Chapter 9 Discount and Commission Set 9.1

Question 1. If marked price = Rs 1700, selling price = Rs 1540, then find the discount.

Solution:

Here, Marked price = Rs 1700,

selling price = Rs 1540

Selling price = Marked price – Discount

∴ 1540 = 1700 – Discount

∴ Discount = 1700 – 1540

= Rs 160

∴ The amount of discount is Rs 160.

Question 2. If marked price Rs 990 and percentage of discount is 10, then find the selling price.

Solution:

Here, marked price = Rs 990,

discount = 10%

Let the percentage of discount be x

∴ x = 10%

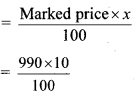

i. Discount

= Rs 99

ii. Selling price = Marked price – Discount

= 990 – 99

= Rs 891

∴ The selling price is Rs 891.

Question 3. If selling price Rs 900, discount is 20%, then find the marked price.

Solution:

Here, selling price = Rs 900, discount = 20%

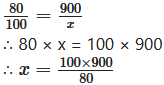

Let the marked price be Rs 100

Since, the discount given = 20%

∴ Amount of discount = Rs 20

∴ Selling price = 100 – 20 – Rs 80

Let actual marked price be Rs x

∴ For marked price of Rs x, selling price is Rs 900

∴ x = Rs 1125

∴ The marked price is Rs 1125.

Question 4. The marked price of the fan is Rs 3000. Shopkeeper gave 12% discount on it. Find the total discount and selling price of the fan.

Solution:

Here, Marked price = Rs 3000, discount = 12%

Let the percentage of discount be x.

∴ x = 12%

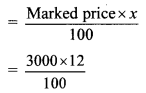

i. Discount

= 30 × 12

= Rs 360

ii. Selling price = Marked price – Discount

= 3000 – 360

= Rs 2640

∴ The total discount is Rs 360 and the selling price of the fan is Rs 2640.

Question 5. The marked price of a mixer is Rs 2300. A customer purchased it for Rs 1955. Find percentage of discount offered to the customer.

Solution:

Here, marked price = Rs 2300,

selling price = Rs 1955

i. Selling price = Marked price – Discount

∴ 1955 = 2300 – Discount

∴ Discount = 2300 – 1955

= Rs 345

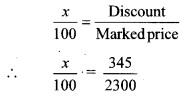

ii. Let the percentage of discount be x

∴ x = 15%

∴ The percentage of discount offered to the customer is 15%.

Question 6.

A shopkeeper gives 11% discount on a television set, hence the cost price of it is Rs 22,250. Then find the marked price of the television set.

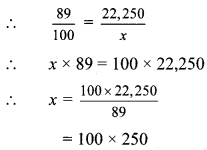

Solution:

Here, selling price = Rs 22,250, discount = 11%

Let marked price be Rs 100

Since, the discount given = 11%

∴ Amount of discount = Rs 11

∴ Selling price = 100 – 11 = Rs 89

∴ Let actual marked price be Rs x

∴ For marked price of Rs x, selling price is Rs 22,250

∴ x = Rs 25,000

∴ The marked price of the television set is Rs 25,000.

Question 7. After offering discount of 10% on marked price, a customer gets total discount of Rs 17. To find the cost price for the customer, fill in the following boxes with appropriate numbers and complete the activity.

Solution:

Suppose, marked price of the item = 100 rupees Therefore, for customer that item costs 100 – 10 = 90 rupees.

Hence, when the discount is [10] then the selling price is [90] rupees.

Suppose when the discount is [17] rupees, the selling price is x rupees.

∴ The customer will get the item for Rs 153.

Question 8.

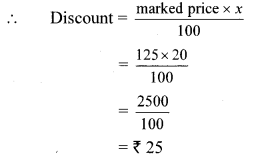

A shopkeeper decides to sell a certain item at a certain price. He tags the price on the item by increasing the decided price by 25%. While selling the item, he offers 20% discount. Find how many more or less percent he gets on the decided price.

Solution:

Here, price increase = 25%,

discount offered = 20%

Let the decided price be Rs 100

∴ Increase in price = Rs 25

∴ Shopkeeper marks the price = 100 + 25

= Rs 125

∴ marked price = Rs 125

Let the percentage of discount be x

∴ x = 20%

∴ Selling price = Marked price – Discount

= 125 – 25

= Rs 100

∴ If the decided price is Rs 100, then shopkeeper gets Rs 100.

∴ The shopkeeper gets neither more nor less than the decided price i.e. he gets 0% more / less.

Intext Questions and Activities

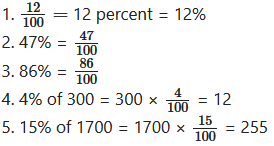

Question 1.

Write the appropriate numbers in the following boxes. (Textbook pg. no. 51)

- 12/100= __ percent = __%

- 47% = __

- 86% = __

- 4% of 300 = 300 × __ = __

- 15% of 1700 = 1700 × __= __

Solution:

Question 2.

You may have seen advertisements like ‘Monsoon Sale’, ‘Stock Clearance Sale’ etc offering different discount. In such a sale, a discount is offered on various goods. Generally in the month of July, sales of clothes are declared. Find and discuss the purpose of such sales. (Textbook pg. no. 51)

Solution:

(Students should attempt the above activity on their own)