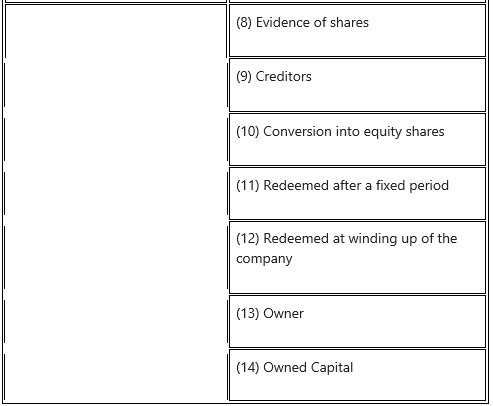

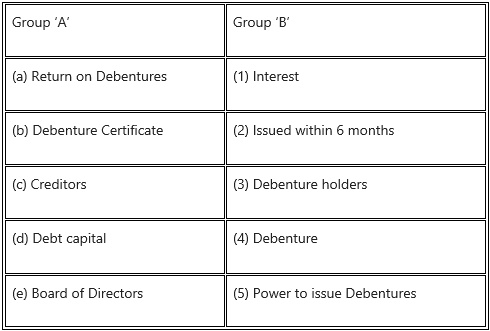

1B. Match the pairs.

Question 1.

Answer:

1C. Write a word or a term or a phrase that can substitute each of the following statements.

Question 1.

Return on investment in debentures.

Answer:

Interest

Question 2.

Documentary evidence of holding the debentures.

Answer:

Debenture Certificate

Question 3.

Status of Debenture holders.

Answer:

Creditor

Question 4.

Debentures can be converted into equity shares.

Answer:

Convertible Debentures

Question 5.

The person who purchases debentures of the company.

Answer:

Debenture holders

Question 6.

An acknowledgment of debt issued by the company under its common seal.

Answer:

Debenture

Question 7.

Debentures whose name is mentioned in the Register of Debentures holders.

Answer:

Registered Debentures

1D. State whether the following statements are true or false.

Question 1.

Debenture holders get regular dividends.

Answer:

False

Question 2.

The debenture is the loan capital of the company.

Answer:

True

Question 3.

Convertible Debentures can be converted into equity shares.

Answer:

True

Question 4.

Interest on Debentures is paid notwithstanding the volume of profit.

Answer:

True

Question 5.

Debenture holders enjoy full membership rights of the company.

Answer:

False

Question 6.

Dividend warrants are used to pay interest to the debenture holders.

Answer:

False

Question 7.

All types of debentures are eligible for conversion into equity shares.

Answer:

False

Question 8.

Debentures are never redeemed by the company.

Answer:

False

Question 9.

Debenture holders are the owners of the company.

Answer:

False

Question 10.

Debentures are always fully paid up.

Answer:

True

1E. Find the odd one.

Question 1.

Depository Interest, Dividend.

Answer:

Depository

Question 2.

Interest Warrant, Dividend Warrant, Demat.

Answer:

Demat

Question 3.

Debenture holders, Shareholders, Dematerialisation.

Answer:

Dematerialization

Question 4.

Debenture holders, Shareholders, SEBI.

Answer:

SEBI

1F. Complete the Sentences.

Question 1.

Debenture holder is a ______________ of a company.

Answer:

Creditor

Question 2.

Company issues ______________ certificate to the Debenture holder after allotment of Debentures.

Answer:

Debenture

Question 3.

Debenture holder gets ______________ at fixed rate as a return or income.

Answer:

Interest

Question 4.

In case of Registered Debentures, Interest ______________ are used to pay interest.

Answer:

Warrants

Question 5.

The ______________ has to correspond with Debenture holders on important occasions.

Answer:

Secretary

Question 6.

The person who purchases the Debentures of a company is called ______________

Answer:

Debenture holder

Question 7.

Interest does not depend upon ______________ of the company.

Answer:

Profit

Question 8.

Company cannot issue Debentures with ______________ rights.

Answer:

Voting

Question 9.

Debenture Certificate should be issued within a period of ______________ months, from the date of allotment of Debentures.

Answer:

6

Question 10.

A company cannot issue Debentures to more than 500 people without appointing a ______________

Answer:

Debenture trustee

Question 11.

The power to issue Debentures has been vested with the ______________

Answer:

Board of Directors

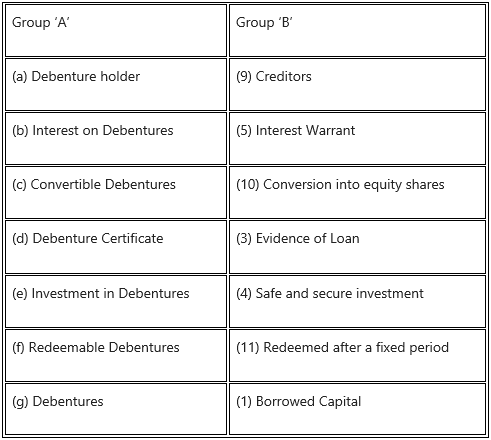

1G. Select the correct option from the bracket.

Question 1.

(Debt capital, Board of Directors, Creditors, Issued within 6 months, Interest)

Answer:

1H. Answer in one sentence.

Question 1.

Who is the Debenture holder?

Answer:

The person who purchases Debentures of the company is known as a Debenture holder.

Question 2.

What is the income of Debentures holder?

Answer:

The income received by the Debenture holder is the fixed rate of interest.

Question 3.

What is Debenture?

Answer:

A debenture is an acknowledgment of debt received by the company.

Question 4.

What are Convertible Debentures?

Answer:

Convertible Debentures are the Debentures that are converted into equity shares.

Question 5.

Who takes the decision to allot the debentures?

Answer:

The Board of Directors takes the decision to allot the Debentures.

Question 6.

Which form is enclosed along with the letter of redemption of debentures?

Answer:

The debenture Redemption form is enclosed along with the letter of redemption of Debentures.

Question 7.

Which certificate will be issued after the Allotment of debenture?

Answer:

A debenture Certificate will be issued after the allotment of the debenture.

1I. Correct the underlined words and rewrite the following sentence.

Question 1.

The person who purchases debentures of the company is called Shareholders.

Answer:

The person who purchases Debentures of the company is called a Debenture holder.

Question 2.

Debenture holders get regular dividends at a fixed rate.

Answer:

Debenture holders get regular interest at a fixed rate.

Question 3.

A Share Certificate must be issued after the allotment of debentures.

Answer:

A Debenture Certificate must be issued after allotment of debentures.

Question 4.

A Debenture Redemption Reserve Fund is created by the company for the redemption of shares.

Answer:

A Debenture Redemption Reserve Fund is created by the company for the redemption of debentures.

Question 5.

A Demat Request Form is sent along with the letter of redemption of debentures.

Answer:

A Debenture Redemption Form is sent along with the Letter of Redemption of Debentures.

Question 6.

A company must issue a Debenture Certificate within 8 months of allotment of debentures.

Answer:

A company must issue a Debentures certificate within 6 months of allotment of debentures.

1J. Arrange in proper order.

Question 1.

(a) Board Resolution

(b) Allotment of Debentures

(c) Board Meeting.

Answer:

(a) Board Meeting

(b) Board Resolution

(c) Allotment of Debentures

Question 2.

(a) Interest Warrant

(b) Allotment of debentures

(c) Board meeting.

Answer:

(a) Board Meeting

(b) Allotment of Debentures

(c) Interest Warrant

2. Explain the following terms/concepts.

Question 1.

Debentures

Answer:

- Debentures represent the borrowed capital of the company.

- A debenture is an acknowledgment of debt given to the company.

- Debenture Capital is also known as the ‘Supporting Capital’ of the company.

Question 2.

Debenture holder

Answer:

- The person who buys Debentures of the company is known as ‘Debenture holders’.

- The debenture holder is the creditor of the company and has no right to participate in the management of the company.

- They get a fixed rate of interest as a return on their investment.

Question 3.

Interest on Debentures

Answer:

- The returns paid on investment in Debentures are known as ‘Interest’.

- The Rate of interest on Debentures is decided at the time of issue of Debentures.

- Debenture holders get a fixed rate of interest which does not depend upon the profit of the company.

Question 4.

Redemption of Debentures

Answer:

- Redemption means repayment.

- Debenture represents borrowed capital of the company and hence, it has to be repaid.

- Redeemable Debentures are repaid at the time of maturity. It is medium-term capital.

Question 5.

Conversion of Debentures

Answer:

- Conversion of Debentures means converting Debentures into equity shares.

- Convertible Debentures are those Debentures that are not repaid on maturity but converted into equity shares.

- Before conversion, they enjoy all rights of creditors whereas after conversion they get all benefits of the owner.

Question 6.

Interest Warrant

Answer:

- An interest Warrant is an instrument or payment of interest to the Debenture holders.

- It is like a crossed cheque that can be encashed through the Debenture holder’s bank account.

Question 7.

Conciseness

Answer:

- Conciseness refers to avoiding irrelevant and unnecessary information.

- As far as possible the letter should be brief, short, and to the point so that, the reader should develop an interest in reading it.

Question 8.

Precise Information

Answer:

- Precise information refers to providing timely and up-to-date information.

- The data given in the letter must be accurate and based on factual information.

Question 9.

Courtesy

Answer:

- Courtesy means politeness.

- The secretary has to be polite while corresponding with debenture holders. Due respect should be given to them being the Creditors of the company.

- The language in the letter should be courteous. Rude and harsh words should be avoided.

Question 10.

Debenture Certificate

Answer:

- A debenture Certificate is an acknowledgment of debt given to the company.

- It is issued under the common seal and signature of two directors of the company as a witness.

- It contains the name of the Debenture holder, number of Debentures, type of Debenture, rate of interest, maturity, etc.

3. Answer in brief.

Question 1.

Which are the precautions to be taken by the Secretary while corresponding with debenture holders?

Answer:

The following precautions are to be kept in mind by the secretary while corresponding with the debentures.

(i) Transparency:

Transparency means disclosing the correct and accurate information of the company. Including the credit rating of the company, true and real facts of companies’ affairs, etc. in correspondence.

(ii) Quick Response:

Secretary should promptly respond to the queries and complaints of debenture holders without any delay.

(iii) Courtesy:

- As debenture holders are the creditors of the company, proper respect should be given to them in correspondence.

- The wordings in the letter should be courteous. Rude and harsh words should be strictly avoided.

(iv) Conciseness:

Letters to the debenture holders should be brief and to the point avoiding unnecessary information.

(v) Accuracy:

The secretary should provide precise and up-to-date information to debenture holders. The information must be true and correct.

(vi) Confidentiality:

As a confidential officer of the company, the secretary must take due care and should not disclose any secret information about the company while writing letters.

(vii) Reputation of the company:

While corresponding with debenture holders, the secretary should try to maintain goodwill and create a good image of the company in the mind of debentures.

(viii) Legal Provisions:

The secretary should follow the statutory provisions of the Companies Act, 2013 and other related laws while corresponding with debenture holders. Secretary must be very careful in corresponding as it can cause legal consequences.

Question 2.

What are the circumstances under which correspondence can be made with debenture holders?

Answer:

Debenture holders are the creditors of the company. They have the right to know about the decisions taken by the management of the company and other information. The secretary corresponds with the debenture holders under various circumstances. The following are the few circumstances under which the secretary enters into correspondence with the debenture holders:

- Informing the applicant about the allotment of debentures.

- Informing about payment of interest through:

- Interest Warrant

- Electronic Mode

- Letter for the conversion of debentures into equity shares.

- Informing the debenture holders about the redemption of their debentures.

4. Justify the following statements.

Question 1.

The company secretary should take certain precautions while corresponding with debenture holders.

Answer:

- Secretary has to be more careful while drafting the letters. The languages used in the letter should be courteous, i.e. showing due respect to the shareholders.

- A prompt reply should be given to the queries raised by the debenture holder.

- The letter should be short and precise containing important information. The data provided in the letter should be up to date.

- It is also necessary for the secretary to keep in mind the goodwill of the company. Simultaneously, it is also necessary to be aware that the company follows all the legal provisions of the Companies Act, 2013.

- Thus, it is rightly justified that, the company secretary should take certain precautions while corresponding with debenture holders.

Question 2.

There are certain circumstances when a secretary has to correspond with debenture holders.

Answer:

- (i) Debenture holders are the creditors of the company and are entitled to receive the interest.

- (ii) Secretary being the link between the company and debenture holders has to draft various letters:

- Allotment letter has to be sent to Debenture holders when the Debentures are allotted.

- Letter for payment of interest has to be written to Debenture holders to inform them.

- Payment can be done either through an interest warrant or ECS/ NEFT.

- Letter informing the Debenture holders about conversion of debentures into equity shares.

- Letter informing the Debenture holders about the redemption (repayment) of Debentures.

- Thus, it is rightly justified that, there are different circumstances when a secretary has to correspond with Debenture holders.

5. Attempt the following.

Question 1.

Draft a ‘Letter of Allotment’ to debenture holders.

Answer:

RADHIKA INDUSTRIES LIMITED

50/A, Bandra-Kurla Complex, Bandra (East), Mumbai: 400 051

CIN: L46001 MH 2002 PLC 503433

Website: www.radhikalimited.com

Email: radhika4@gmail.com

Date: 14th May 2019

Tel. No.: 022-24761524

Fax No.: 022-24881242

Ref. No.: D/DH/2018-19

Mr. Amit Desai,

C/23, LIC colony,

L.J Road, Mahim,

Mumbai – 400 096

Sub.: Public issue of 10,00,000 @ 12.5% non-convertible debentures of ₹ 100 each at par.

Dear Sir,

In response to your application AD- 1884 dated 19th April 2019, I am directed by the Board of Directors to inform you that, you have been allotted 100,12.5% non-convertible debentures of ₹ 100 each. The period of debentures is for 7 years.

These debentures are allotted to you as per the resolution passed at the Board Meeting held on 8th May 2019 and as per the terms and conditions of Debenture Trust Deed and Articles of Association of the company.

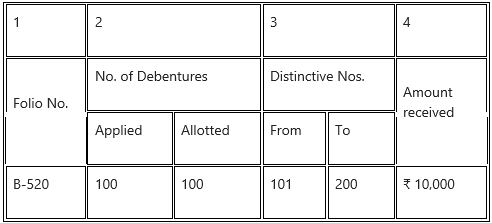

Details of allotment are as follows:

The debenture Certificate will be sent to you within the stipulated period.

Thanking you,

Yours faithfully,

For, Radhika Industries Limited.

Sign

Company Secretary

Question 2.

Write a letter to debenture holders regarding payment of interest through an Interest Warrant.

Answer:

RADHIKA INDUSTRIES LIMITED

50/A, Bandra-Kurla Complex, Bandra (East), Mumbai: 400 051

CIN: L46001 MH 2002 PLC 503433

Website: www.radhikalimited.com

Email: radhika4@gmail.com

Date: 10th Jan 2019

Tel. No.: 022-24761524

Fax No.: 022-24881242

Ref. No.: D/DH/2018-19

Mrs. Bharati Nikumbh,

A/22, BPT colony,

N.K Road, Mahim,

Mumbai – 400 096

Sub.: Payment of interest on debentures.

Dear Madam,

As per the board resolution passed in the Board Meeting held on 20th Jan 2019, this is to inform you that, the payment on your 10% non-convertible debentures of ₹ 100 each is due.

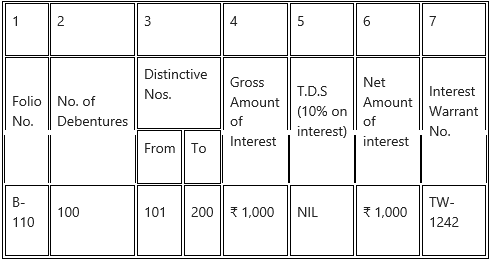

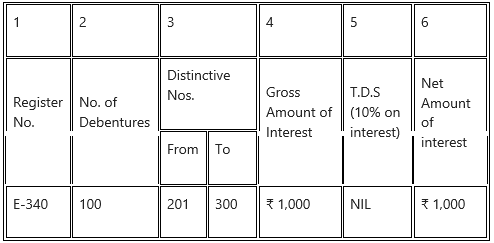

The details of the amount of interest payable to you are as follows:

The interest warrant is enclosed herewith. Please acknowledge the receipt.

Thanking you,

Yours faithfully,

For, Radhika Industries Limited.

Sign

Company Secretary

Encl: Interest Warrant No. IW-1242.

Question 3.

Draft a letter to the debenture holder informing him about the redemption of debentures.

Answer:

SWARG MARBLE LIMITED

40/B, C-Ramchandra Road, Khar (East), Mumbai: 400 053

CIN: L24308 MH2006 PLC211388

Website: www.swarglimited.com

Email: swarglimitedl2@gmail.com

Date: 16th March 2019

Tel. No.: 022-4133242

Fax No.: 022-4215212

Ref. No.: R/DH/14/18-19

Mr. Amit Berde

A/21, Swastik Colony,

Bhadkamkar Marg,

Fort, Mumbai 400 020

Sub: Redemption of debentures.

Dear Sir,

In accordance with the terms decided at the time of issue of 1,00,000, 10% Non-convertible debentures, this is to inform you that, the said debentures are due for redemption on 30th April 2019.

According to Board Resolution No. 4432 passed at the Board meeting held on 15th March 2019, said debentures shall be redeemed out of the Debentures Redemption Reserve of the company.

Please arrange to submit a duly filled up Debentures Redemption Form along with a duly discharged debenture certificate at the Registered Office of the company on or before 7th April 2019.

On completion of the above formalities, the redemption amount will be credited to your bank account. You are requested to provide us your bank account details.

Thanking you,

Yours faithfully,

For, Swarg Marble Limited.

Sign

Company Secretary

Encl: Debenture Redemption Form.

Question 4.

Draft a letter to debenture holder informing him about conversion of debentures into equity shares.

Answer:

SUNRISE INDUSTRIES LIMITED

50/A, Swami Narayan Road, Tunga Village, Mumbai: 400 072

CIN: L42105 MR 2005 PLC: 402512

Tel. No.: 022-23731242

Fax No.: 022-23738656

Ref. No.: D/DH/2018-19

Email: sunrise5@gmail.com

Website: www.sunriselimited.com

Date: 2nd May 2019

Mr. Uddhav Ansurkar

20, Hilton Complex,

Laxmi Road,

Solapur- 413018

Sub: Conversion of Debentures into Equity shares.

Dear Sir,

In accordance with the terms decided at the time of issue of 1,00,000, 10% fully Convertible debentures, this is to inform you that, the said debentures are due for conversion.

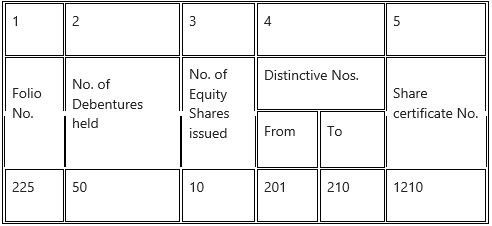

Accordingly, a special resolution was passed at the Extra Ordinary General Meeting held on 20th April 2019 for approval of the conversion of debentures into equity shares in the ratio of 5: 1. As per your letter of option, you have been allotted 10 equity shares in lieu of your 50 debentures.

Details of your holding after conversion are as follows:

A duly signed and executed shares Certificate is enclosed.

Debenture Certificate will be null and void w.e.f. 30th April 2019.

Thanking you,

Yours faithfully

For, Sunrise Industries Limited.

Sign

Company Secretary

Encl: Share Certificate No. 1210

Question 5.

Write a letter to debenture holders regarding payment of interest electronically.

Answer:

RADHIKA INDUSTRIES LIMITED

50/A, Bandra-Kurla Complex, Bandra (East), Mumbai: 400 051

CIN: L46001 MH 2002 PLC 503433.

Tel. No.: 022-24761524

Fax No.: 022-24881242

Ref. No.: D/DH/2018-19

Email: radhika4@gmail.com

Website: www.radhikalimited.com

Date: 10th March 2019

Mrs. Shweta Gawde.

B/20 Mahindra Tower,

Tardeo Road, Mumbai Central,

Mumbai – 400 034

Sub.: Payment of interest on debenture through ECS or NEFT.

Dear Madam,

As per the Board resolution passed in the Board Meeting held on 8th March 2019, this is to inform you that, the board is finalizing to pay interest @10% on Redeemable Debentures of ₹ 100 each for the year ending 31st March 2019.

We have complied with all the provisions relating to the payment of interest on debentures.

Details of your interest payment are as follows:

Interest will be paid through ECS or NEFT transfer by crediting your bank account as per details provided by you to the company.

Thanking you,

Yours faithfully,

For, Radhika Industries Limited.

Sign

Company Secretary