Organisation of Commerce & Management SAMPLE PAPER-1

SAMPLE PAPER-1

1. Organisation of Commerce & Management

Questions

- From the given sub questions attempt any four: (20)

(A) Select the appropriate option from options given below and rewrite them:

(i) The State Commission has members.

(a) Three

(b) Four

(c) Two

(ii) Entreprendre means to

(a) Undertake

(b) Enterprise

(c) Businessman

(iii) Startup India is an initiative of the

(a) RBI

(b) Government of India

(c) World Bank

(iv) Principle of is not applicable to life insurance..

(a) Insurable interest

(b) Utmost good faith

(c) Indemnity

(v) The term market is derived from word MERCATUS’

(a) French

(b) Latin

(c) Greek

(B) Give one word or phrase for the following sentences:

(i) Name of the policy where several ships belonging to one owner are insured under the same policy.

(ii) The first step in online transaction.

(iii) Who propounded the concept of trusteeship?

(iv) Organisation which aims at promoting the welfare of the people.

(v) Two sellers selling either a homogeneous or a differentiated product

(C) True or false:

(i) The 4P’s of marketing mix are product, price, place and packaging.

(ii) Middle level is mainly concerned with planning activities

(iii) Marketing helps business to understand the needs of the consumers.

(iv) NEFT stands for National Electric Funds Transfer.

(v) The term e-business is derived from the term e-mail and e-commerce.

(D) Match the pairs:

Group “A” | Group “B” | |||

1. | Air transport | a. | Time utility | |

2. | Warehousing | b. | Intangible in nature | |

3. | Money remittance | c. | Fastest mode of transport | |

4. | Pipeline transport | d. | Western union money transfer |

5. | Business service | e. | Petroleum and gas |

f. | Tangible in nature | ||

g. | Saving account | ||

h. | Place utility |

- Explain the following terms/concepts in detail (Any 4 out of 6 ):

(i) Planning

(ii) Globalisation

(iii) Branding

(iv) Staffing

(v) District Commission

(vi) Corporate Social Responsibility.

- Study the following case/situation and express your opinion (Any 2):

(i) Yash Ltd. is providing facilities for their female staff like day care centre for kids and work from home. Management also takes suggestions even though they are member of trade unions, by doing this, Yash Ltd. are following social responsibilities towards which interest groups?

(ii) Mr. Lobo wishes to transport goods from Goa to Delhi and seeks your opinion regarding modes of transport that can be used.

(iii) In ABC Ltd, Mr. Amar gives instructions to the employees working under him, guides and motivates them for their best performances. Mr. Akbar takes efforts to harmonise the work done by the employees of different departments while achieving the organisational goals.

Mr. Anthony is looking after the arrangement of required resources for the business organisation. Mention the name of the employee engaged in following functions:

(a) Organisation

(b) Direction

(c) Coordination

- Distinguish between (Any 3):

(i) Organising and Directing

(ii) Life Insurance and Marine Insurance

(iii) and

(iv) National Commission and State Commission

- Answer the following questions in brief (Any 2): (8)

(i) Define any four principles of insurance with examples.

(ii) Explain entrepreneurship development program with its steps and objectives.

(iii) Define marketing mix along with its types.

- Justify the following statements (Any 2):

(i) Explain the nature of principle of management.

(ii) Principle of Equity and Principle of Order are very important.

(iii) State Importance of controlling.

(iv) State the benefits and limitations of e-business.

7. Answer the following questions in detail (Any 2): (10)

(i) State the importance of marketing to the firm.

(ii) Describe the importance of co-ordinating.

(iii) Define the secondary functions of Bank.

- Answer the following questions in detail (Any 1): (8)

(i) Define and explain Henry Fayol’s administrative theory of management in detail.

(ii) Explain primary and secondary functions of commercial bank

3. [.]. Answer Key

- (A) (i) (b) Four

(ii) (a) Undertake

(iii) (b) Government of India

(iv) (c) Indemnity

(v) (b) Latin

(B) (i) Fleet

(ii) Registration

(iii) Mahatma Gandhi

(iv) Non-Government Organisation

(v) Duopoly

(C) (i) False

(ii) False

(iii) True

(iv) False

(v) True

(D)

Group “A” | Answers | ||

1. Air transport | c. Fastest mode of transport | ||

2. Warehousing | a. Time utility | ||

3. Money remittance |

| ||

4. Pipeline transport | e. Petroleum and gas | ||

5. Business service | f. Intangible in nature |

- (i) Planning: Planning is the basic function of management. Every function of management is based on planning. It includes deciding the things to be done in advance. Planning is an intellectual process of logical thinking and rational decision making. It focuses on organisation’s objectives and develops various courses of action.

Designing proper planning and implementing accordingly is the key of achieving the objectives of an organisation. In short, planning is a detailed programme of future courses of action.

(ii) Globalisation: The entire globe is the market place nowadays. It provides more opportunities and challenges to business. International trade barriers have reduced which resulted in global distribution of goods and services. Countries who have adopted good practices are influencing the world. (iii) Branding: Every businessman wants to have special identity in the market for his product. Branding is a process of giving special identity to a product through unique brand name to differentiate it from competitor’s products. In simple words giving of distinct name to one’s product is called as branding.

Registered brands are known as trademarks.

Trademarks cannot be copied. Branding helps to get recognition among the consumers. It can help to get new business and increase brand awareness in the market.

(iv) Meaning: Staffing is the function of execution according to plan and organisational structure, It is the process of attracting, recruiting, selecting, placing, appraising, remunerating, developing and retaining the best workforce. Overall growth and success of every venture is based on appropriateness of staffing function. It is very challenging for organisation to focus on best utilisation of workforce by using their talents and skills, retaining them and arranging training and development programmes. The function emphasizes managing human and not material or financial resources.

The need of staffing arises since the initial period of organisation. Due to promotion, transfer, business expansion, retirement, resignation, accidents, death of employee etc, vacancies are created in organisation. In this context, staffing function plays very important role in organisation. Right person at right job with right pay is the basic principle of staffing

(v) Meaning: A consumer dispute redressal commission at each district established by the State Government is known as District Commission.

Composition: Each District Commission shall consist. of the following:

President: A person who is sitting or retired or qualified to be a District Judge.

Member: Not less than two and not more than such number of members as may be prescribed, in consultation with the Central Government.

Tenure: Any person appointed as President or a member of the District Commission shall hold office as such as President or as a member till the completion of his term for which he has been appointed. The members will hold office for a term

of five years or upto the age of sixty five years, whichever is earlier.

(vi) Corporate Social Responsibility (CSR): Is selfregulating business model, which aims to contribute to societal goals or support volunteering or ethicallyoriented practices. It makes a company socially responsible and accountable. This accountability is towards itself, its stakeholders, public in general etc. By practicing social responsibility, companies can be conscious about economic, social and environmental aspects of the society.

- Study the following case / situation and express your opinion.

(i) Yash Ltd, is showing responsibilities towards employees. Employees are human resource of the organisation.

They must be treated with dignity and respect. The management and employees should develop mutual understanding and trust. Government has passed various labour laws to safeguard the interest of employees.

(ii) Generally, transportation is carried through various modes such as railways, roads, waterways and airway. Modes of transport are as follows:

(a) Road Transport

(b) Rail Transport

(c) Air Transport

(d) Water Transport

(e) Mono Rail and Metro

(f) Ropeways

(g) Pipeline

(iii) Organisation: Mr. Akbar

Direction: Mr. Amar

Coordination: Mr. Anthony.

- (i) Organising and Directing:

Point of Distinction | Organising | Directing | ||||||||

Meaning |

|

| ||||||||

Objective |

|

| ||||||||

Area of function |

|

| ||||||||

Factors |

|

| ||||||||

Order | It is based on planning. |

| ||||||||

Resources |

|

| ||||||||

Nature |

|

| ||||||||

Level of management |

|

|

(ii) Life Insurance and Marine Insurance:

Point of Distinction | Life Insurance | Marine Insurance | ||||||||||

Meaning |

|

| ||||||||||

Policy taken by |

|

|

Subject matter |

|

| ||||||||

Insurable interest |

|

| ||||||||

Compensation |

|

| ||||||||

Principle of indemnity |

|

| ||||||||

Number of policies |

|

| ||||||||

Beneficiary |

|

| ||||||||

The policy can be surrendered before | ||||||||||

the expiry of the term subject to | ||||||||||

certain conditions. |

(iii) and :

Basis for Distinction | BPO | KPO | ||||||||||

Meaning |

|

| ||||||||||

Degree of complexity | BPO is less complex. | KPO is more complex. | ||||||||||

Requirement | BPO requires process expertise. | KPO requires knowledge expertise. | ||||||||||

Talent required in employees |

|

| ||||||||||

Focus on | BPO focus on low level process. | KPO focus on high level process. |

(iv) National Commission and State Commission:

Points of Distinction | State Commission | National Commission | ||||||||

Meaning |

|

| ||||||||

President |

|

|

Member |

|

| ||||||||

Membership tenure |

|

| ||||||||

Area covered | It covers particular state. | It covers the entire country. | ||||||||

Monetary jurisdiction |

|

| ||||||||

Appeal |

|

|

4. 5. (i) Principles of Insurance:

(a) Principle of Utmost Good Faith: In all types of insurance contracts both the parties must have utmost good faith towards each other. The insurer and insured must disclose all material facts clearly, completely and correctly. The insured must provide complete, clear and correct information of the subject matter of insurance to the insurer. Similarly, the insurer must provide relevant information regarding terms and conditions of the contract. Failure to provide complete, correct and clear information may lead to non-settlement of claim.

For example, Mr. Shantanu has not provided information regarding his heart surgery at the time of taking policy. After his death, insurance company comes to know about this fact. As Mr. Shantanu has not provided correct and complete information at the time of taking policy, insurance company can refuse to give compensation to his family members.

(b) Principle of Insurable Interest: Insurable interest means some financial interest in the subjectmatter. The insured must have insurable Interest in the subject-matter of insurance. Insurable interest is applicable to all insurance contracts. It is said to have insurable interest in subjectmatter, when the existence of that subject matter puts the insured in financial benefit. Whereas nonexistence of subject-matter put him into financial loss. For example,

- A person has insurable interest in his own life and property.

- A business man has insurable interest in the goods he deals and in the property of business. In life insurance, the insurable interest refers to the life insured. Insurable interest must exist at the time of taking a life insurance policy: In fire and marine insurance, the insurable interest must be present at the time of taking policy and at the time of occurrence of loss.

(c) Principle of Indemnity: Indemnity means a guarantee or assurance to put the insured in same financial position in which he was immediately prior to the happening of the uncertain event.

This principle is applicable to fire, marine and general insurance. It is not applicable to life insurance as loss of life can never be measured in monetary terms. In case of death of the insured, the actual sum assured is paid to the nominee of the insured.

Under this principle, the insurer agrees to compensate the insured for the actual loss suffered. The amount of actual compensation is limited to the amount assured or the loss, whichever is less. For example, if property is insured for ₹ two lacs and if the loss by fire is one lac, then the Insured can claim compensation of ₹ one lac only.

(d) Principle of Subrogation: This principle is applicable to all contracts of indemnity. As per this principle, after the insured is compensated for the loss due to damage of the property insured, then the right of ownership of such property passes on to the insurer. This principle is applicable only when the damaged property has any value after the event causing the damage.

For example, Mr. A owns a two-wheeler. The vehicle was stolen and subsequently Mr. A filed a complaint in local police station. Upon receiving report from police, the insurance company compensated fully Mr. A for the loss of the vehicle. Later on, the stolen vehicle was recovered by police. In this situation, the owner of the vehicle does not have any claim over the vehicle as he has already subrogated i.e., transferred the ownership rights of the vehicle to the insurer. The insurer gets every right to sell or to scrap the said vehicle.

(e) Principle of Contribution: This principle is applicable to all contracts of indemnity where the insured has taken out more than one policy for the same risk or subject-matter. Under this principle, the insured can claim the compensation only to the extent of actual loss either from one insurer or all the insurers. If the one insurer pays full compensation then that insurer can claim proportionate amount from other insurers from whom insured has taken policy.

For example, Ms. Sayali insures her property of ₹ two lac fifty thousand with two insurers, With T insurance Co. for ₹ One lac (2/5th of the property value) and insurance . for one lac fifty thousand ( th of the property value). If Ms. Sayali ‘s property is destroyed and the loss is worth ₹ one lac twenty thousand, then both insurance companies will contribute towards actual loss i.e. ₹ one lac twenty thousand. Thus company T will pay ₹ 48,000 /- (2/5th of the Loss) and company will pay th of the loss).

(f) Principle of Mitigation of Loss: Insured must always try to minimise the loss of the property, in case of uncertain events. The insured must take all possible measures and necessary steps to control and reduce losses. Hence, it is the responsibility of the insured to protect the property and avoid loss. For example, a house of Mr. Jayant is on fire due to electric short circuit. In this case, Mr. Jayant cannot remain passive and must try his best to save his house from fire. Mr. Jayant must be active and cannot watch his house burn, just because house is insured.

(g) Principle of Causa-Proxima: Principle of causaproxima means, when a loss is caused by more than one causes, then proximate cause of loss should be taken into consideration to decide the liability of the insurer. The property is insured against some causes and not against all causes, in such a case, the proximate cause of loss is to be found. If the proximate cause is the one which is insured against, the insurance company is bound to pay compensation and vice-versa.

For example, a house was insured against the risk of theft. There was a theft in the house and before leaving, the house was set on fire by thieves. Now. there are two causes of loss, theft and fire, and the nearest cause of loss was fire. As the house was insured against theft and not by fire, the insured will not get any compensation from insurance company for loss by fire. But, he will get the compensation for the property lost by theft.

(ii) Entrepreneurship Development Programmes (EDP):Anentrepreneurship development programme has been defined as ‘a programme designed to help a person in strengthening his entrepreneurial motive and in acquiring skills and capabilities necessary for playing his entrepreneurial role efficiently:

EDP is a device through which people with latent entrepreneurial traits are identified, motivated to take up new industrial venture, trained in managing the unit and guided in all aspects of starting a venture/an enterprise.

EDP was first introduced in Gujarat in 1970 and was sponsored by the Gujarat Industrial Investment corporation. The EDP’s are based on Mcclellands experiments in Kakinanda district of Andhra Pradesh where businessmen were provided with motivation and training.

5. The EDP includes following steps:

(a) Arrangement of infrastructure.

(b) Selection of potential entrepreneur.

(c) Identification of enterprise.

(d) Actual training program.

(e) Selection of training personnel.

(f) Selection of method of training.

(g) Actual training.

(h) Monitoring and follow-up.

6. Objectives of EDP:

The following objectives of EDP are identified as:

(a) To foster entrepreneurial growth in the country.

(b) Optimum use of available resources.

(c) Development of backward regions and improving economic status of socially disadvantaged groups.

(d) Generation of employment opportunities.

(e) Widening base for small and medium scale industries.

(iii) Marketing Mix with its Types: Marketing mix is the combination of different marketing variables that the firm blends and controls to achieve the desired result from the target market. In simple words the marketing mix is putting the right product, at the right time, at the right price in the right place. It is one of the important tools of the marketing. The 4P’s of marketing mix were introduced by . Jerome McCarthy in 1960. It was further extended by Booms & Bitner in 1981 by adding 3 new elements to the 4 Ps principle.

There are two types of marketing mix-product marketing mix (4Ps) and service marketing mix (7Ps). The four Ps are the key factors that are involved in the marketing of goods or services. They are the product, price, place, and promotion.

(a) Product: Product refers to the goods or services that are offered to the customers for sale and are capable of satisfying the need of the customer. The product can be intangible or tangible, as it can be in the form of services or goods. The business need to decide the right type of product through extensive market research. Success of the business depends on the impact of the product in the minds of the customer.

(b) Price: The price of the product is basically the amount that a customer pays for the product. Price plays an important role in creating demand for the product. The business needs to take utmost care to decide the price of the product. Cost of the product and willingness of the customer to pay for the product play an important role in pricing the product. Too high price may affect the demand for the product and pricing it too low may affect the profitability of the business. While deciding the prices, the value and utility of the product to its customers are to be considered.

(c) Place:Place is also known as distribution channel. Placement or distribution is a very important part of the marketing. Making a right product at the right price is not enough. Businessman needs to make the product available to potential customer at the right place too. Business needs to distribute the product in a place that is accessible to potential buyers. It covers location, distribution and ways of delivering the product to the customer. Better the chain of distribution higher the coverage of the product in the market.

(d) Promotion: Promotion is an important element of marketing as it creates brand recognition and sales. Promotion is a tool of marketing communication which helps to publicise the product to the customer. It helps to convey product features to the potential buyer and inducing them to buy it. Promotion mix includes tools such as advertising, direct marketing, sales promotion, personal selling, etc.

Combination of promotional strategies depends on budget, the message business wants to communicate and the target market.

The above four P’s of marketing are associated with the product marketing mix. In addition to the 4Ps, when there is consumer-oriented or service marketing, there are 3 more P’s taken into consideration namely-people, physical evidence and process.

(e) People: People inside and outside the business directly or indirectly influence the business. People comprise of all the human beings that play an active role in offering the product or service to the customer. The people include employees who help to deliver services to the customer. Right people at right place add value to the business. For the success of the business, it is necessary to recruit right people, train them, develop their skill and retain them.

(f) Process: Process refers to the steps involved in delivering products and services to the customer. Processes are important to deliver a quality service. Good process helps to ensure same standard of service to the customer as well as save time and money by increasing efficiency. The advancement in technology helps businesses in effective monitoring of the process of the business and take corrective action wherever is necessary.

(g) Physical Environment: Physical environment refers to the marketing environment wherein the interaction between customer and firm takes place. Since services are intangible in nature service providers try to incorporate certain tangible elements into their offering to enhance customer experience. In the service market, the physical evidence is important to ensure that the service is successfully delivered.

Through physical evidence customers know the brand leaders in the market. Physical evidence affects the customer’s satisfaction. It includes location, layout, interior design, packaging. branding, dress of the staff and how they act, waiting area etc.

- (i) Management principles are formed to guide and influence the behaviour of employees these principles insist on improving efficiency of organisational resources in terms of profit. These principles also focus on best coordination between superior. subordinates and all the members of organisation.

7. The nature of management principles is given

below:

(a) Universal Application: The principles of management are universal in nature. That means they can be applied to all types of organisations, irrespective of their size and nature. Their results may vary and application may be modified but these are suitable for all kinds of organisations. Similarly, they are applicable to all levels of management.

(b) General Guidelines: Management principles provide general guidelines in tackling the organisational situations wisely as well as in solving the problems. They are not rigid, which management principles are to be applied depends upon the situation, size and nature of organisation. For example, when we say fair remuneration, then the term ‘fair’ can vary as per the nature, size and financial condition of the organisation.

(c) Principles are Formed by Practice and Experiments: The management principles are developed gradually with thorough research work. Systematic observations and experiments are conducted before developing them. The results of such experiments have been developed as a principle after its practice in organisations.

(d) Flexibility: Management principles are flexible in nature. It means they can be changed or modified according to the situation. Managers can be flexible while implementing principles to suit the requirement.

The business situations keep on changing. Management principles can be adjusted or

modified and can be used in the organisation according to its need.

(e) Behavioural in Nature: Management is group activity. Management aims at achieving certain goal through a group of human being. Management principles are designed to influence human beings. These principles control a group of persons and direct them to achieve the objectives.

(f) Cause and Effect Relationship: Principles of management are the base for taking decisions. They determine the cause or reason for particular effect. For example, payment of good wages and incentives helps in increasing the output of workers or making effective advertisement increases the sale of a product.

(g) All Principles are of Equal Importance: All principles of management are of equal importance. Those are to be practiced simultaneously to get best results in the form of achievement of predefined goals. If any specific principle is focused more and others are not followed with same focus, then it affects the working of organisation. Management principles are the principles of social science. The nature of principles of management is not absolute like pure sciences i.e., Chemistry. Mathematics etc. With some modifications according to requirement, organisation needs to apply the principles of management.

(ii) Principle of Equity and Order:

(a) Principle of Equity: Management should be fair as well as friendly to the subordinates. While dividing the work, delegating the authorities, deciding the monetary terms etc, there should not be any discrimination between the employees. It is also suggested that the remuneration should not depend on the department but at the level on which subordinates are working. The employees working on the same level but in different departments should be paid same wages. This equity will help in avoiding conflicts in the organisation.

(b) Principle of Order: This principle is based on ‘A place for everything and everything in its place. Human resources and materials should be in the right place.

(iii) Importance of Controlling:

Controlling is important in maintaining standards and to achieve desired goals effectively and efficiently. It is a function of checking the performance of employees at every stage of their work in process. The importance of controlling function in an organisation is as follows:

(a) Fulfilling Goals of Organisation: Controlling is the function of measuring the performances at every possible stage, finding out the deviations, if any; and taking corrective actions according to planned activities for the organisation. Thus, it helps in fulfilling the organisational goals.

(b) Making Efficient Utilisation of Resources: Various techniques are used by managers to reduce of material and spoilage of other resources. Standards are set for every performance. Employees have to follow these standards.

As the effect of this, the resources are used by employees in the most efficient and effective manner so as to achieve organisational objectives.

(c) Accuracy of Standards: An efficient control system helps management in judging the accuracy of standards whether they are accurate or not. Controlling measures are flexible to some extent. So after reviewing them according to changing circumstances, they are revised from time to time which is beneficial for checking performances accurately.

(d) Motivates Employee : After setting standards of checking performance, they are communicated to employees in advance. Due to this, employees get an idea about what to do and how to do. Performances are evaluated and on that basis employees are rewarded in the form of increment, bonus, promotion etc. It motivates the employees to performance of their best level.

(e) Ensures Order and Discipline: Controlling is the function of order and maintaining discipline. It works for reducing unprofessional behaviour of the employees. Discipline is maintained by continuous checking of performances by the superiors and preventive actions are taken to minimize the gap between actual and standards.

(f) Facilitates Co-ordination: Control is a function in which the roles and responsibilities of all departmental managers and the subordinates are designed clearly. Coordination between them helps to find out the deviations in their respective departments and to use remedial measure for desired results of the organisation.

(g) Psychological Pressure: The performance are evaluated with the standard targets. The employees are very well aware that their performance will be evaluated and they will be rewarded accordingly. This psychological pressure works as a motivational factor for employees to give their best performance.

(h) Ensures Organisational Efficiency and Effectiveness: Factors of control include making managers responsible, motivating them for higher performance and achieving departmental coordination. It ensures about organisational efficiency and effectiveness.

(i) Builds Good Corporate Image: Controlling functions helps to improve the overall performance of the organisation. Minimum deviation in predetermined standards and actual

performance results into the progress of business. It can be achieved with the help of proper control. This builds good corporate image and brings good will for the business.

(j) Acts as a Guide: Controlling function provides set of standard performance. Managers as well as subordinates work according to it. Wherever necessary, they can take the help of these standards and can achieve desired results. Thus, controlling function acts as a guide for everyone. The steps taken for controlling an activity guide the management while planning the future activities.

(iv) Benefits of E-business: The main advantage of e-business is people get product information online and order the product online through cash on delivery or pre-payment options. In this way seller and buyer both get advantage of internet platform.

Traditionally trading by the buyers and sellers was done through three channels like face to face, mail and phone. The internet has become the fourth channel for trade. Internet trade is booming and allowing business to sell more and at a lower cost. Thus, internet offers a great opportunity over traditional channels as it has some advantages or strengths.

(a) Ease of Formation: The formation of traditional business is difficult, whereas e-business is relatively easy to start.

(b) Lower Investment Requirement: Investment requirement is low as compared to traditional business as the store does not have physical existence and can be managed with less manpower so if trade does not have much of the investment but have contact (network), he can do fabulous business.

(c) Convenience: Internet offers the convenience of days a year. Business is working on any time and flexibility is available. E-business is truly a business that has enabled and enhanced by the use of electronics and computers network. It offers the advantage of accessing anything, any where, any time.

(d) Speed: This benefit becomes all the way more attractive when it comes to information. Much of the buying or selling involves exchange of information that internet allows at the click of mouse.

(e) Global Access: Internet is truly without boundaries. On one hand, it allows the seller an access to the global market. On the other hand, it offers a freedom to the buyer to choose products from almost any part of the world. No need of face to face interaction between buyer and seller.

(f) Movement towards a Paperless Society: Use of internet has considerably reduced the dependence on paperwork. Thus, recording and referencing of information has become easy. (g) Government Support: The government provides favourable environment for setting up of e-business. This support ensures maximum transparency.

(h) Easy Payment: The payment in e-business is done by credit card, internet banking etc. And it is available round the block.

Limitations of E-business: E-business have certain disadvantages when compared to the traditional way of doing business.

Some of the limitations of e-business are as follows.

(a) Lack of Personal Touch: E-business lacks the personal touch. One cannot touch or feel the products. So it is difficult for the consumers to check the quality of products.

(b) Delivery Time: The delivery of the products takes time. In traditional business you get the product as soon as you buy it. But that doesn’t happen in online business. This time lag often discourages customers e.g. Amazon now assures one day delivery. This is an improvement but does not resolve the issue completely.

(c) Security Issues: There are a lot of people who scam through online business. Also, it is easier for hackers to get the financial details of the customers. It has a few security and integrity issues.

(d) Government Interference: sometimes the government monitoring can lead to interference in the business.

(e) High Risk: High risk is involved as there is nodirect contact between the parties. In case of frauds, it becomes difficult to take legal action.

8. 7. (i) Importance of marketing to the firm:

(a) Increases Awareness: Marketing helps in creating awareness about the existing products, new arrivals as well as the company which sells a particular product in the market. This raises awareness among the potential consumers. It creates brand image among the consumers.

(b) Increases Sales: Once marketing creates awareness about the products or services among the consumers, it attracts them to purchase the same. Successful marketing campaign helps to increase the sales of the organisation. Increase in sale generates profit for the organisation. This income and profit are reinvested in the business to earn more profits in future. In modern business, survival of the organisation depends on the effectiveness of the marketing function.

(c) Creates Trust: People want to buy from a business that has a trustworthy reputation. Creating trust among the customers is a time consuming process. Creating trust among the

consumers helps the business to earn loyal customers. Once your business can establish this trust with your clients, it creates customer loyalty. Happy customers enhance the brand image in the market. Effective marketing plays an important role in building a relationship between the customers and the organisation. Effective pricing policy and timely after sales services improve image of the organisation. A majority of the activities of the marketers are directed towards building the brand equity of the Business.

(d) Basis for Making Decisions: From inception of idea to delivering the final product to the customer, businessman has to take several decisions. Businessman has to look after many problems such as what, how, when. How much and for whom to produce? As the scale of operation increases, these decisions become more complex. Marketing helps to take right decision at right time.

(e) Source of New Ideas: Marketing helps business to understand the needs of the consumers. Feedbacks from the consumers help in the improvement of the existing products. There is rapid change in tastes and preference of people. Marketing helps in understanding these changes. It helps to understand new demand pattern emerged in the market. Research and development department develop products accordingly. The 4P’s of marketing mix i.e., Product, price, place and promotion play a huge role in the product development. Inventions and innovations are taken place as per the need by the research and development team of the business.

(f) Tackling the Competition: There is increasing competitionin almostallsectors of the economy.It is difficult for any business to create monopoly for their products and services. The role of marketing is important to create brand image in the minds of potential customers. Marketing not only helps to communicate about the products and services to the consumers but also motivates them to buy the same. Sound marketing strategies can portray better image of the business than the competitors. Businesses can take use of modern technology for effective marketing.

(ii) Importance of Co-ordinating: Need for coordination arises out of the fact that different elements and efforts of an organisation are to be harmonised and unified to achieve the common objectives. Importance of coordination are as follows:

(a) Encourages Team Spirit: In organisations, group of individuals work together. There may be existence of conflicts, disputes between individuals, departments and employer and employees regarding organisational policies. roles and responsibilities etc. Coordination arranges the work in such a way that minimum conflicts are raised. It increases the team spirit at work place.

(b) Gives Proper Direction: Coordination integrates departmental activities for achieving common goal of the organisation. The work is arranged in a very systematic way. The interdependence of departments gives proper direction to the employees.

(c) Facilitates Motivation: Coordination motivates the employees to take initiative while completing their assigned task. An effective co-ordination increases efficiency and results into growth and prosperity of the organisation.

A prosperous organisation ensures job security. higher income, promotion and incentives. Such monetary and non-monetary incentives provide job security and motivate the employees to do hard work

(d) Optimum Utilisation of Resources: Managers try to integrate all the resources systematically. It helps in utilizing all available resources at its optimum level Co-ordination also helps to minimize the wastage of resources and control the cost of work.

(e) Achieve Organisational Objectives: Coordination leads to minimize the wastages of materials, idle time of employees, delay in completion of targets, departmental disputes etc. to a great extent. It ensures smooth working of the organisation in the process of achieving the objectives of the organisation.

(f) Improves Relation: Co-ordination develops cordial relations between all the levels of management in an organisation. Every department depends on functioning of other department. For example, sales department works according to production department, production department depends on purchase department and so on. Co-ordination helps the employees to build strong relations among them and achieve the given targets.

(g) Leads to Higher Efficiency: With the help of optimum utilisation of resources and effective integration of resources, the organisation can achieve high returns in terms of high productivity. high profitability as well as can reduce the cost. Thus, co-ordination leads to higher efficiency.

(h) Improves Goodwill: Higher sales and higher profitability can be achieved due to synchronised efforts of organisational people, strong human relations and lower costs. It directly results into creating goodwill for organisation in the market. It reflects on market value of shares as well as it helps in building good image in society.

(i) Unity of Direction: Different activities are performed by different departments. Coordination harmonises these activities for achieving common goal of organisation. Thus, co-ordination gives proper direction to all departments of the organisation.

(j) Specialisation: All departments of the organisation are headed by experts in their respective fields. The specialised knowledge of these departmental heads helps in making effective managerial decisions. It leads organisation to march towards growth and success in the competitive world of business

(iii) (A) Agency functions: A commercial bank acts as an agent representative of its client and performs certain functions as follows:

(a) Periodic Collections and Payments: Commercial bank collects salary, dividends, interests and any other income periodically as well as makes periodical payments, such as taxes, bills, premiums, rent etc. on the standing instructions provided by customer. Commercial bank charges certain fixed amount quarterly or annually in the form of service charges from customer for providing such services.

(b) Portfolio Management: Large commercial banks undertake to purchase and to sell securities such as shares bonds, debentures etc. on behalf of the clients. The handling of securities is known as portfolio management. Due to this facility more clients are opting for such services of commercial banks.

(c) Fund Transfer: Commercial banks provide facility fund transfer from one branch to another branch or branch of another bank. Commercial banks come with various initiatives to make these transfer hassles free.

(d) Dematerialisation: Bank provides dematerialisation facilities to their clients to hold their securities in an electronic format. On behalf of clients, it undertakes the electronic transfer of shares in case of purchase or sale.

(e) Forex Transactions: Forex is an abbreviation for foreign exchange. A bank may purchase or sell foreign exchange on behalf of its clients. A bank purchases forex from its client which the clients receive from foreign transactions and sell the forex when the clients need it for overseas transactions.

(B) Utility Functions: A commercial bank performs utility functions for the benefits of its clients.

It provides certain facilities or products to its clients as follows:

(a) Issue of Drafts and Cheques: A draft/ cheque is on order to pay money from one branch of bank to another branch of the same bank or other bank. A bank issues drafts to its account holders as well as non account holders whereas cheques are issued only to the account holders. Bank charges commission for issuing a bank draft.

(b) Locker Facility: This is common utility function of any commercial bank. This bank provides locker facility for the safe custody of valuables, documents,. gold ornament etc.

(c) Project Reports: A bank may prepare project reports and feasibility studies on behalf of clients. Projects reports enable the business firm to obtain funds from the market and to obtain clearance from government authorities.

(d) Gift Cheques: Banks issue gift cheques and gold coins to account holders as well as to non account holders. The gift cheques/coins can be used by the clients for the purpose of gifting on occasions like weddings birthdays etc.

(e) Underwriting Services: A commercial bank may underwrite the issue of securities issued by companies. If the shares are not fully subscribed, the underwriting bank agrees to take up the unsubscribed portion of the securities.

(f) Gold related Services: Now a days many banks are providing gold services to its customers. Bank are commercially buying and selling gold ornaments from customers on large scale basis. Some bank also provides advisory services to its customers in terms of gold funds, gold ETF, etc.

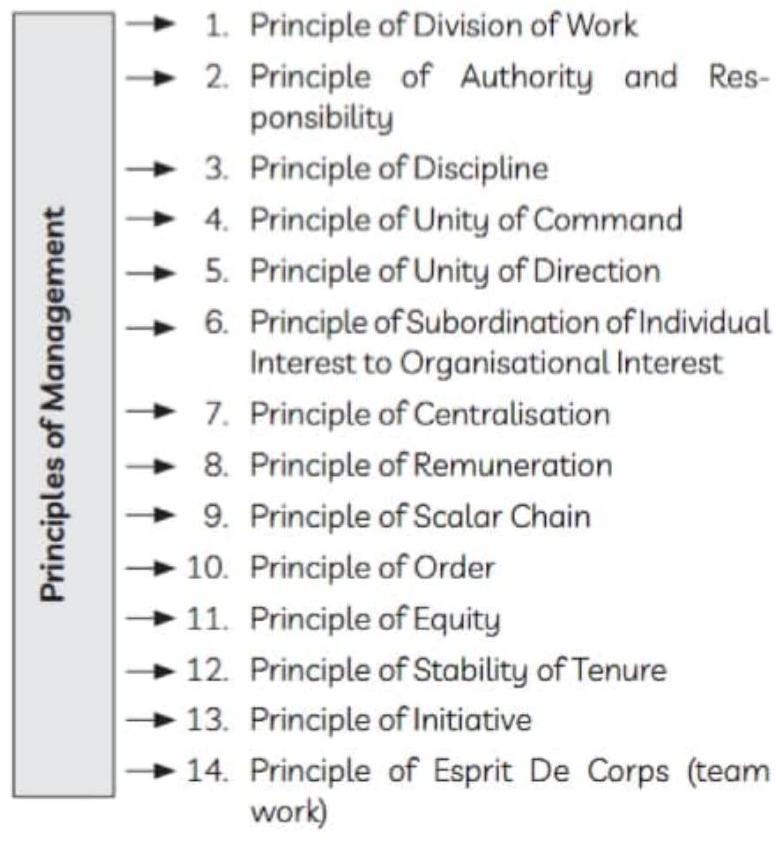

- (i) Henry Fayol (1841-1925) was a french mining engineer who turned into a leading industrialist and a successful manager. He started his career as a mining engineer in a french mining company and rose to the position of the chief managing director. After conducting many experiments and observations in organisation, Fayol proposed 14 Principles of management which are explained in his famous book ‘General And Industrial Administration’. Due to his contribution in development of managerial thoughts he is called as ‘Father of Modern Management’. Fayol suggested 14 principles of management. These statements serve as a guideline for decision-making and management actions.

14 Principles are Summarised as follows:

(a) Principle of Division of Work: According to this principle, the work is divided into different kinds such as technical, financial, commercial, security operations, accounting and managerial. It is assigned to employees as per their qualities and capabilities. It helps in improving efficiency and expertise of employees which ultimately turns into expected productivity level.

(b) Principle of Authority and Responsibility: Authority is the right to take decisions. It is necessary to get the things done appropriately from subordinates. Authority always comes with the responsibility. If the manager is given the authority to complete a task within a given time, he should be held responsible if he does not complete the work in given time. Manager should have proper authorities to take managerial decision on his own in respect to the goal.

(c) Principle of Discipline: According to Fayol, discipline is the most essential thing in the organisation. Employees must obey and respect the rules that govern the organisation. Discipline helps to achieve the goals in the organisation. Good discipline is the result of effective leadership. There must be a clear understanding between the management and workers regarding the organisation’s rules. Basic discipline should be observed at all levels of management.

(d) Principle of Unity of Command: Each member of organisation should receive orders from only one superior. This principle helps in managing conflicts and solving disputes among people in organisation. It also helps in avoiding confusion. If an employee receives commands from more than one authority, he will get confused and will not be able to take decision about whose orders should be followed. This is wrong approach. For this organisational hierarchy should be well defined. Each employee should know his immediate superior and should receive orders from him only.

(e) Principle of Unity of Direction: This principle states that ‘there should be one head and one plan’ in every organisation. Each group in the organisation should have the same objective and the group should be directed by one manager using single plan.

(f) Principle of Subordination of Individual Interest to Organisational Interest: According to this principle the interest of an individual must be given less importance than the interest of the organisation. While taking decision in the organisation the manager should always consider the interest of the whole group rather than the interest of a single employee. Similarly the employee should protect the interest of the organisation first and his personal interest should be subordinated. For example, in every game, the players are always thinking about winning the match as a team rather than their individual records.

(g) Principle of Centralisation: Centralisation refers to the concentration of powers and authorities. In some organisations this power is vested in one hand or few hands. This situation occurs in the small organisations. But, if the size of organisation is large then there is a decentralisation of the power or authority.

According to this principle there must be a proper balance between centralisation and decentralisation in the organisation. This is to be done according to the size of the organisation, nature of the activity etc.

(h) Principle of Remuneration: Appropriate remuneration to staff or employees is the principle to keep them satisfied financially as well as retain them for long span of time within the organisation. The fair remuneration has effect on the productivity and efficiency level of employee. The remuneration should be fixed by taking into consideration the skill, expertise, knowledge, tenure, cost of living, market trend, profitability of organisation etc.

(i) Principle of Scalar Chain: Scalar chain means the hierarchy of authority from the top level to the lower level for the purpose of communication. This helps to ensure the orderly flow of information and communication. Traditionally organisations used to frame large scalar chain which is time consuming. For example, a general Manager informs the decision to respective functional manager, then functional manager will pass it to supervisor, the supervisor will inform it to foreman and so on according to level of authority. For avoiding this longer chain and to take speedy decisions cross communication

or direct communication is followed by various organisations which is known as gang plank. For direct communication, proper permission of the authorities is necessary.

(j) Principle of Order: This principle is based on ‘a place for everything and everything in its place. Human resources and materials should be in the right place at the right time for maximum efficiency. Human resources should be placed at right place and on right job. The principle focuses on the proper utilisation of physical and human resources.

(k) Principle of Equity: Management should be fair as well as friendly to the subordinates. While dividing the work, delegating the authorities, deciding the monetary terms etc. There should not be any discrimination between the employees. It is also suggested that the remuneration should not depend on the department but at the level on which subordinates are working. The employees working on the same level but in different departments should be paid same wages. This equity will help in avoiding conflicts in the organisation.

(l) Principle of Stability of Tenure: At the time of recruitment of employees, the management should assure them about stability of tenure or job security. It plays very important role in creating sense of belongingness among the employees. Insecurity in job always affect the efficiency of employees adversely whereas job security minimizes employee turnover ratio.

(m)Principle of Initiative: Initiative refers to volunteering to do the work in an innovative way. The freedom to think and work on new ideas encourages employees to take initiative while working on given task. This initiative should be welcomed by the manager including thorough discussion on those new ideas. It also helps in creating healthy organisational culture.

(n) Principle of Esprit De Corps : (team work) Henry Fayol has given emphasis on team work. Esprit de corps means union is strength. Running any organisation is a group activity and human resources are the valuable asset of the organisation. If all employees are working as a union and with mutual trust, the difficulties can be solved quickly. Therefore, as a leader. manager should create a spirit of team work and understanding among employees to achieve organisational goal easily.

Above fourteen principles of Henry Fayol are very useful to manage the organisation efficiently and effectively. These are also supportive to functions of management. These principles are very logical and therefore are applicable in modern management era.

(ii) Primary and Secondary Functions of Commercial Bank (a) Primary Functions: The primary functions of commercial banks are known as core banking functions. The primary functions are as follows:

- Accepting Deposits: Commercial banks collect deposits from individuals and organisations. The deposits can be classified into two types i.e., Time deposits and demand deposits.

(A) Time Deposits: Time deposits are called as time deposits because they are repaid to the customers after the expiry of decided time.

(1) Fixed Deposit: Fixed deposit account is an account where fixed amount is kept for fixed period of time bearing fixed interest rate. Rate of interest is more as compared to saving bank account and varies with the deposit period. Normally, withdrawal of amount is not permitted before maturity date. However, depositor can withdraw amount before maturity date for which bank will reduce the interest rate. For amount deposited in this account, a fixed deposit receipt (FDR) is issued by the bank. Against this receipt loan can be taken from the bank.

(2) Recurring Deposit: It is operated by salaried persons and businessmen having regular income. A certain fixed sum of money is deposited into the account every month. Withdrawal of accumulated amount along with interest is paid after the maturity date. Rate of interest is higher which is similar to fixed deposit account. Separate passbook is provided to know the position of RD account.

(B) Demand Deposits: Demand deposits are those which are repaid to customers whenever they demand. That means, money can be withdrawn as per the wish of the customer through withdrawal slips, cheques, ATM cards, online transfer etc.

(1) Saving Account: It is generally operated by those who earn regular or fixed income such as salary or wages. The main aim of this deposit account is to encourage habit of savings among people. These deposit accounts are meant for the purpose of maximum savings. There are restrictions on withdrawal limits from these accounts. These accounts carry low interest rates. Interest is credited monthly, quarterly, halfyearly and yearly basis on this

account. Passbook facility, balance on SMS, account statement etc. Facilities are provided to account holders to ascertain financial position.

For saving account holders some banks provide separate facility of flexi deposit. This facility combines the advantages of saving account and fixed deposit account. This is not separate deposit account. It is a type of saving bank account or current deposit account with special features and benefits. In case of multiple option deposit account, the excess amount after a particular limit gets automatically transferred to fixed deposit. When adequate funds are not available to honour payments or cheques in savings account, funds get transferred from fixed deposit to saving banks account.

(2) Current Account: This account is operated by business firms and other commercial organisations such as hospitals, educational institutions etc. Who have regular banking transactions. In this account there is no restriction on deposits and withdrawals of amounts. No interest is paid by the bank on this account. Overdraft facility is available for this account. For current account, banks provide statement of account every month.

- Granting Loans and Advances: Banks grant loans and advances to business firms and others who are in need of bank funds. The loans are provided for longer period of time from 1 year and more. Advances are provided for shorter period from 4 months to 1 year. The advances are in the form of cash credit, overdraft and discounting of bills etc.

(A) Loans: Commercial banks provide loan to businessman and others. The borrowers can use entire amount sanctioned or can withdraw in installments. Interest is charged on the amount sanctioned. The loans are as follows:

(1) Short-term loans are for a period upto 1 year to meet working capital requirements of the borrower.

(2) Medium-term loans are for a period of 1 year to 5 years to meet working capital as well as fixed capital requirements of the borrower.

(3) Long-term loans are for a period of 5 years or more to meet long term capital requirements of the borrower.

(B) Advances: Advances are small-term fund provided to businessman to satisfy different financial requirements of the business. Advances are as follows:

(1) Cash Credit: The cash credit advances are provided to current account and savings account holders. It provides working capital for longer period of time. Interest rate is higher on cash credit Separate cash credit account has to be maintained by the borrower.

(2) Overdraft: This facility is offered to current account holders to meet their working capital requirements. The period can vary from 15 to 60 days. Interest is charged on actual amount withdrawn. No separate account is maintained, and entries are shown in current account. It is a temporary arrangement for a short period.

(3) Discounting of Bills of Exchange: The drawer of bills of exchange or beneficiary can discount the bill with bank and obtain an advance. On the due date of the bill, the bank will recover the amount from the drawee.

(b) Secondary Functions: Secondary functions of commercial banks are classified into two groups:

- Agency Functions: A commercial bank acts as an agent or representative of its client and performs certain functions as which are as follows:

(1) Periodic Collections and Payments: Commercial bank collects salary, dividends, interests and any other income periodically as well as makes periodical payments such as taxes, bills, premiums, rent etc. On the standing instructions provided by customer. Commercial bank charges certain fixed amount quarterly or annually in the form of service charges from customer for providing such services.

(2) Portfolio Management: Large commercial banks undertake to purchase and to sell securities such as shares, bonds, debentures etc. on behalf of the clients. This handling of securities is known as portfolio management. Due to this facility more clients are opting for such services of commercial banks.

(3) Fund Transfer: Commercial banks provide facility of fund transfer from one branch to another branch or branch of another bank. Commercial banks come with various initiatives to make these transfer hassle free

(4) Dematerialisation: Banks provides dematerialisation facilities to their clients to hold their securities in an electronic format. On behalf of clients, it undertakes the electronic transfer of shares in case of purchase or sale.

(5) Forex Transactions: Forex is an abbreviation for foreign exchange. A bank may purchase or sell foreign exchange on behalf of its clients. A bank purchases forex from its clients which the clients receive from foreign transactions and sell the forex when the clients need it for overseas transactions.

- Utility Functions: A commercial bank performs utility functions for the benefits of its clients. It provides certain facilities or products to its clients as follow:

(1) Issue of Drafts and Cheques: A draft/cheque is an order to pay money from one branch of bank to another branch of the same bank or other bank. A bank issues drafts to its account holders as well as non account holders whereas cheques are issued only to the account holders. Bank charges commission for issuing a bank draft.

(2) Locker Facility: This is common utility function of any commercial bank. The bank provides locker facility for the safe custody of valuables, documents, gold ornaments etc.

(3) Project Reports: A bank may prepare project reports and conduct feasibility studies on behalf of the clients. Project reports enable the business firm to obtain funds from the market and to obtain clearance from government authorities.

(4) Gift Cheques: Banks issue gift cheques and gold coins to account holders as well as to non account holders. The gift cheques and coins can be used by the clients for the purpose of gifting on occasions like wedding, birthdays etc.

(5) Underwriting Services: A commercial bank may underwrite the securities issued by companies. If the shares are not fully subscribed, the underwriting bank agrees to take up the unsubscribed portion of the securities.

(6) Gold Related Services: Now a days many banks are providing gold services to its customers. Bank are commercially buying and selling gold or gold ornaments from customers on large scale basis. Some bank also provides advisory services to its customers in terms of gold funds, gold ETF etc.